Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal policies are weighing on demand. Although early U.S. imports from Mexico provided temporary support, risks remain elevated. A Q2 contraction is likely, and full-year growth is expected to be flat, with downside risk if tariffs are implemented.

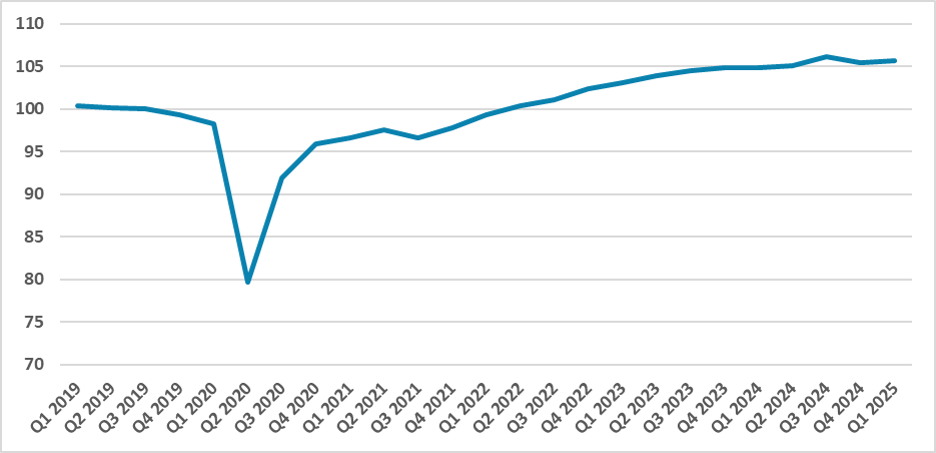

Figure 1: Mexico’s GDP (Seasonally Adjusted)

Source: INEGI

The Mexican National Statistics Institute has released the preliminary estimate of GDP for Q1. The data shows that GDP grew 0.2% (q/q) during the quarter, after a -0.6% contraction in the last quarter of 2024. Therefore, Mexico has avoided a technical recession — defined as two consecutive quarters of contraction — but the news is not entirely positive, as this small growth confirms a slowdown scenario.

What saved Mexico from a technical recession was the growth registered in the agricultural sector. This sector grew 0.8% in the quarter, mostly recovering from the contraction in Q4. However, this sector is very volatile and sensitive to climate change, and it is not the engine of Mexico’s growth. The main challenge lies in the industrial and services sectors. The industrial sector contracted by 0.3%, while the services sector remained flat, with 0% growth.

The first quarter of 2025 was mainly impacted by the uncertainty surrounding potential tariffs. Although they have not yet been fully implemented, the anticipation of tariffs is already affecting Mexico’s economic environment. One positive factor is that U.S. companies have advanced some imports from Mexico in an effort to avoid potential tariffs by purchasing goods before they are introduced.

We also believe that Mexico’s internal demand is being affected by contractionary monetary policy. Internal demand is clearly cooling, and this is also being impacted by the fiscal adjustment the government is implementing this year, aiming for a balanced budget after recording a deficit last year.It is quite possible that the worst is still to come in terms of the impact of tariffs. Although products under the USMCA are currently exempt, the uncertainty is already having an effect. The imposition of 25% tariffs would clearly impact demand. Additionally, if the U.S. economy also slows down, Mexico’s industrial sector will be further affected.

We believe there is likely to be a contraction in Q2, followed by some recovery in the second half of the year. Our baseline forecast is for 0% growth in the Mexican economy in 2025 — even if the tariffs are not fully implemented — with the potential for a 0.5% contraction if they are.