Mexico CPI Review: 0% Inflation in August as Expected

Mexico's CPI remained flat in August, causing year-over-year CPI to drop from 5.6% to 5.0%. This stability was driven by a 0.7% decline in non-core CPI, while core CPI rose 0.2%. The Food and Beverages CPI fell 0.6%, reflecting easing pressure on agricultural goods. With the economy cooling, inflation trends suggest continued disinflation, especially in core goods. Banxico is expected to cut rates, with three 25bps reductions forecast, bringing the policy rate to 10.0% by the end of 2025.

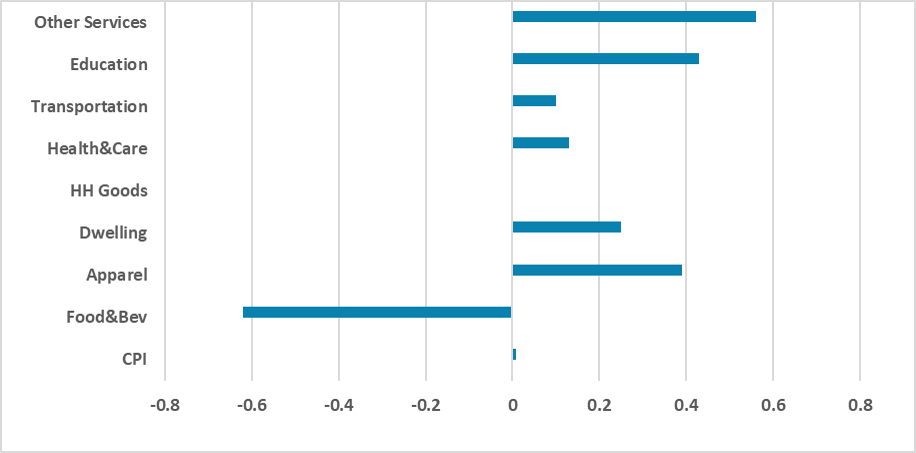

Figure 1: Mexico’s CPI by Group (%, m/m)

Source: INEGI

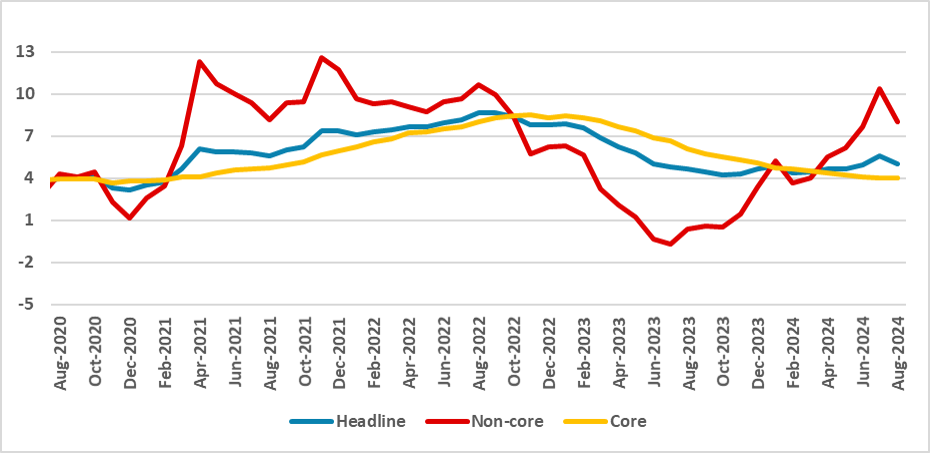

The Mexico National Statistics Institute (INEGI) has released the CPI figures for August. The numbers were aligned with our preview (here) and most market expectations (according to Bloomberg), showing that the CPI grew 0% in August. Consequently, year-over-year CPI dropped to 5.0% from 5.6% in July. This stability in the CPI was mainly driven by a contraction in non-core CPI, which fell 0.7% month-over-month in August. On a year-over-year basis, non-core CPI grew 8.0%. Core CPI performed well in August, increasing by 0.2%, with the year-over-year index showing a 4.0% growth. However, Services CPI grew 0.3%, exhibiting some persistence.

Figure 2: Mexico’s (%, Y/Y)

Source: INEGI

Looking at specific categories, the Food and Beverages CPI was responsible for the lower overall CPI, decreasing by 0.6% in August. It appears that pressures related to agricultural goods are finally easing. Overall, tradable CPI is weakening, which is consistent with an economy that is cooling down. Education prices increased by 0.4% month-over-month, reflecting seasonal adjustments in school and university fees. "Other Services" was the group that rose the most in August, increasing by 0.6%. It seems this new phase of disinflation will be marked by a faster decline in core goods rather than in core services CPI.

At present, the rise in non-core CPI is overshadowing core CPI due to shocks in agricultural goods. We believe that as we approach the end of the year, non-core CPI will start to decline as these shocks dissipate, and core CPI will likely continue to fall gradually. This is aligned with our year-end forecast of 4.7% for headline CPI and 3.8% for core CPI.

The softer inflation numbers, combined with weaker GDP figures (here), indicate that the Mexican economy is finally cooling. We believe this will give Banxico the confidence to resume cutting the policy rate. The risk of these agricultural shocks spreading to other CPI components is now low, and it seems the impact of the depreciation on inflation will be limited. We now forecast three 25bps cuts from Banxico, which means the policy rate will end 2025 at 10.0%.