Mexico GDP: Demand Sustains Q3 Rebound, but Growth Expected to Slow

Mexico's Q3 GDP grew by 1.0% quarter-over-quarter, beating market expectations, though annual growth slowed to 1.5%. High employment and stronger-than-expected U.S. demand sustained growth, but the outlook remains cautious. Slower growth is expected ahead, with limited structural shifts such as nearshoring. Banxico may continue gradual rate cuts, restrained by inflation risks. U.S. election results could pose further risks, especially if U.S.-Mexico relations are impacted. GDP forecasts stand at 1.6% for 2024 and 1.3% for 2025.

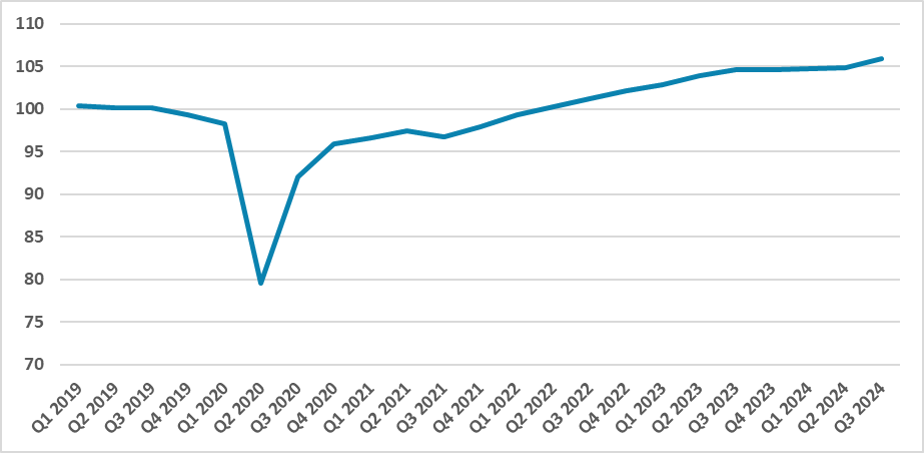

Figure 1: Mexico GDP (Seasonally Adjusted, 2019 = 100)

Source: INEGI

Mexico's National Statistics Institute has released preliminary GDP data for Q3. While markets expected 0.8% quarter-over-quarter (q/q) growth, according to a Bloomberg survey, the figures showed a 1.0% q/q growth. On an annual basis, GDP grew by 1.5% compared to the same quarter of 2023, marking a significant deceleration, as the same index had shown 4.4% growth a year prior.

We believe internal demand sustained growth in the third quarter. Although the economy is weaker, a high level of employment kept it buoyant. Additionally, demand from the U.S. was stronger than previously expected, as the U.S. economy tends to cool more slowly. We do not yet have data by demand components, but preliminary data indicates that both industry and services grew by 0.9%, while the agricultural sector expanded by 4.6%, recovering from the previous quarter when it contracted by over 3.0%.

Although the Mexican economy surprised on the upside, our medium-term outlook remains largely unchanged. We continue to see the Mexican economy slowing in the upcoming quarters, with most past growth more attributable to the overheated U.S. economy and the lagged post-pandemic recovery rather than any structural shift, such as nearshoring. We still believe some fiscal consolidation will be necessary in 2025, and although monetary policy will be somewhat less tight, it will remain in contractionary territory.

The stronger-than-expected growth and potential food inflation risks will likely prevent Banxico from accelerating the pace of rate cuts. We continue to anticipate 25 basis points cuts in each meeting until rates approach neutrality.

The major risk will be clarified in a few days when election results are announced. The biggest concern is a Trump victory, which could jeopardize U.S.-Mexico relations and harm Mexican exports to the U.S. At present, we are increasingly skeptical about nearshoring prospects, especially given Mexico's institutional changes, which tend to deter fresh investment on Mexican soil.

Our GDP forecast for Mexico now stands at 1.6% for 2024 and 1.3% for 2025.