EM After the Elections: Fiscal Focus and Inflation Questions

Enhancing fiscal credibility is key post-election in India and S Africa, but also for Brazil. India, will do this in the 3 week of July, but S Africa needs to move from ANC/DA led coalition optimism to reality quickly. Brazil needs to stop the vicious circle of sentiment building up on fiscal slippage. Mexico constitutional changes are key for global investors, but event risk exists if Donald Trump were elected U.S. President. With China seeing 5% growth in 2024 but an underlying structural growth slowdown into 2025, we favour India still among big EM’s.

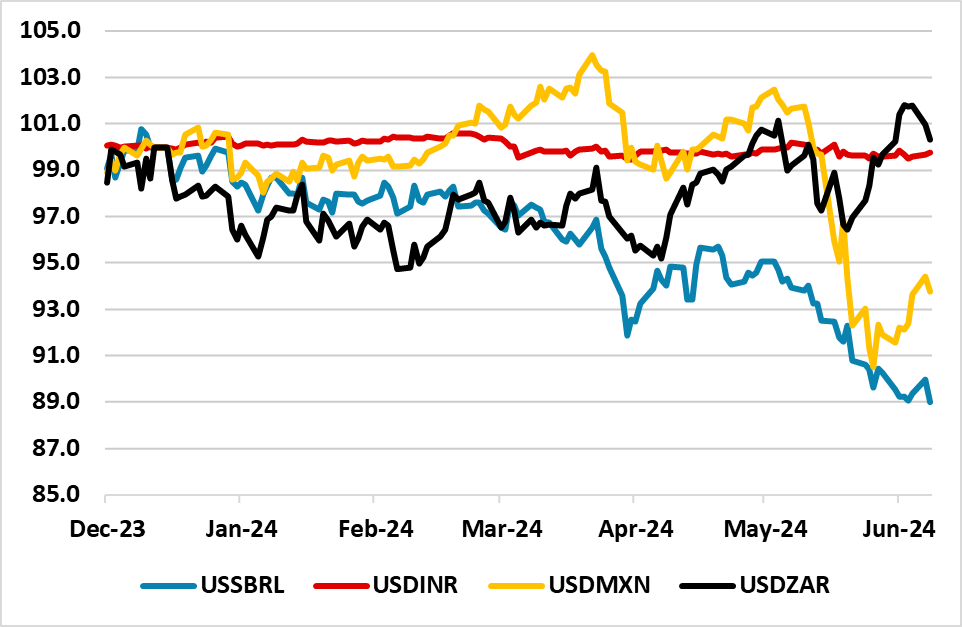

Figure 1: EM Currencies Versus the USD (Dec 31 2023 =100)

Source: Continuum Economics. Decline means a weaker currency versus the USD

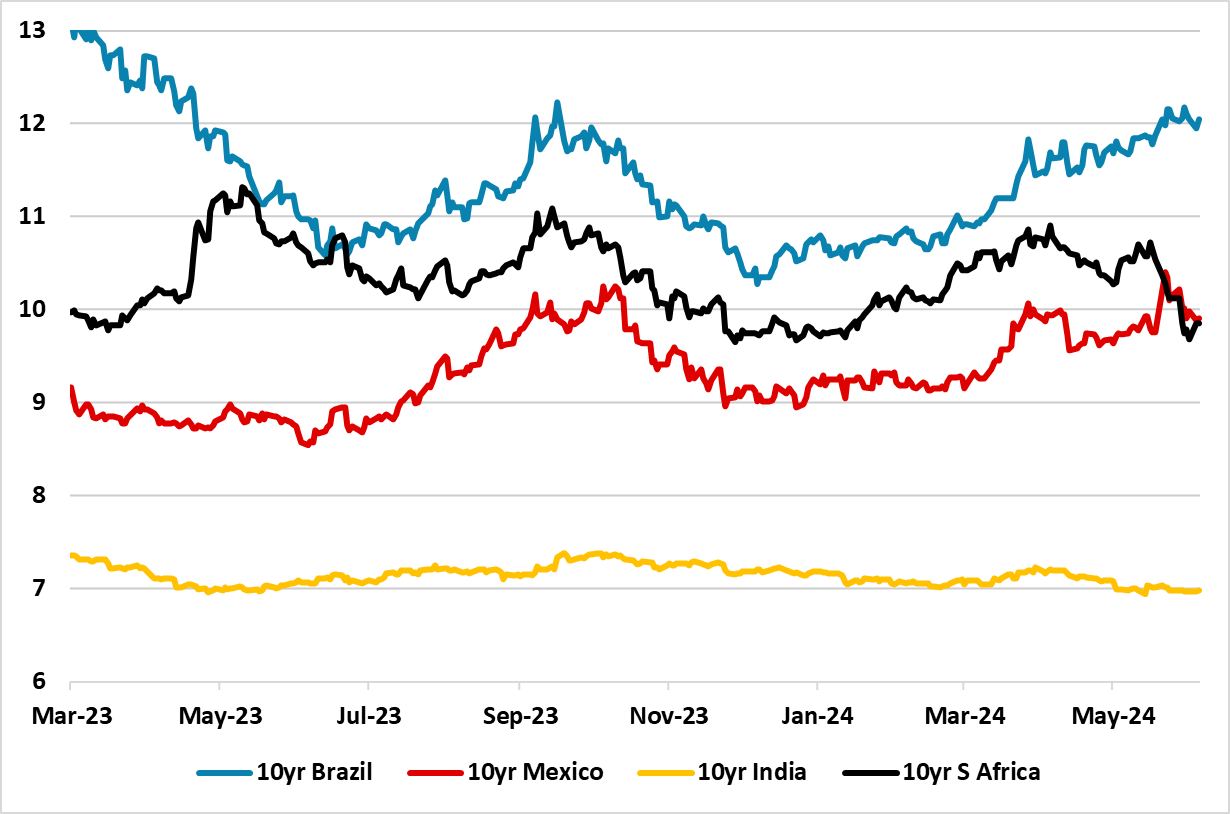

Financial markets in EM countries have been seeing volatility, but also divergence. Part of this reflects post-election rethinks in India, Mexico and S Africa. However, we would also highlight fiscal themes and inflation trajectories as being important underlying drivers for the coming months. So far S Africa has come out of the elections the best, helped a sense that the ANC/DA led GNU (Government of National Unity) coalition will be better for growth and dealing with the fiscal picture (here). This has prompted a recovery in the South Africa Rand (ZAR) (Figure 1), an improvement in mood towards the South Africa equity market (Figure 2) and a decline in 10yr bond yields (Figure 3), despite lengthy cabinet negotiations and bargaining put pressure over ZAR in the last few days.

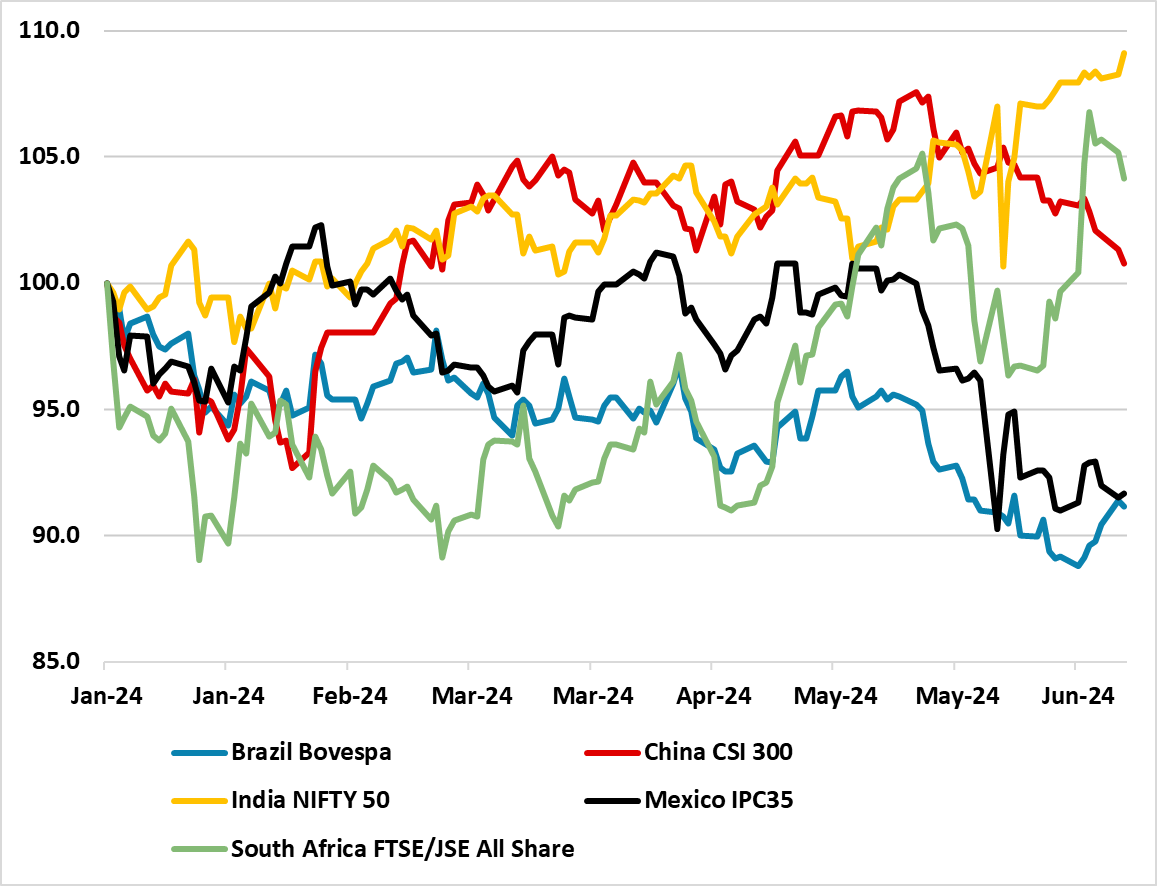

In contrast the Mexican Peso (MXN) has dropped and 10yr Mexican yield jumped on concerns that the surprise 2/3 majority could prompt market unfriendly constitutional change (here). Finally, the smaller than expected majority for PM Modi in India initial prompted an equity market selloff (Figure 2), that has been reversed on the view that Modi 3.0 will still be good for growth and reform (here).

Figure 2: Equity Market Performance (Dec 31 2023 =100)

Source: Datastream/Continuum Economics

Figure 3: 10yr Government Bond Yields Select EM (%)

Source: Datastream

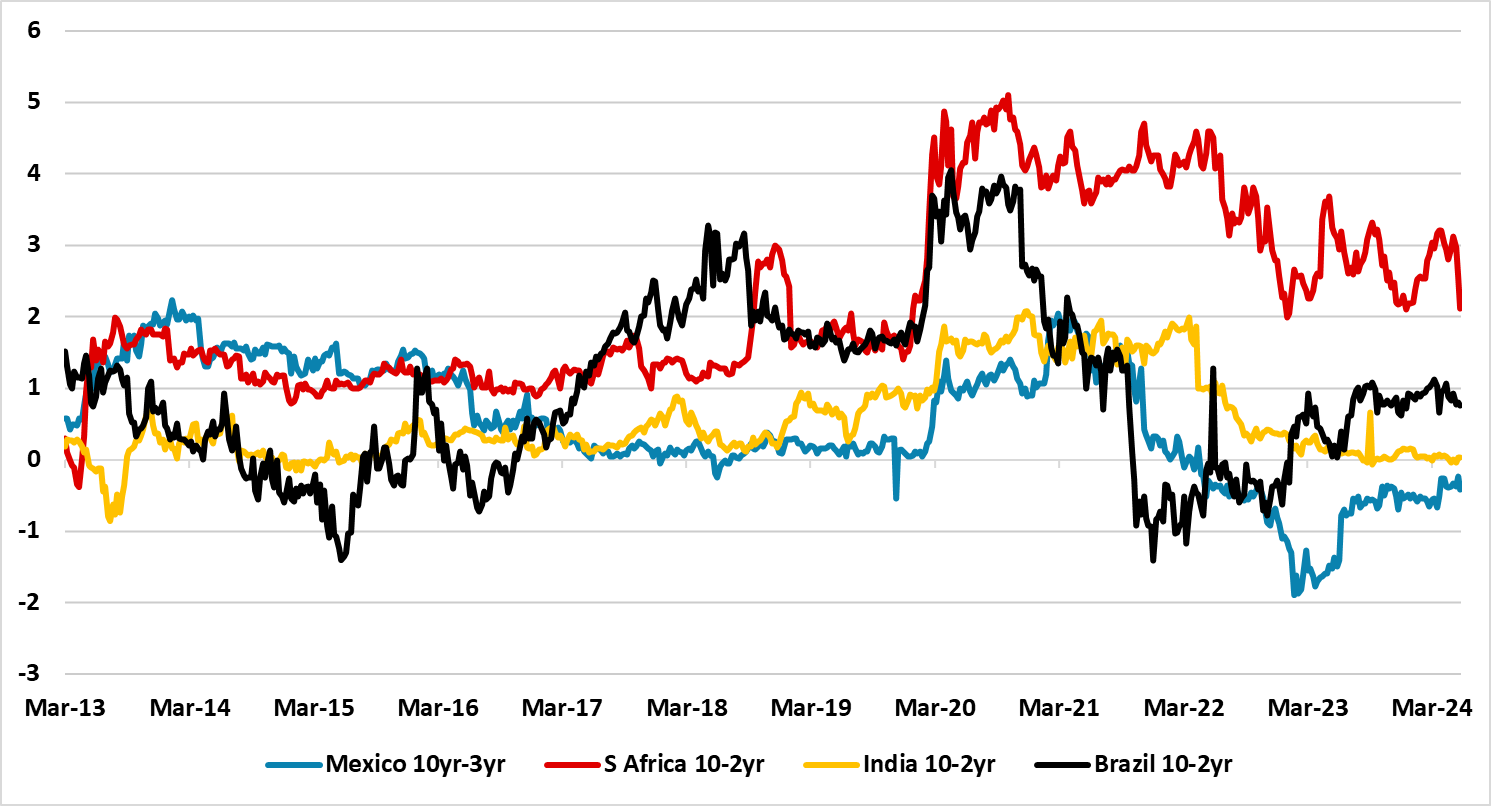

Figure 4: Select Government Bond Yield Curves (%)

Source: Continuum Economics

Nevertheless, fiscal policy and inflation remain key across these countries. We cover these in our June Asia (here); EMEA (here) and Latam (here) Outlooks. S Africa had been unloved before the election, due to fears that an unstable or a left wing coalition could emerge and derail multi year fiscal consolidation. 10yr India yields and 10-2yr yield curve (Figure 4) are relaxed on the fiscal trajectory as 10-12% nominal GDP trajectory allows India to run budget deficits but bring down government debt/GDP by the end of the decade. Brazil 10yr yield surge has been impacted by Mexican contagion, but also fears that Lula government will miss fiscal targets given uncertain tax revenues to fund recent expenditure commitments.

Sticky inflation in Brazil (here) and Mexico (here) also means that 10yr yields have been elevated by concerns that the convergence towards inflation targets will take long and could prolong the pause from BCB and Banxico (here). In Brazil, fiscal uncertainties are also producing central bank caution and a vicious cycle of sentiment that has led to higher 10yr real yields and a 10-2yr yield curve that is positive despite BCB being in clear restrictive territory.

What next? It is crucial that S Africa new coalition actually undertake a credible fiscal consolidation plan, but also a long-term plan to relieve the electricity and logistic crisis. Arguments and power sharing conflict within the coalition means that the honeymoon could soon end for S African assets. The planned July budget will be watched closely and if delayed would be unsettling. We foresee the coalition government would likely push for some fiscal tightening in the budget for the current 2024/5 year given limited fiscal space, but this will depend on how fast a coalition will start taking decisions effectively.

For Mexico, one focal point is the pace and scope of constitutional changes, with some differences between the current and incoming presidents that will need to be watched closely. Additionally, service and wage inflation are key for Mexico interest rate trajectory. If constitutional change is delayed then this could see markets returning to the carry theme for Mexico. However, event risk surrounds the U.S. presidential election in November. If Donald Trump were elected he will likely pick a fight with Mexico to dramatically slow immigration and this could involve trade threats. This would cast a temporary cloud over Mexican assets. Additionally, there is some doubts whether the new administration will keep its promise of a fiscal consolidation after an expected budget deficit of 5.0% of GDP in 2024.

For Brazil, Lula government needs to regain fiscal credibility with the markets and BCB, otherwise domestic sentiment will worry about a vicious circle of high rates and the government debt/GDP trajectory. However, if fiscal calm returns then it could prompt a return to the carry trades that dominated in 2023 and 2024 Q1 that caused the previous virtuous circle of sentiment with a firmer BRL and lower 10yr bond yields.

Finally, India is expected to present the full FY25 budget in the 3 week of July, which should show some medium-term fiscal consolidation and modest reforms. The budget focus will be capital expenditure led growth, alongside welfare schemes to prop up consumption. This all fits with the narrative that India is the favorite big EM with inflation in target; high real and nominal GDP growth; plus a decade of momentum moving towards middle income GDP per capita. In equities, we still remain bullish for India, despite high valuations (here). Mexico was seen as a structural EM winner, alongside India and Indonesia but needs to find a balance on the constitution question. Brazil and South Africa needs to have fiscal credibility first.

For China, public investment and industrial production in high tech and renewables are helping to support growth and should get the economy close to 5% in 2024. However, underneath the surface, consumption is slowing, private sector investment and employment growth is sluggish, and residential property investment continues to be a negative drag on GDP. These can come through to slow the economy into 2025 and we still forecast 4.0% GDP growth. Meanwhile, we continue to forecast a large undershoot of the 3% inflation desires, with a mere +0.3% for 2024 CPI inflation.