LatAm Outlook: Diverging Patterns

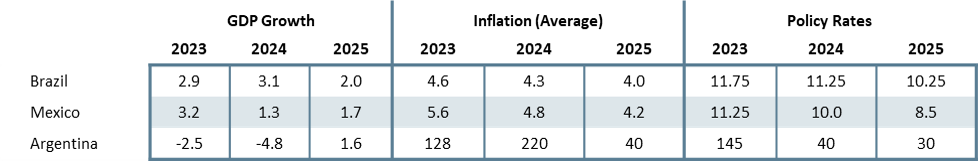

· Brazil and Mexico started to diverge in terms of growth. While we see Brazil GDP growing above 3.0% in 2024 (pushed by the internal demand), we see Mexico’s growth decelerating to 1.3%, due to weaker demand from U.S. and contractionary monetary policy. In 2025, we see Brazil growing 2.0%, while Mexico will likely grow 1.7%. Argentina will see a strong contraction of 4.8% in 2024, due to the government shock plan, and a partial recovery of +1.6% in 2025.

· Inflation is showing some stickiness in Brazil and Mexico and some inflationary shock, such as energy prices in Brazil and food prices in Mexico, will add persistence until the end of the year. We forecast a 4.3% inflation for Brazil in 2024, and 4.7% for Mexico. Some persistence will continue in 2025 as we see inflation finishing this year at 4.0% in Brazil, and 4.2% in Mexico. Argentina will see a 220% inflation in 2024, affected by the strong devaluation in the beginning of the year, and a slow down to 40% in 2025.

· In terms of interest rates, Brazil resumed hiking due to a positive output gap, de-anchoring of expectations and credibility issues. We forecast the policy rate to finish at 11.25% in 2024, with a reduction to 10.25% by end-2025. Mexico has resumed its cutting cycle and its policy rate will likely finish 2024 at 10.0%, while we see them cutting to 8.5% in 2025.

· Forecast changes: From our June outlook, we have reduced growth for Mexico, in 2024 and 2025, and raised our growth forecast for Brazil for both of those years. We have significantly lowered our growth forecast for Argentina in consequence of the continued impact of Milei’s shock plan. We have risen our forecast for the policy rate of Brazil, as we see them hiking now, and dropped for Mexico, as they resumed their cutting cycle before we expected. We have lowered a bit the inflation forecast for Argentina as the fiscal adjustment is helping to lower the level of inflation.

Forecasts

Source: Continuum Economic

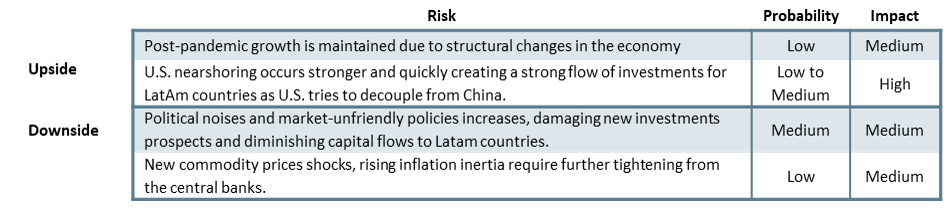

Risks to Our Views

Source: Continuum Economics

Brazil: Strong Growth and Hikes

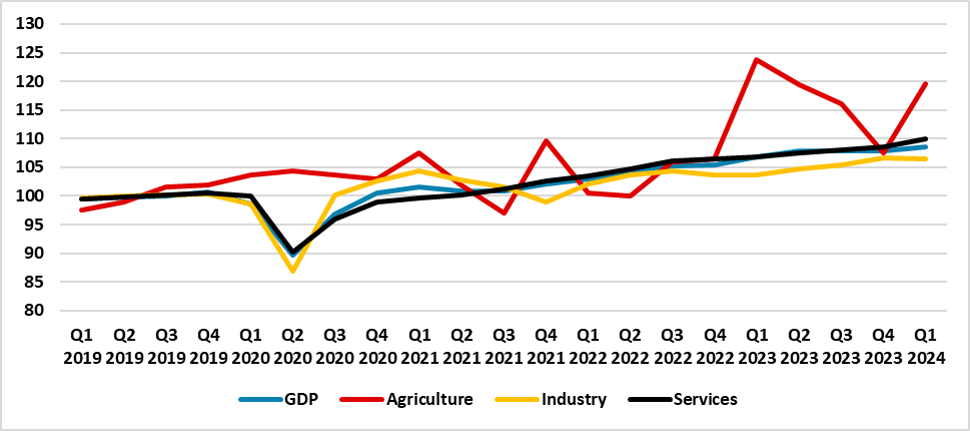

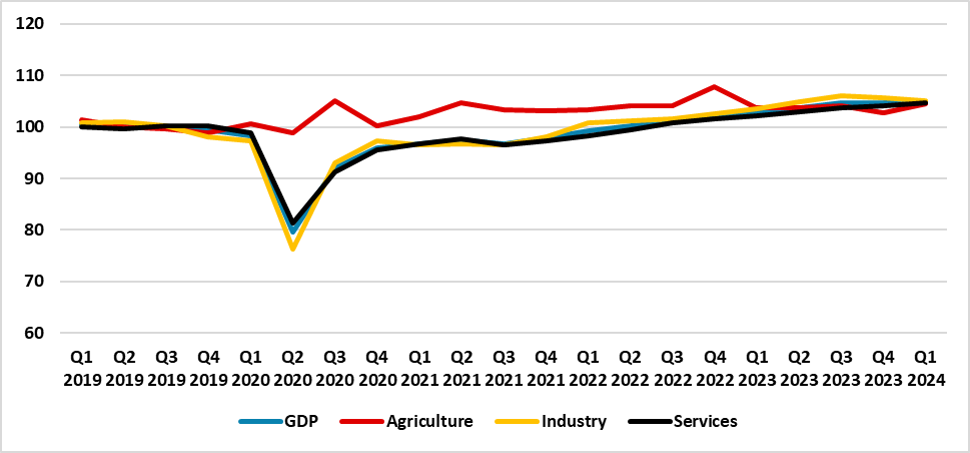

The Brazilian economy has once again surprised in terms of growth. While most analysts were expecting limited growth in 2024, the first half of the year proved them wrong. In Q1 and Q2, the Brazilian economy grew by 1.0% and 1.4% quarter-on-quarter, respectively. This growth was driven by the industry and services sectors, contrasting with 2023, when the agriculture sector was the main engine of growth. Additionally, the unemployment rate has decreased to 6.9%, reaching its lowest level since the historical series began in 2012.

Figure 1: Brazil GDP by Sectors (2019 = 100, Seasonally Adjusted)

Source: IBGE

Questions have arisen in an attempt to explain this. First, Brazil had a lagged recovery from the 2015-16 crisis, and fiscal policy had been fairly restrictive until the beginning of the pandemic, with some structural reforms approved in the meantime. This led to the Brazilian economy accumulating some idle capacity. With the strong fiscal push last year, around 2.5% of GDP, and its multiplicative effects, the economy was able to close the output gap without putting much pressure on prices. Some views advocate that this strong growth is the result of the structural reforms, such as pension reform and the Economic Freedom Law, among others. However, we remain skeptical of this view, as productivity growth has yet to show any significant improvement.

There are still doubts about whether this strong growth will be sustained in the coming quarters. We believe that most of the impact of the fiscal push has already been transmitted to the economy, indicating that we will likely see some deceleration in the next quarters, although we still expect growth to remain positive. We forecast the Brazilian economy to grow by 3.1% in 2024. In 2025, we believe that this strong fiscal push will not be repeated, nor will it have the same impact as in 2023. Additionally, monetary policy will continue to be contractionary, pointing to a slowdown. We forecast the Brazilian economy to grow by 2.0%, impacted by some statistical carry-over from the strong growth in 2024.

One of the controversial themes in Brazil at the moment is fiscal policy. We still hold the view that markets are somewhat overreacting, and no signs of a fiscal crisis are on the horizon. Although the government will likely not meet its proposed fiscal targets, the fiscal deficit tends to diminish in the long term, which will help stabilize the debt-to-GDP ratio. However, the government's strategy will likely continue to focus on the revenue side, applying measures to increase it, while efforts to reduce expenditures will be limited.

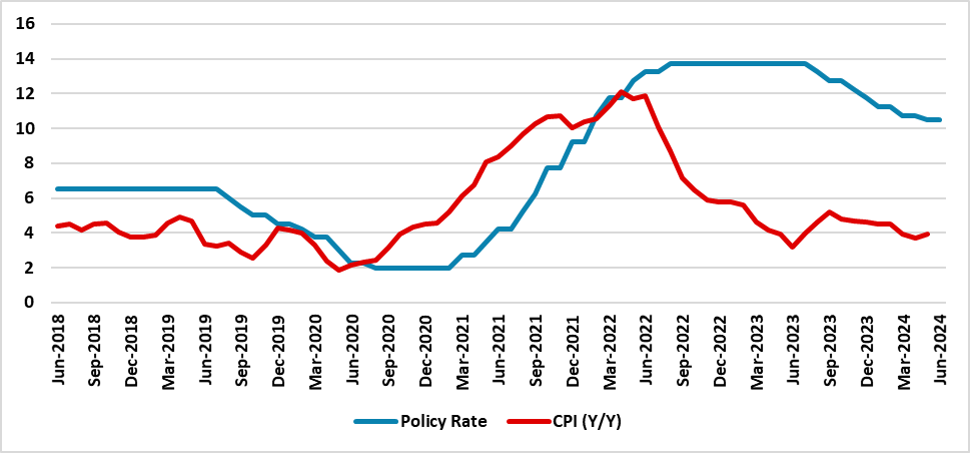

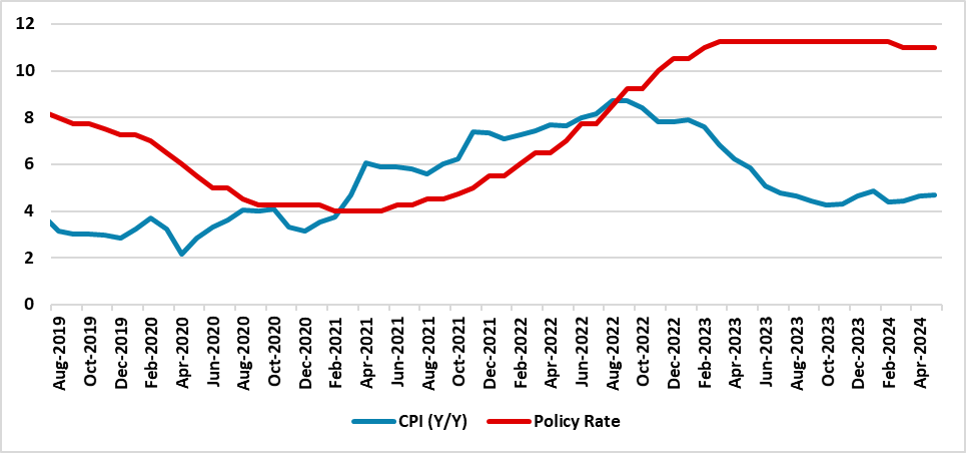

Figure 2: Brazil CPI and Policy Rate (%, Y/Y)

Source: IBGE and BCB

Source: IBGE and BCB

Inflation has remained stubbornly high, particularly in services, which are now at 5.2%. Furthermore, new inflationary risks are on the horizon as severe droughts are affecting hydroelectric regions, reducing reservoir levels and impairing electricity generation capacity. The usual solution is to activate thermoelectric plants, which typically raise electricity prices, meaning we are likely to see an inflationary surge in the coming months. We forecast CPI to finish 2024 at 4.3% (year-on-year average). In 2025, we expect inflation to continue declining gradually, assuming no additional inflationary shocks occur, as monetary policy remains tight but the economy stays somewhat heated. Our forecast for 2025 is now 4.0%.

Turning to monetary policy, after pausing the rate-cutting cycle with a policy rate of 10.5% for a few meetings, the Brazilian Central Bank (BCB) has found itself compelled to raise rates again (here). The main reasons cited by the BCB were the now positive output gap, which is generating further inflationary pressures, and de-anchored expectations. However, we still see some reputational risk in this decision, as the new BCB President, Gabriel Galípolo, comes from an unorthodox school of thought, and some market participants might expect him to be more lenient with inflation to stimulate growth. Therefore, this hike could be seen as a way for the BCB to gain credibility and bring inflation expectations down. We now expect the BCB to implement two more 25-bps hikes, meaning the policy rate will end 2024 at 11.25%. In 2025, as the economy weakens and inflation expectations fall, we expect the BCB to resume cutting rates in the second half, applying 100 bps of cuts and bringing the policy rate to 10.25% by the end of 2025.

Mexico: Growth Slowing at the U.S. Heels

The Mexican economy was already starting to lose momentum by the end of 2023, but the numbers registered in the first half of 2024 confirmed that the economy has finally begun to cool down. We believe the major reason for this slowdown is the deceleration of its biggest trade partner, the U.S., with external demand slowing the industrial sector. We also believe that this sector, which was starting to produce above its capacity, has cooled down. Additionally, monetary policy has been kept tight for a while, contributing to the slowdown in domestic demand.

Figure 3: Mexico GDP (2019 =100)

Source: INEGI

Our central scenario is that the U.S. economy will continue to decelerate, and the lagged effects of monetary policy will still be felt in the second half of the year. Thus, we expect the Mexican economy to present subpar growth. As most of the construction projects that justified the 2024 fiscal deficit have already commenced, their impact in terms of growth will likely be limited in the second half, although we do not foresee a contraction in either of the upcoming quarters. Our forecast for Mexican GDP growth in 2024 is 1.3%, with much of it inherited from the statistical carry-over from 2023.

Looking ahead to 2025, several risks remain, which will be clarified in the coming months. First, the U.S. elections will be pivotal. In the event of a Donald Trump victory, U.S.-Mexico relations are likely to deteriorate, with possible restrictions on Mexican imports, and some Mexican companies used as third-part company to bypass U.S. tariffs on China will also likely to be affects. This would restrict U.S. demand for Mexican products, limiting growth. A Kamala Harris victory, on the other hand, would likely maintain the current U.S.-Mexico relationship. Secondly, Mexico is yet to send its 2025 budget to Congress. If the government keeps its promises, a reversal of the fiscal deficit will be announced, signaling reduced domestic demand. We forecast the Mexican economy to grow by 1.7%, more in line with its pre-pandemic trend.

Claudia Sheinbaum's victory (here), along with control of Congress, would enable her administration to promote significant changes in the Mexican economy. The controversial judicial reform (here), which proposes elections for federal judges, risks Morena controlling the judiciary, which has so far limited anti-market reforms. We believe that facts will speak louder: Mexico still has a solid macroeconomic situation, and relations with the U.S. will likely be more important than domestic reforms, as long as the Mexican framework doesn't change abruptly. We remain skeptical about the nearshoring phenomenon (here), as much of the FDI in Mexico has originated from profit reinvestment, indicating that companies already established in the country are expanding their production capacity rather than new companies setting up fresh plants.

Turning to monetary policy, Banxico has resumed its rate-cutting cycle after pausing for two meetings. The reasons for the pause were related to the potential overheating of the economy and the strong depreciation of the MXN. However, risks have now shifted back toward cooling, and the impact of the depreciation has been minor and is expected to be transitory. We expect Banxico to continue with 25bps cuts at its next meeting, suggesting the policy rate will likely end 2024 at 10.0%, though a risk of a 50bps cut exists. In 2025, we expect the Mexican economy to remain somewhat cool, allowing for an additional 150bps cut, bringing the policy rate to 8.5%, which would still be in contractionary territory.

Figure 4: Mexico’s CPI and Policy Rate (%)

Source: INEGI and Banxico

Source: INEGI and Banxico

The inflation outlook has been recently affected by a surge in food CPI. Adverse climate conditions have impacted agricultural capacity, reducing the supply of fruits and vegetables, and the FX depreciation has influenced the prices of some imported vegetables from the U.S. However, core CPI continued to decline and is now registering a 4.0% Y/Y growth. We expect core CPI to continue to fall gradually, in line with a cooling economy. Headline CPI will likely end 2024 at 4.8% Y/Y (average), impacted by the seasonal rise in electricity prices at the end of the year. In 2025, we expect monetary policy to remain contractionary, allowing inflation to continue to decline, ending the year at 4.2% Y/Y (average), although still slightly above the 3.0% target. We believe that tight labor markets, along with minimum wage increases and expanding social transfers, will limit the pace of inflation decline.

Argentina: Paying the Price for the Adjustment

Argentina has registered three consecutive quarters of economic contractions. We believe that most of this contraction is a direct consequence of Javier Milei's economic plan to address many of Argentina's imbalances. Although the plan makes sense, we believe its success will only be felt in the long term. Much of the Argentine economy has depended heavily on subsidies and capital controls, a situation the government seeks to change rapidly.

The fiscal adjustment of around 4.0% of GDP, along with the significant devaluation registered in December, will likely leave some economic scars that will take time to heal. We are forecasting the Argentine economy to contract by 4.8% in 2024. In 2025, we expect the recovery to be partial, as the traditional subsidies will still need to stand on their own, and fiscal policy will remain tight. Therefore, we project the Argentine economy to grow by 1.6% in 2025.

In terms of inflation, we see some progress. Argentina's CPI has decreased from 23% month-on-month (m/m) in January to 4.0% m/m in August, and we expect it to close 2024 with a monthly inflation rate of around 2.5%. Much of this reduction is attributed to the central bank's zero net emission policy to avoid monetary financing of the budget deficit. The reduction of the fiscal deficit is also allowing the government to reduce monetary emissions. Additionally, weaker demand is also contributing to this trend. However, high inflation inertia will take some time to fade.

The government's crawling peg of a 2% monthly increase in the official exchange rate suggests that it aims to bring inflation down to around 2% m/m, a target we believe will only be achieved in 2025. Our forecast for Argentina's inflation in 2024 stands at 220% year-on-year (Y/Y) on average, with a further reduction to 40% in 2025. We do not expect a strong devaluation in 2025, and we anticipate the 30% gap between the official exchange rate and the parallel (BLUE) rate to narrow slowly throughout the year. The unification and liberalization of exchange rates will likely occur in the second half of 2025 when the Vaca Muerta gas pipeline becomes fully operational and a new IMF deal is expected to be approved.

Regarding monetary policy, the government is maintaining the policy rate at 40%, which is significantly negative in real terms. However, this is a deliberate strategy to clean the central bank's balance sheet and reduce monetary financing of pesos. We expect this rate to remain stable in 2024 and to be reduced to 30% in 2025 as inflation slows further.