View:

March 11, 2026

FOMC Preview for March 18: Little change seen in either statement or dots

March 11, 2026 3:37 PM UTC

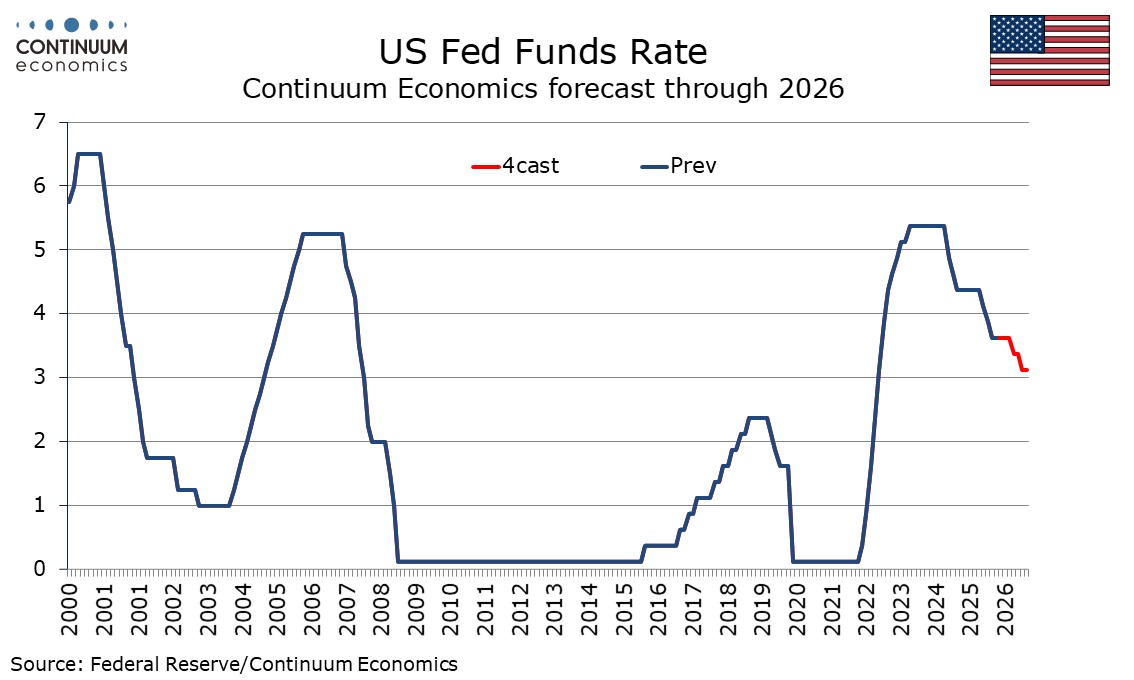

The FOMC meets on March 18 with rates likely to be left unchanged at 3.5-3.75%. The dots will be updated but we expect them to remain where they were in December, looking for one 25bps easing in 2026 and one more in 2027. The economic forecasts are likely to see only modest changes from September, w

ECB Preview (Mar 19): No Longer in a Good Place?

March 11, 2026 2:53 PM UTC

With no change in policy expected, what the ECB says is the most important aspect of the ECB meeting next week, both explicitly and implicitly via its updated forecasts (Figure 1). Both are likely to underscore that rate hikes are certainly possible if the almost inevitable inflation rise proves t

Preview: Due March 12 - U.S. January Housing Starts and Permits - Weaker and not only on weather

March 11, 2026 1:14 PM UTC

We expect January housing starts to fall by 6.0% to 1.32m to follow a 6.0% December increase while permits fall by 5.2% to 1.38m to follow a 4.8% December increase. Underlying slowing in demand and bad weather are both likely to contribute to the decline, with the latter impacting starts more than p

Preview: Due March 12 - U.S. January Trade Balance - May be stabilizing close to pre-tariff levels

March 11, 2026 1:07 PM UTC

We expect a January trade deficit of $69.0bn, which would be only a marginal correction from December’s $70.3bn which was the widest since July, though still well below the record $136.0bn deficit seen in March of 2025 shortly before the tariff announcement.

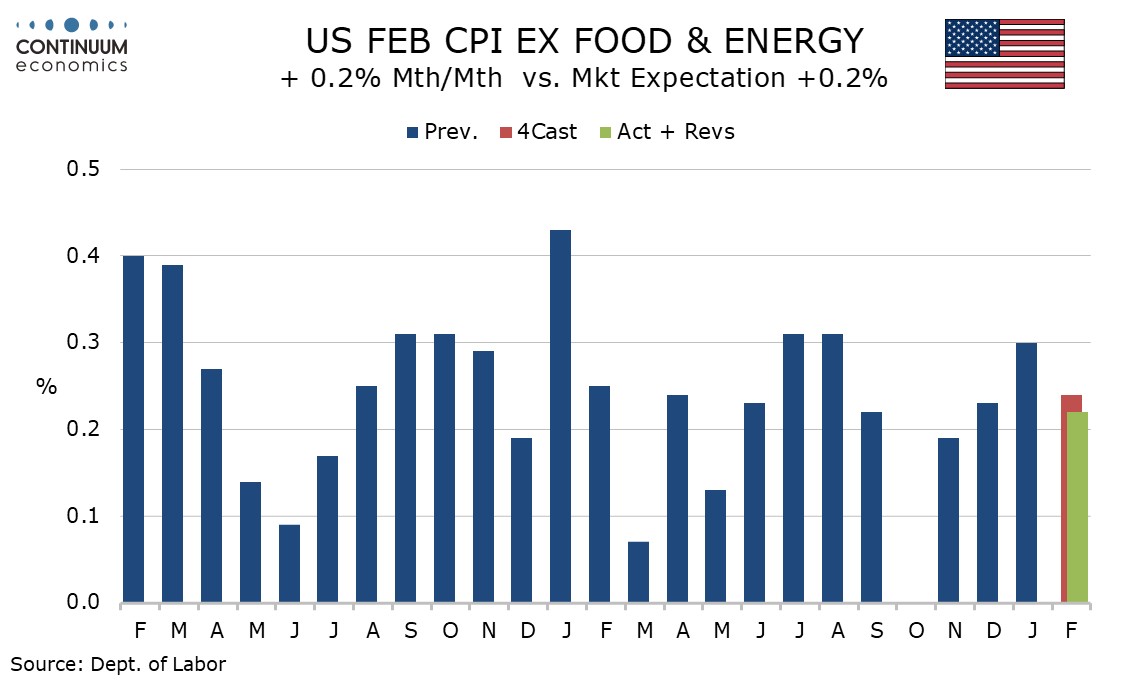

U.S. February CPI - Core rate has slowed, but inflation not yet defeated

March 11, 2026 1:00 PM UTC

February CPI is in line with expectations at 0.3% overall, 0.2% ex food and energy, with the respective gains before rounding being 0.267% and a reasonably subdued 0.216%. Yr/yr rates are unchanged at 2.4% overall and 2.5% ex food and energy. The data is not alarming but inflationary pressures remai

Iran War Scenarios

March 11, 2026 9:45 AM UTC

· Our central scenario (75%) remains a multi-week war in Iran. Trump loathing of long wars and high gasoline prices prompts U.S. to declare victory before end of March. Israel and Iran would most likely agree an effective ceasefire. The ceasefire would be fragile, however, as it w