EM Markets Divergence with China Harder Landing Concerns

Global market turbulence has had a spillover impact into EM, but also some EM assets have benefitted from rotation away from the U.S. What are the prospects in the coming months?

We see scope for a 2nd wave of U.S. equity and Japanese Yen (JPY) correction, which are a mixed influence for EM assets but favor EM local currency debt yields declining – as Fed rate cuts start in September. Brazil and Mexico yield risk premia are high, though event risk surrounds Mexico with November’s U.S. presidential election. Some rotation could be seen into EM equities, but H2 will be tricky for risk. Additionally, India equities are stretched on valuations terms with an increasing risk of a correction, while cheap valuations for China are not enough given harder landing risks for 2025 (sub 4% growth) and as policy makers remain incremental rather than aggressive.

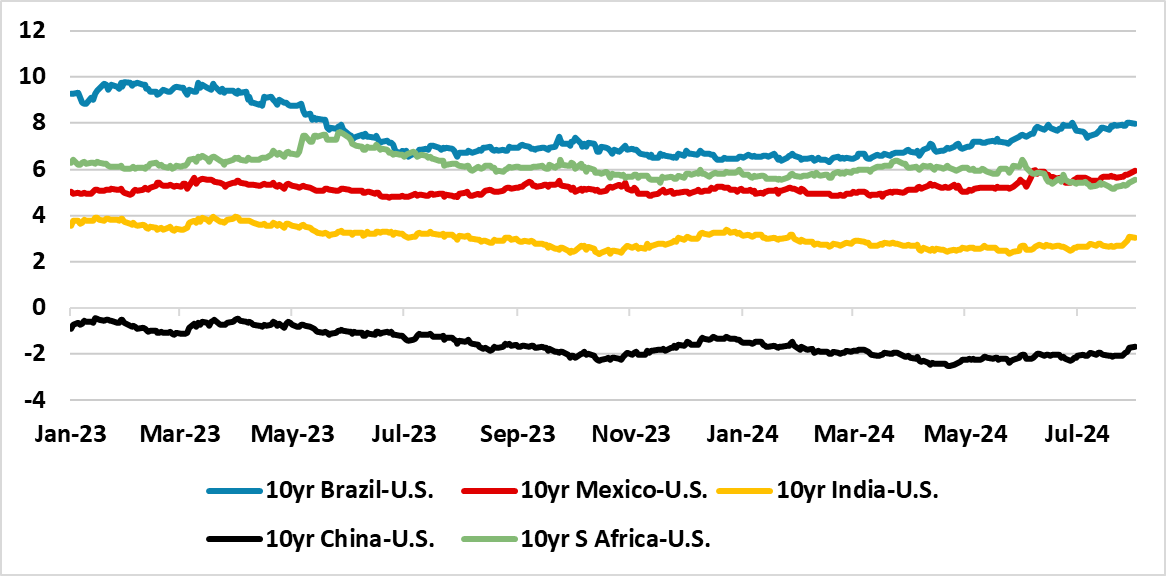

Figure 1: 10Yr U.S. Treasuries v Major EM’s (%)

Source Datastream/Continuum Economics

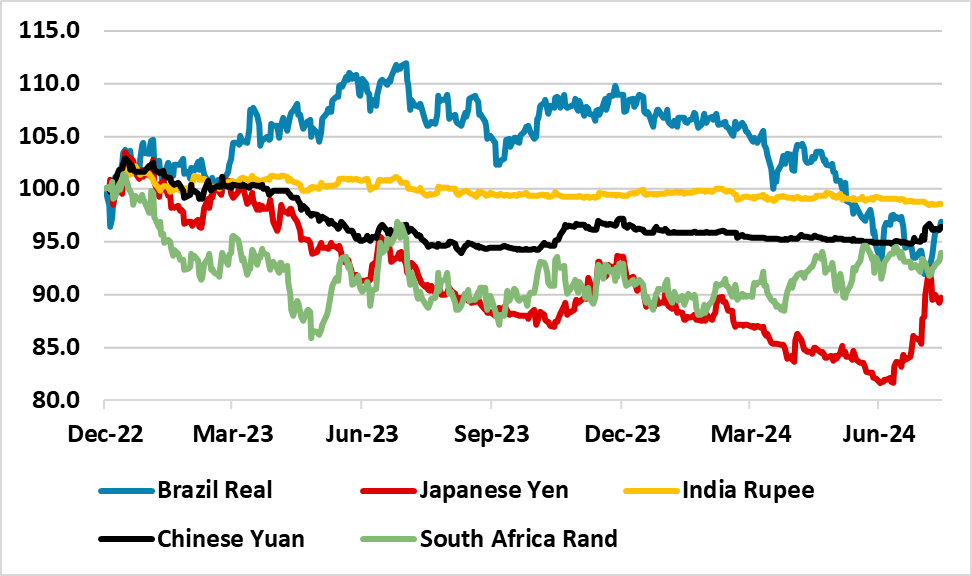

The Brazilian Real (BRL) and Mexican Peso (MXN) have seen renewed weakness and volatility over the past few weeks, with JPY carry trades having been shaken out (Figure 2). However, increased Fed easing expectations and a softer overall USD have also prompted some debate about whether this is time to rotate into EM assets generally. We take a more selective view for a number of reasons.

· EM policy rate prospects differ. Financial markets are now discounting over 100bps of Fed cuts by year-end (we forecast 75bps of cuts), which will provide a window for some EM central banks to ease policy. However, differences exist with India (here), S Africa (here) and Indonesia (here) likely to be slower than the Fed, due to domestic concerns over inflation. Brazil (here) and Mexico (here) also have some concerns over the pace of convergence towards inflation targets, but will likely ease further in H2 as FX volatility subdues – we see some further unwinding of JPY carry trades (here) but this will likely have only a temporary adverse impact on BRL and MXN. Russia (here) and Turkey (here) are still stuck with too high inflation, which means restrictive policy for the remainder of the year. 10yr government bond spreads for big EM are narrowly wider over the past few weeks (Figure 1), but this reflects the decline in U.S. Treasury yields not being matched – risk premia in S Africa are down noticeably post-election and as load shedding has eased (here).

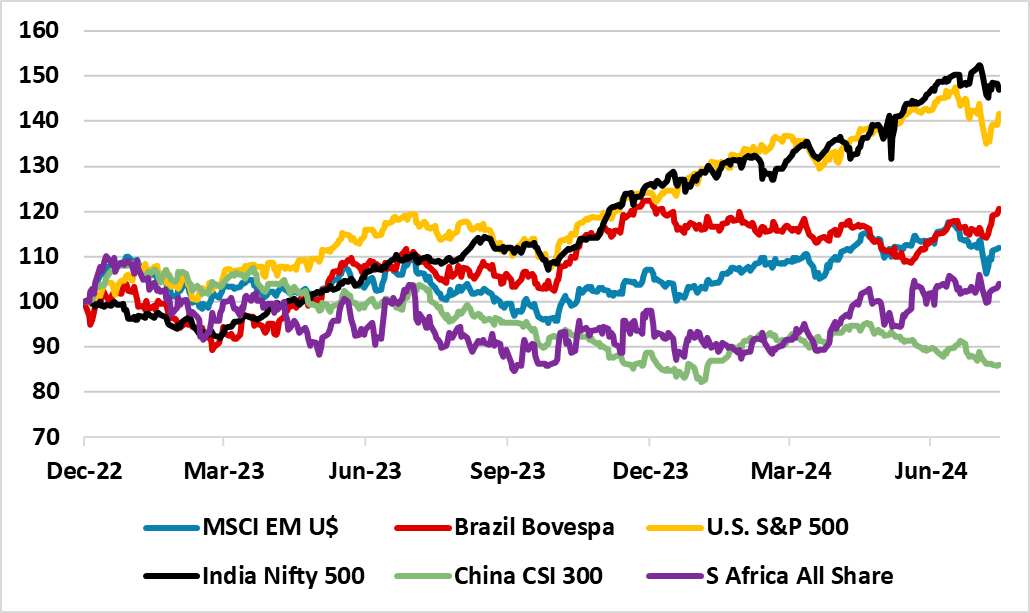

· U.S. soft or harder landing? Our view is that growth is slowing, but some numbers will cause jitters in markets about a harder landing. This can see further correction in the S&P500 and USDJPY (here), which can cause similar EM spillover to recent weeks. A 2nd phase of U.S. equity market correction could encourage some to look for rotation into EM assets generally. However, a key question is whether a U.S. soft or harder landing is evident. A U.S. harder landing would cause risk off, which could help EM local currency yields to fall but cause turbulence in EM equity markets – India equities (the current EM favorite) could see a pullback in such a scenario (Figure 3). We do not attach a high probability to a harder landing for the U.S. economy but rather a low to modest probability, both due to the overall read of economic numbers and as the Fed has lots of scope to ease policy. China harder landing probability (sub 4% growth in 2025) are now circa 30% however.

Figure 2: USD v JPY and Big EM currencies (31/12/2022 =100)

Source Datastream/Continuum Economics

Figure 3: S&P500 Still Overvalued Versus Real 10yr Government Bond Yields (%)

Source Datastream/Continuum Economics

· China slowing or harder landing. China economy is slowing into H2, as consumer softness is adding to the negative drag from private residential investment. We have highlighted that China households are suffering adverse wealth effects, as house prices keep coming down (here). The latest money supply and lending figures this week are also awful by China standards, with net pay down of debt by households. Additionally, private sector business have slowed hiring, which is restraining household income growth and hence consumption. Risk aversion is also evident in weak private sector business investment and the flight to safety in China government bonds in recent months. Meanwhile, the third plenum policy actions have been incremental in nature rather than aggressive and the prospects are for only targeted fiscal and monetary policy easing in H2 2024. The high overall level of debt is restraining the scale of policy action for fears of producing a Japan style debt boom and bust. On the plus side is the central and local government infrastructure investment that has still to feedthrough, alongside a bias to boost high tech production and investment. Our baseline view remains for a moderate slowing in H2 and 4% GDP growth in 2025. However, the risks are skewed do the downside, as household risk aversion could mean a quicker slowdown in China's economy that risks a harder landing – we attach around a 30% probability to sub 4% growth in 2025. Since China is still the biggest buyer of commodities, this creates uncertainty for EM commodity producers such as Brazil and S Africa.

In terms of EM asset markets, structurally we are bullish on India equities, given multi year corporate earning prospects and a reform bias of the Modi government. However, 12mth forward price/earnings are now stretched versus history and 2025 earnings prospects and a correction is a growing risk before end 2024. China equities are cheap in valuations terms and would see a clear rally if aggressive China policy action emerged. However, game changing policy stimulus is not our baseline views and we remain structurally underweight China equities.

The 10yr Brazil-U.S. government bond spread can narrow multi month, both as risk premia are now high and as the market is discounting BCB tightening rather than easing that we forecast, we still have some domestic views on the fiscal risk are too pessimistic and they will likely not materialize. Mexico is strategically of interest, but tactically depends on the outcome of the U.S. presidential election. If Donald Trump were elected we still feel he would pick a fight with Mexico over immigration (here). There is also still some concern on whether the judicial reform will damage Mexico institutionally and frighten foreign investors. Elsewhere, India 10yr yield spread is about right given the macro differences in growth/inflation and rate prospects. China-U.S. spreads are a function of Fed action rather than expectations, plus the scale of U.S. economic slowdown, as the PBOC will likely ease in only 10bps steps late 2024.

In terms of EM currencies it is a cross current of forces. Yield spreads and current lower exchange rates versus the USD would normally favor the BRL and MXN. However, we do feel that the unwinding of JPY carry trades will have a 2nd leg (here), while the MXN has event risk surrounding the U.S. presidential election and the likely reform in the judicial system. This could mean better entry points into the autumn. Meanwhile, RBI wants to ensure stability of India Rupee (INR), which will likely mean FX intervention on either side of current spot rates. BI will be comfortable with the Indonesian Rupee (IDR) rebound from H1 weakness and some further recovery scope exists for the IDR.