Mexico: Back Toward Neutral Policy Rates

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory would be required. Then two further 25bps cuts to 7% in H1 2026 on the condition that inflation comes down towards 3.0%.

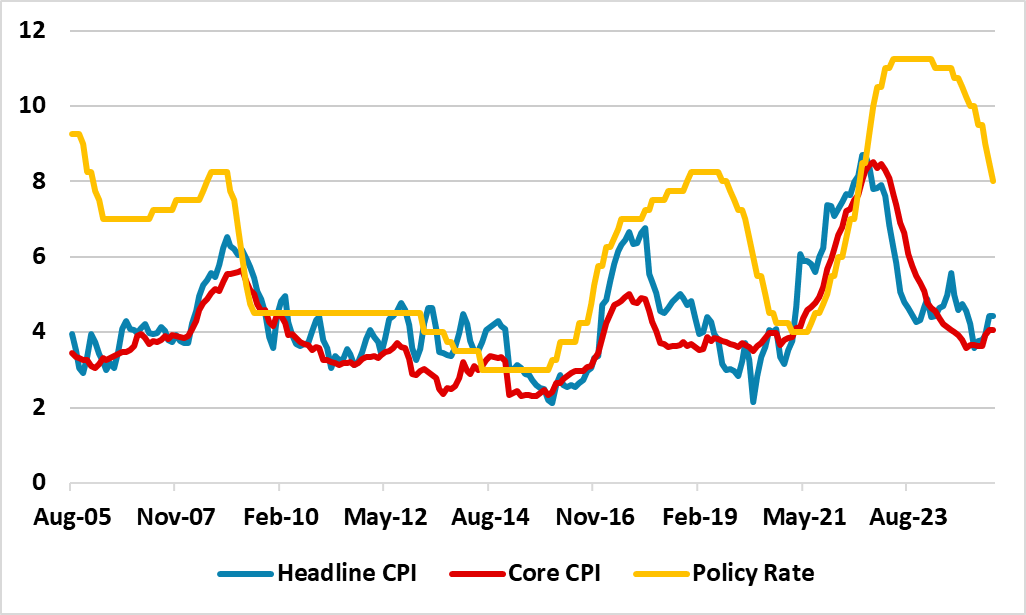

Figure 1: Mexico Headline, Core Inflation and Banxico Policy Rate (%)

Source: Datastream/Continuum Economics

Banxico has cut by 50bps to 8.00%, while also signalling in its statement that further easing will now be data dependent (Figure 1). Banxico now has a balancing act, as conditions are still tight with the policy rate above neutral rate estimates of 6-7%. Additionally, GDP and activity data suggest that growth remains below trend and the labor market is softening, which then is expected to bring inflation down still further in 2026. However, CPI Yr/Yr has stalled recently (Figure 1) and future Banxico easing is driven by both current and forecast inflation figures. The Banxico statement also showed that future decisions will be data dependent. This point to a slowing of the aggressive easing going forward. Our forecast is for easing to move to a 25bps pace and to come once a quarter – most likely in September and December. Some improvement in the monthly inflation trajectory would be required. This inflation improvement is still evident in Banxico quarterly CPI forecasts. Then two further 25bps cuts to 7% in H1 2026 on the condition that inflation comes down towards 3.0%.

Though the policy rate differentials with the U.S. will continue to narrow with H2 Banxico easing, we see this dipping just below 4% before the Fed starts easing in December and in 2026 Banxico easing will be marginally slower than the Fed. This is not the policy rate narrowing that occurred 2014-15 that caused MXN trend weakness. We see USD/MXN at 19.15 for end 2025 (here) and 18.8 end 2026. The Banxico statement appears comfortable with the MXN performance. The slowing of easing pace is all to do with Banxico caution as it waits for the lagged easing effects; current inflation above target and the policy rate approaching the neutral range.