View:

March 06, 2026

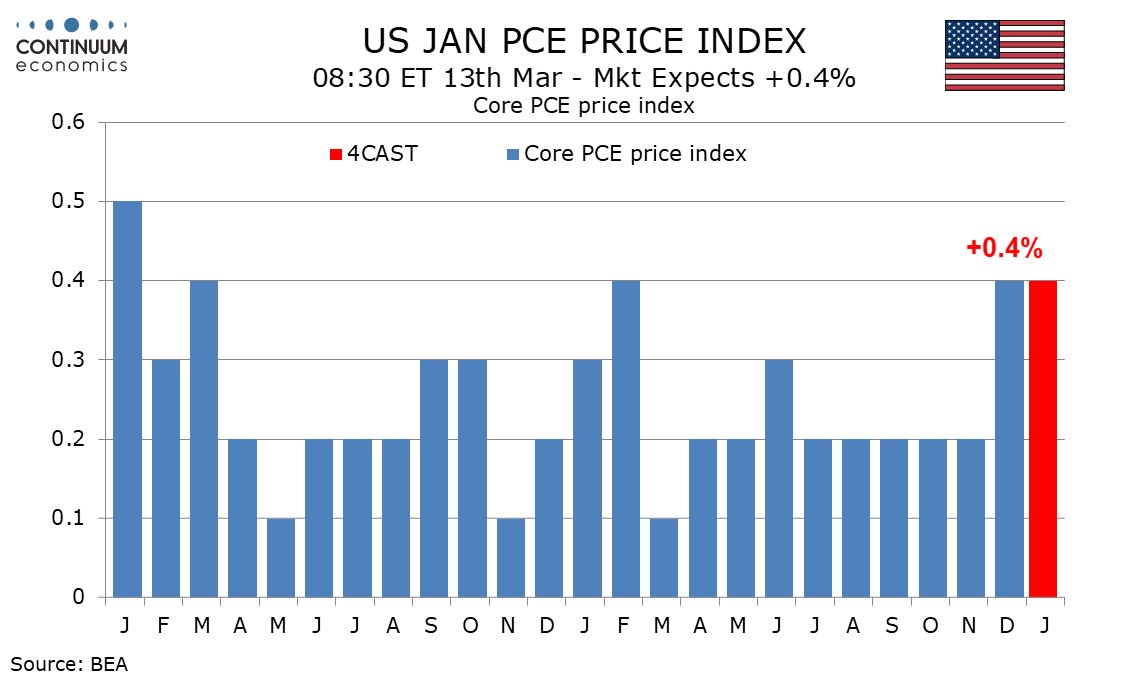

Preview: Due March 13 - U.S. January Personal Income and Spending - Core PCE Prices to outperform CPI

March 6, 2026 3:24 PM UTC

We expect January to see a strong core PCE price index increase of 0.4%, matching the rise seen in December. We expect personal income to increase by 0.6%, unusually outpacing personal spending, which we expect to rise by 0.4% for a third straight month.

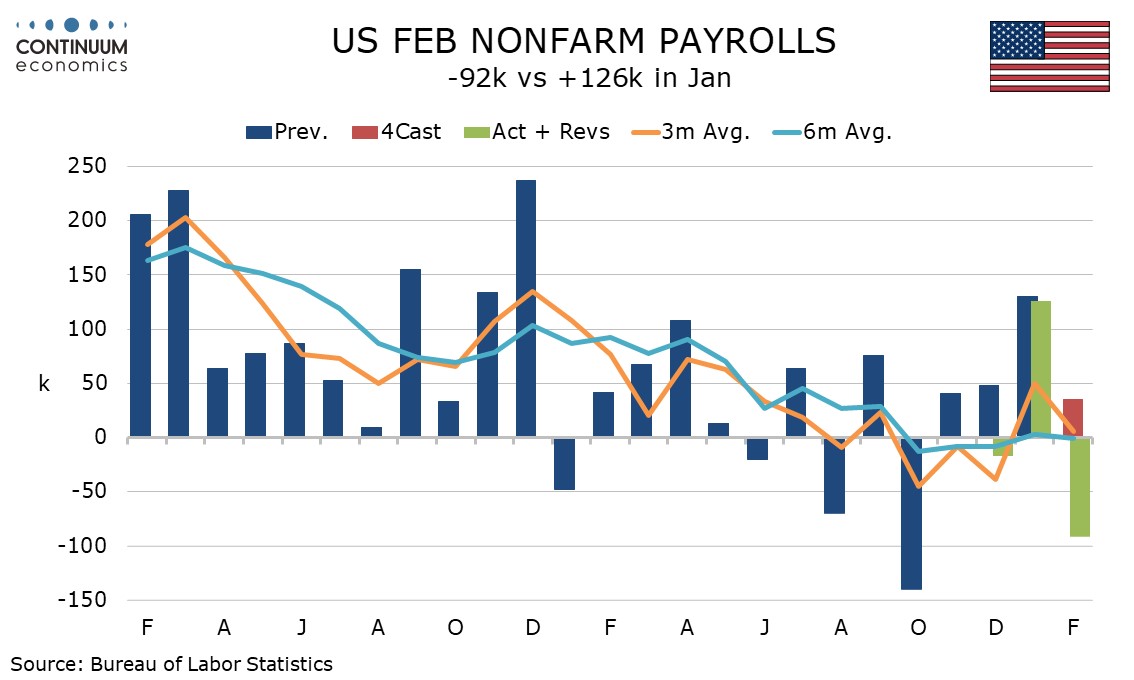

U.S. February Employment - Decline follows an above trend January, trend near flat

March 6, 2026 2:24 PM UTC

February’s non-non-farm payroll with a 92k decline is well below expectations but needs to be seen alongside a 126k increase in January, and in the context of bad weather between the two surveys. Unemployment edged up to 4.4% from 4.3% though more positive are a 0.4% rise in average hourly earning

March 05, 2026

China: 4.5-5.0% GDP Growth for 2026

March 5, 2026 9:16 AM UTC

• China announced a central government budget deficit at 4% of GDP, which is the same as last year and points to only modest fiscal stimulus. Though investment was supported, consumption trade in programs were cut from Y300bln to Yuan250 and no new structural safety net for households hav

March 04, 2026

U.S. February ISM Services strength contrasts slower S&P Services PMI

March 4, 2026 3:15 PM UTC

February’s ISM services index of 56.1 from 53.8 is the strongest since July 2022 and in a stark contrast to a weaker S and P services PMI of 51.7, revised down from 52.3 to its weakest level since April 2025. The true picture probably lies somewhere between the two surveys, but averaging the two a

Markets and the Iran War

March 4, 2026 9:50 AM UTC

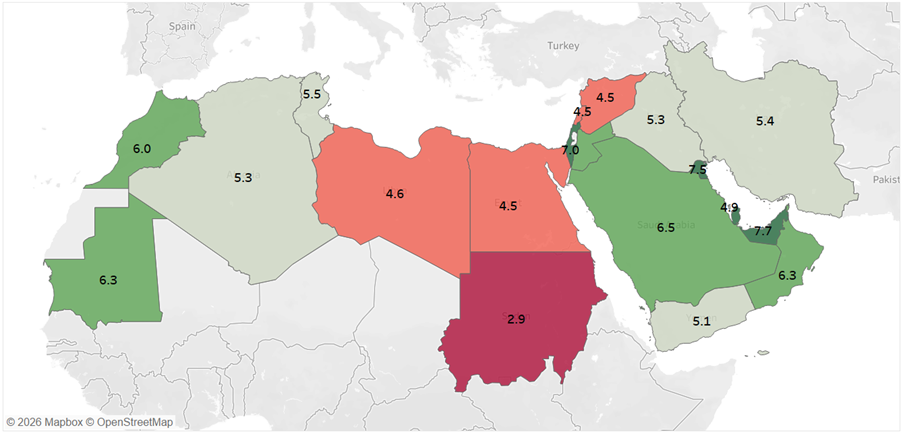

• The Trump administration’s objective appears to be pivoting from regime change to hurting Iran ballistic missile capabilities, which argues for a 2-4 week war rather than a prolonged war. However, the most intense missile battles will likely occur in the next one week and markets are

March 03, 2026

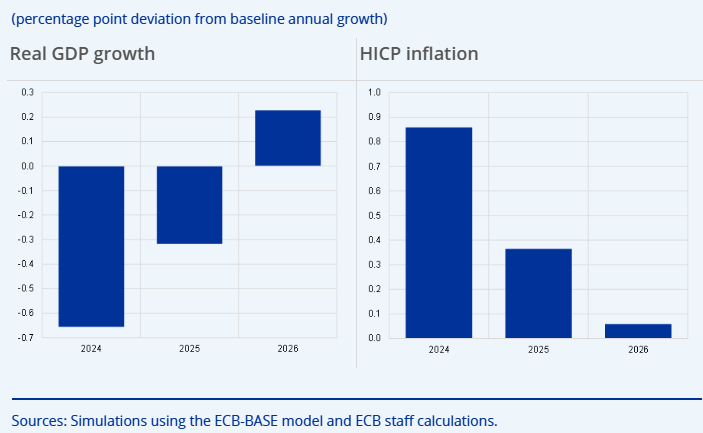

EZ HICP Review: Core Rate Spikes as Upside Inflation Risks Return

March 3, 2026 10:35 AM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is likely especially in view of the Middle East conflict that the headline HICP rate may not be any lower through this year and into next. Indeed, we headline rate rose 0.2 ppt to 1.9%

2025 Q4 Country Insights Scores to Download in Excel

March 3, 2026 10:00 AM UTC

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. The access to our full range of scores across 174 countries corresponding to the fourth quarter

China: Yuan Appreciation; U.S. 301 Threat and 4.5-5.0% GDP Growth for 2026?

March 3, 2026 6:35 AM UTC

• The Yuan has continued to appreciate with no resistance from China authorities. Part of this is a willingness to allow a modest Yuan appreciation in the face of the huge China trade surplus and pressure from U.S./Europe/IMF and others over an undervalued Yuan, but appreciation is also des

March 02, 2026

Iran: What Length For War?

March 2, 2026 7:44 AM UTC

· If the war is short (ie 1-2 weeks) and leads to a ceasefire then the global economic impact will be small, with the greatest impact in the middle east of oil/gas supplies on a temporary basis and tourism. If the war is more prolonged (ie months) then oil/gas supplies could be sque

February 26, 2026

India GDP preview: India’s Economic Momentum to Ease in Q3 FY26

February 26, 2026 1:07 PM UTC

India’s Q3 FY26 GDP growth is expected to moderate to around 7%, down from over 8% in the previous quarter, reflecting base effects and softer services momentum. The bigger story may lie in the new GDP series revisions, which could reshape the recent growth narrative more than the headline quarter

AI, Fed and Inflation and Disinflation Risks

February 26, 2026 8:24 AM UTC

• Existing Fed officials and Fed chair designate Warsh have divergent views on the impact of AI in boosting productivity and whether this means lower inflation/policy rates or high business investment/electricity prices argues against lower policy rates and potentially meaning a higher shor

February 25, 2026

EZ HICP Preview (Mar 3): ECB Too Focused on Services Inflation as Goods May Soon Take Core Below Target

February 25, 2026 1:54 PM UTC

Having dropped to 1.7% in the January data, thereby matching expectations and the short-lived Sep 24 outcome, it is possible that the headline HICP rate may not be any lower through this year and into next. Indeed, we see the headline rate edging up to 1.8% in the February flash mainly due to ener

China: Housing Not Bottomed Yet

February 25, 2026 10:55 AM UTC

• We do not feel that China residential property market has bottomed, as it faces two cyclical and two structural headwinds. Cyclically outstanding inventory of complete houses remains high, while households are also suffering from low income and employment growth. Structurally populati

February 24, 2026

Iran: Limited U.S. Attack?

February 24, 2026 10:00 AM UTC

· Iran authorities appear reluctant to meet the Trump administration’s demand to stop nuclear fuel production for potential weapons. This increases the odds of a limited attack by the U.S. on Iran to 30-40% (Figure 1), which could occur as soon as this weekend. The most likely I

February 23, 2026

GBP: Foreign Investor Flows

February 23, 2026 11:05 AM UTC

· Inbound inflows into the UK have been solid in the last few years attracted by yield pick-up and fiscal consolidation for gilts and cheap comparable valuations in UK equities. UK BOP data suggests something would have to go really wrong to stop inbound portfolio flows e.g. UK recessio

February 20, 2026

Reciprocal Tariffs: Supreme Court Strike Down

February 20, 2026 4:31 PM UTC

· The 6-3 vote by the Supreme court and full ruling against reciprocal tariffs means that the Trump administration will likely resort to other tariffs for negotiating leverage. However, the Trump administration will also pressure to codify existing trade framework deals that have be

Q4 U.S. GDP: Lower Than Expected

February 20, 2026 2:13 PM UTC

Lower than expected Q4 GDP was mainly caused by the temporary government shutdown (-5.1% annualised), while consumer spending remained reasonable at 2.4% and AI related spending helping parts of fixed investment. However, income growth remains lower than consumption and we see this slowing the U.S.

February 19, 2026

FOMC Minutes: Shows Splits, But Rate Cuts Should Still Arrive

February 19, 2026 9:24 AM UTC

· The January FOMC minutes show a split Fed, with some sounding mildly hawkish. However, the district Fed presidents are on the mildly hawkish side, but most are non-voters and we feel that the FOMC voting consensus is more neutral. Additionally, we feel that Fed is too upbeat on th

February 18, 2026

Taiwan: Trade Deal with U.S. and China Grey Warfare

February 18, 2026 11:55 AM UTC

· The most likely option for China is to continue the air and naval grey zone warfare around Taiwan, combined with support for pro-China factions in Taiwan’s parliament to build pressure for reunification at some stage before 2049 (the 100th anniversary of the communist party). Wi

February 17, 2026

China: Boosting Consumption In March?

February 17, 2026 2:05 PM UTC

· China’s consumption medium term could be boosted by higher structural safety nets (social spending/health/pensions) and revisions to the Hukou system (shifting 200mln urban workers from lower rural to higher urban benefits). However, March NPC will likely see only further small to m

February 16, 2026

Warsh, AI and Lower Policy Rate?

February 16, 2026 10:55 AM UTC

· Warsh will find it tricky to convince FOMC members that AI is currently boosting productivity and acting as a disinflationary force. However, Warsh could also try to get the Fed to be more forward looking and less data dependent, which could add some proactivity into Fed debates. Fo

India’s CPI Overhaul: Smoother Prints, Deeper Scrutiny

February 16, 2026 6:37 AM UTC

India’s January 2026 CPI rose to 2.75% yr/yr, marking the launch of a rebased 2024=100 index that better reflects modern consumption patterns. Food’s reduced weight is likely to dampen headline volatility, while services, housing and discretionary spending will exert greater influence going forw

February 13, 2026

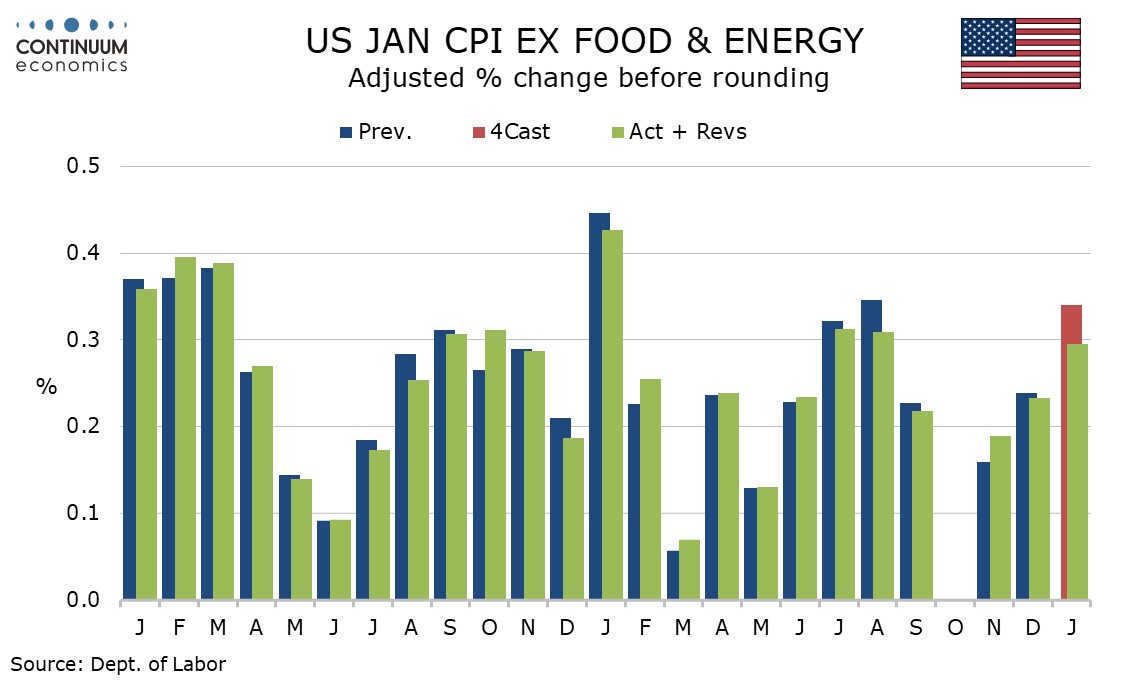

U.S. January CPI - Yr/yr ex food and energy pace slowest since March 2021

February 13, 2026 2:18 PM UTC

January CPI is slightly lower than expected at 0.2% overall though the ex food and energy rate at 0.3% is on consensus, with the core rate almost spot on 0.3% even before rounding. Given a strong year ago rise, yr/yr growth slowed, overall to 2.4% from 2.7% and the core to 2.5% from 2.6%, the latter