EM-EMEA Central Banks

View:

July 31, 2025

SARB Cuts Key Rate to 7.0% Given Subdued Inflation; Lower CPI Goal Announced

July 31, 2025 3:32 PM UTC

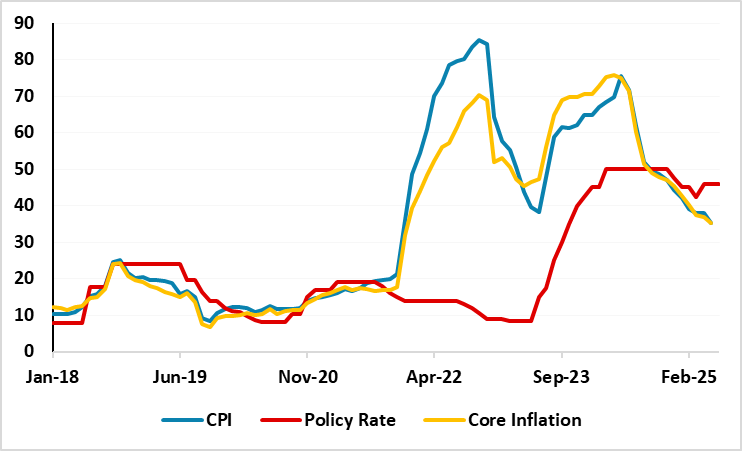

Bottom Line: Despite the uncertainty around United States tariffs and rising domestic food inflation, South African Reserve Bank (SARB) reduced the policy rate by 25 bps to 7.0% during the MPC on July 31 as annual inflation hit 3.0% YoY in June coupled with eased core inflation, and a relatively sta

July 25, 2025

CBR Reduced its Key Rate to 18% as Inflation Softens

July 25, 2025 11:41 AM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June fro

July 24, 2025

Easing Cycle Restarts: CBRT Reduced the Key Rate to 43% on July 24

July 24, 2025 2:15 PM UTC

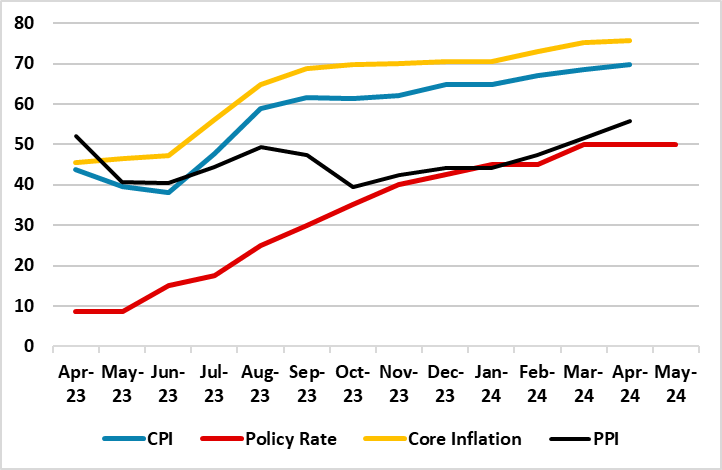

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 300 bps to 43% during the MPC meeting on July 24 taking the deceleration trend in inflation and relative TRY stability in June into account. CBRT highlighted in its written statement that the underly

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

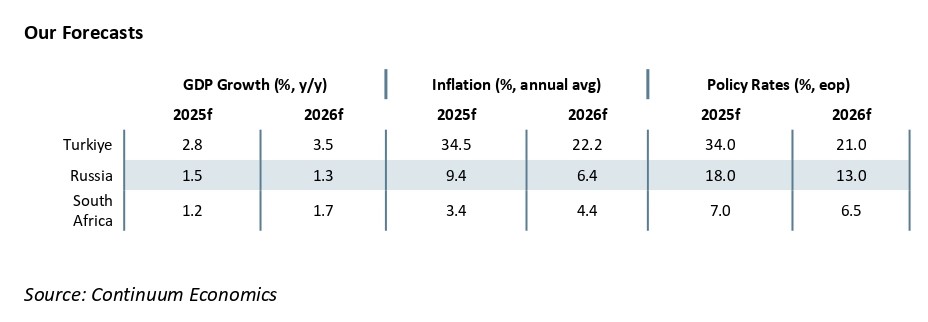

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 19, 2025

Hawkish Stance Maintained: CBRT Held the Key Rate Stable at 46% Despite Softening Inflation

June 19, 2025 7:49 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) held the policy rate unchanged at 46% during the MPC on June 19 despite inflation continues to ease. CBRT highlighted in its written statement that the tight monetary stance will be maintained until price stability is achieved via a sustained decline in in

June 06, 2025

Surprising Move: CBR Reduced Key Rate to 20% from 21%

June 6, 2025 1:10 PM UTC

Bottom Line: Despite predictions were centered around no change, Central Bank of Russia (CBR) cut policy rate on June 6 for the first time after September 2022 citing easing in inflationary pressures, including core inflation. CBR indicated in its written statement that CBR will maintain monetary co

May 29, 2025

SA MPC Review: SARB Cuts Key Rate to 7.25% on May 29 Given Subdued Inflation

May 29, 2025 4:03 PM UTC

Bottom Line: South African Reserve Bank (SARB) reduced the policy rate to 7.25% during the MPC on May 29 highlighting that annual inflation remained below SARB’s target range of 3%-6% hitting 2.8% YoY in April coupled with eased core inflation in April and a stronger Rand. We think the recent with

May 23, 2025

Turkiye Inflation Report: CBRT Keeps Its End-Year Inflation Forecast at 24%

May 23, 2025 6:28 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its second quarterly inflation report of the year on May 22, and kept its inflation forecast constant for 2025 at 24%. CBRT governor Karahan signalled to maintain a tight stance until a permanent decline in inflation is sustained and price stabili

May 21, 2025

SA MPC Preview: No Rate Cuts Are Expected on May 29 Due to Uncertainties

May 21, 2025 1:10 PM UTC

Bottom Line: Taking into account that annual inflation increased to 2.8% YoY in April due to higher food prices, we think South African Reserve Bank (SARB) will likely hold the rate constant at 7.5% during the next MPC scheduled on May 29 given plenty of upside risks to inflation including unpredict

April 25, 2025

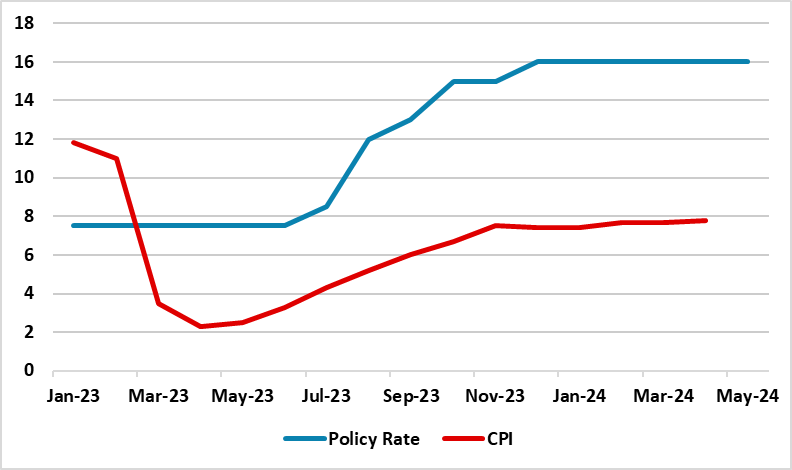

CBR Continues to Keep Key Rate Constant at 21% Despite Surging Inflation

April 25, 2025 1:56 PM UTC

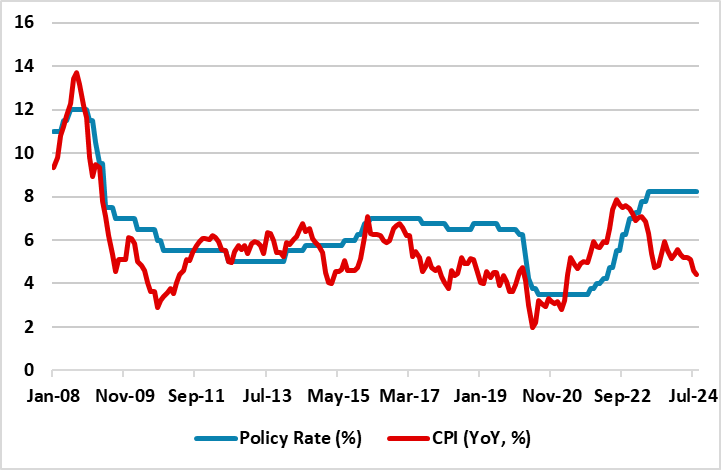

Bottom Line: As we predicted, Central Bank of Russia (CBR) held the policy rate stable on April 25 for the fourth consecutive time to combat price pressures. CBR indicated in its written statement that CBR will maintain monetary conditions as tight as necessary to return inflation to the target

February 14, 2025

CBR Held Key Rate Constant at 21% on February 14

February 14, 2025 12:24 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) kept the policy rate constant on February 14 for the second consecutive time supported by the recent RUB strengthening while the inflation remains elevated. CBR said in its statement on February 14 that current inflationary pressures remain

February 06, 2025

CBR Will Likely Hold Key Rate Constant at 21% on February 14

February 6, 2025 10:05 AM UTC

Bottom Line: After Central Bank of Russia (CBR) held the key rate stable at 21% on December 20 despite expectations were centered around a rate hike, we now foresee that the rate will be kept constant on February 14 taking into account that January will likely bring a little inflation relief support

January 30, 2025

As Expected, SARB Cut the Key Rate to 7.5% on January 30

January 30, 2025 4:54 PM UTC

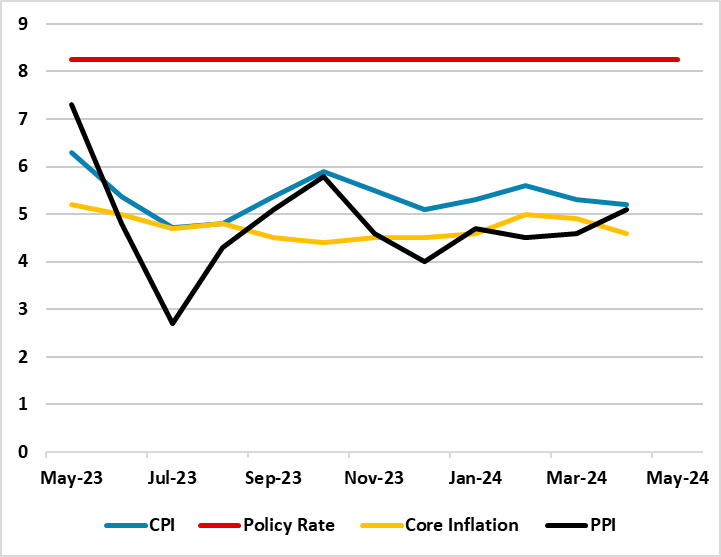

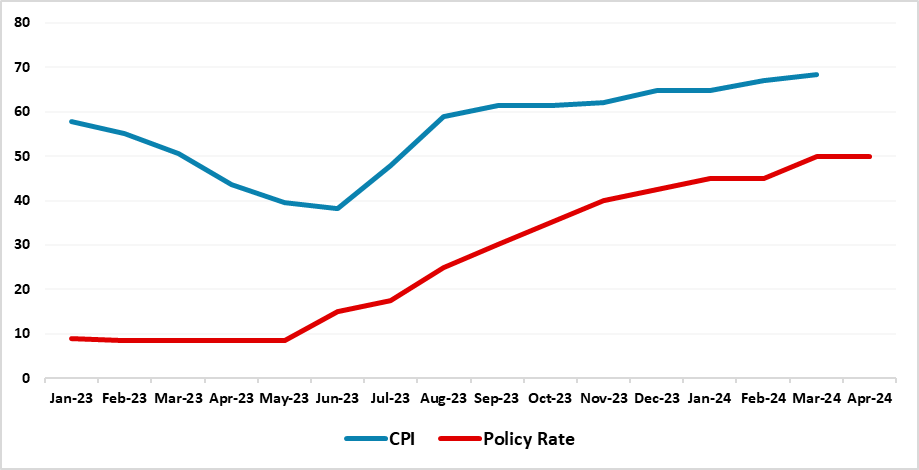

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, South African Reserve Bank (SARB) decided to cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate, power cuts (loadsheddin

January 24, 2025

SA MPC Preview: SARB will Likely Cut the Key Rate to 7.5% on January 30

January 24, 2025 1:19 PM UTC

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, we now think it is likely that South African Reserve Bank (SARB) will cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate

January 23, 2025

As Expected, CBRT Continued its Easing Cycle on January 23

January 23, 2025 12:06 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate to 47.5% on December 26, the easing cycle continued on January 23 as CBRT reduced the policy rate by 250 bps to 45% backed by the deceleration trend in inflation continued in December, monthly inflation stood below expecta

January 16, 2025

Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on January 23

January 16, 2025 3:09 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, we believe the rate cuts will continue during the MPC meeting scheduled for January 23. CBRT will likely reduce the policy rate by 250 bps to 45% as the deceleration trend in inflation c

January 10, 2025

Reserves, Rates, and Reform: BI’s 2025 Strategy to Stabilise the Rupiah

January 10, 2025 8:06 AM UTC

Currency pressures and policy pivots define BI’s entry into 2025, with the rupiah breaching 16,000 per dollar. Strong reserves and strategic moves signal resilience, but sustaining investor confidence in the face of fiscal and structural vulnerabilities remains a tough challenge.

January 09, 2025

SARB to Continue Rate Cuts in 2025, but the Pace Will Depend on Inflation Trajectory and Global Developments

January 9, 2025 11:23 AM UTC

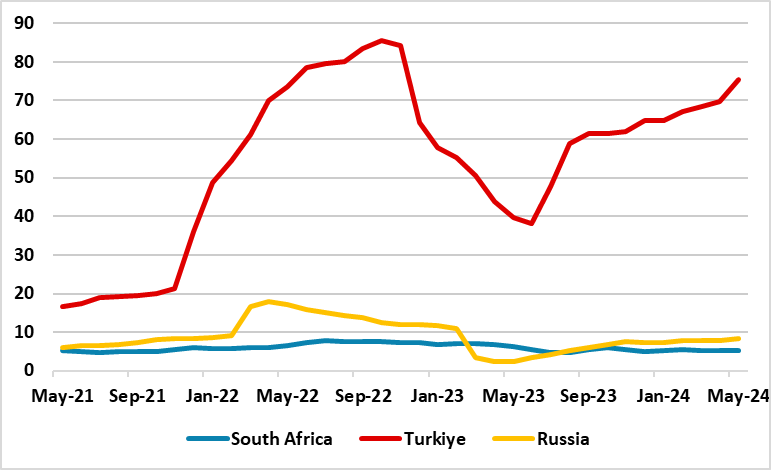

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased the rate from 8.25% to 7.75% in 2024 given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we for

January 08, 2025

2025 will be Key for CBRT

January 8, 2025 3:06 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, which was the first rate cut in around two years, we believe the rate cuts will continue in 2025 following inflation fighting drive in 2024 while our end year key rate prediction remains

December 26, 2024

First Cut Since 2023: CBRT Lowered Key Rate to 47.5%

December 26, 2024 3:14 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26 which was the first rate cut in around two years, but said it would remain cautious about future cuts. In its press release, CBRT cited a flat underlying trend of inflation in November and sugg

December 20, 2024

Surprising Move: CBR Held Key Rate at 21% Despite Surging Inflation

December 20, 2024 1:39 PM UTC

Bottom Line: Despite expectations, Central Bank of Russia (CBR) announced on December 20 that it held the key rate constant at 21%. The CBR emphasized in its statement that monetary conditions tightened more significantly than envisaged by the October key rate decision, and it would continue to eval

November 21, 2024

SARB MPC Review: Fall in Inflation Sparked Easing Cycle to Continue on November 21

November 21, 2024 3:58 PM UTC

Bottom line: South African Reserve Bank (SARB) cut the key rate by 25 bps to 7.75% at its final meeting of the year on November 21 given power cuts (loadshedding) are suspended, inflation expectations decelerated, and CPI softened further to 2.8% YoY in October due to falling fuel prices and slowing

No Surprises: CBRT Held Key Rate Stable at 50% on November 21

November 21, 2024 11:48 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% for the eighth consecutive month on November 21. In its press release, CBRT highlighted that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation

October 25, 2024

CBR Hiked Key Rate to Historic 21% Level

October 25, 2024 12:31 PM UTC

Bottom Line: Central Bank of Russia (CBR) announced on October 25 that it increased its policy rate by 200 bps to 21% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press release that “Over th

October 17, 2024

CBRT Continued to Hold Key Rate Stable at 50% for Seventh Consecutive Meeting

October 17, 2024 4:27 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% for the seventh consecutive month on October 17. CBRT’s press release remained almost unchanged, as the regulator highlighted that tight monetary stance will be maintained until a significant and sustained decline in th

October 08, 2024

SARB in 2025: Rate Cuts Will Continue

October 8, 2024 5:25 PM UTC

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased it from 8.25% to 8.0% given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we now foresee the ra

September 25, 2024

EMEA Outlook: Rate Cuts Loading in 2025

September 25, 2024 7:00 AM UTC

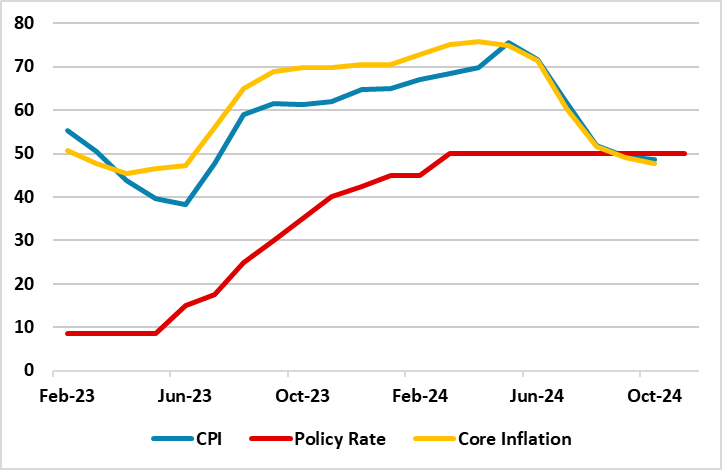

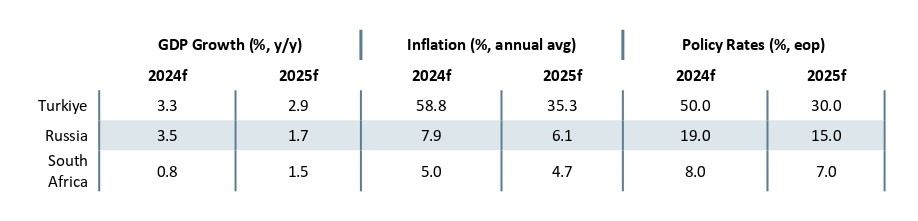

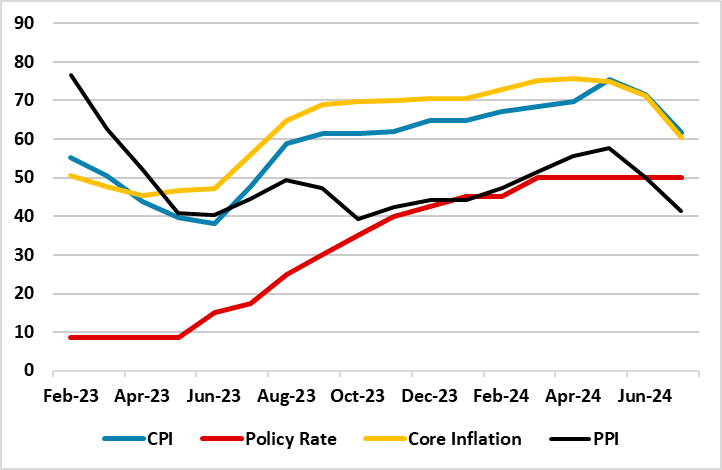

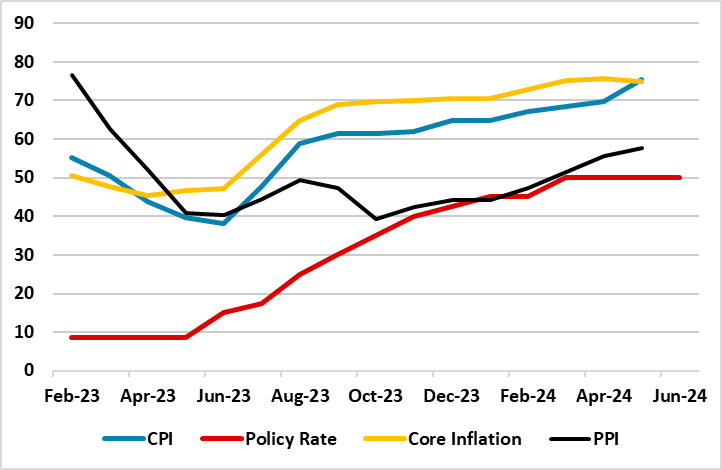

· In Turkiye, we still foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation, and adverse geopolitical impacts leading average inflation to stand at 58.8% and 35.3% in 2024 and 2025, respectively. We think Central Bank of Republic of Turkiye (CBRT

September 19, 2024

Time Has Come: SARB Cut the Key Rate to 8.0% on September 19

September 19, 2024 3:57 PM UTC

Bottom line: As we expected, South African Reserve Bank (SARB) started cutting the key rate at the upcoming MPC meeting on September 19 and decreased it from 8.25% to 8.0% given recent fall in inflation, suspended power cuts (loadshedding) after March, deceleration in inflation expectations and a re

No Surprises as CBRT Continued to Hold Key Rate Stable at 50% on September 19

September 19, 2024 1:11 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% for the sixth consecutive month on September 19. CBRT reiterated in a statement that tight monetary stance will be maintained until a significant and sustained decline in the

September 13, 2024

As we Expected, CBR Hiked Key Rate to 19% as Inflation Continues to Soar

September 13, 2024 4:20 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on September 13 that it increased its policy rate by 100 bps to 19% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press rele

September 12, 2024

Time Has Come: SARB will Likely Decrease the Key Rate to 8.0% on September 19

September 12, 2024 7:09 PM UTC

Bottom line: South African Reserve Bank (SARB) will likely start cutting the key rate at the upcoming MPC meeting on September 19 and decrease the rate from 8.25% to 8.0% given recent fall in inflation, suspended power cuts (loadshedding) after March, deceleration in inflation expectations and a rel

August 29, 2024

CBRT Remains Cautious Holding Key Rate at 50% Despite Recent Fall in Inflation

August 29, 2024 10:24 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) recently released its summary of the Monetary Policy Committee (MPC) meeting after keeping the policy rate stable at 50% on August 20. CBRT said in its summary that tight monetary stance will be maintained until a significant and sustained decline in the u

August 22, 2024

Rupiah Gains Ground: BI Stays Cautious on Rate Cuts

August 22, 2024 11:26 AM UTC

Bank Indonesia held its key interest rate at 6.25% to stabilise the rupiah and attract FX inflows, while maintaining interventions in the FX and bond markets. Inflation remains within target, and GDP growth forecasts are steady. Future rate cuts depend on US Federal Reserve actions. A 25bps cut is e

July 26, 2024

CBR Hiked Key Rate to 18% as Inflation Soars

July 26, 2024 2:16 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on July 26 that it increased its policy rate by 200 bps to 18% after four consecutive rate holds, and first time in 2024, to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal pol

July 23, 2024

CBRT Continued to Keep Key Rate Stable at 50%

July 23, 2024 1:48 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on July 23. CBRT said in a statement that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is ob

July 17, 2024

Stable Rupiah, Steady Growth: Inside Bank Indonesia's Latest Rate Decision

July 17, 2024 1:13 PM UTC

Bank Indonesia held its key interest rate at 6.25% to stabilize the rupiah and attract FX inflows, while maintaining interventions in the FX and bond markets. Inflation remains within target, and GDP growth forecasts are steady. Future rate cuts depend on US Federal Reserve actions. A 25bps cut is e

July 02, 2024

Softening inflation will provide BI room to hold rate

July 2, 2024 1:36 PM UTC

Bank Indonesia in a pro-stability move decided to maintain the key policy rate at 6.25%. The move comes at a time when the weakness in the Indonesia Rupiah has increased in recent weeks. A rate cut is therefore not on the horizon.

June 27, 2024

As Widely Expected, CBRT Kept Key Rate Stable at 50% on June 27

June 27, 2024 12:32 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on June 27 despite galloping inflation edged up to 75.5% in May, up from 69.8% in April. CBRT said in a statement on June 27 that "(…) the tight monetary stance will be main

June 24, 2024

EMEA Outlook: Stubborn Inflation Dominates

June 24, 2024 1:00 PM UTC

· In Turkiye, we expect Central Bank of Republic of Turkiye (CBRT) will likely halt the key rate at 50% until the end of 2024, which is our baseline scenario. We expect a fall in inflation likely after July due to favorable base effects, additional macro prudential measures, public savings

June 21, 2024

Bank Indonesia Holds Rate Despite IDR Weakness

June 21, 2024 5:54 AM UTC

Bank Indonesia in a pro-stability move decided to maintain the key policy rate at 6.25%. The move comes at a time when the weakness in the Indonesia Rupiah has increased in recent weeks. A rate cut is therefore not on the horizon.

June 07, 2024

CBR Kept the Key Rate Stable at 16% despite Increasing Inflation

June 7, 2024 12:57 PM UTC

Bottom Line: Central Bank of Russia (CBR) announced on June 7 that it decided to keep the policy rate unchanged at 16% for the fourth meeting in a row, but signalled that a rate hike is possible in the near term to tame the stubborn price pressures stemming from high military spending, tight labour

May 30, 2024

SARB Held the Key Rate Stable at 8.25%

May 30, 2024 3:06 PM UTC

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at a 15-year high of 8.25% on May 30 despite inflation rate fell for a second consecutive month in April due to less severe power cuts (load shedding), a firmer South African rand (ZAR) coupled with lower f

May 23, 2024

As Expected, CBRT Kept Key Rate Unchanged at 50%

May 23, 2024 7:30 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on May 23 despite galloping inflation which edged up to 69.8% in April, up from 68.5% in March. CBRT said in a statement on May 23 that "(...)considering the lagged effects of

May 22, 2024

Bank Indonesia Holds Firm on Rates: A Steady Hand for Currency Stability

May 22, 2024 9:29 AM UTC

Bank Indonesia in a pro-stability move decided to maintain the key policy rate at 6.25% today. The move comes at a time when the wakness in the Indonesia Rupiah has abated and headline inflation has edged down. Despite improving stability, a rate cut is not in sight in the near term.

April 29, 2024

Indonesia: MPC Review: Bank Indonesia Surprises With A Rate Hike

April 29, 2024 11:26 AM UTC

In a pre-emptive move to both curb inflationary pressures and safeguard the Indonesia Rupiah (IDR) against furhter depreciation, Bank Indonesia, in a surprise move, increased its main policy rate by 25 bps to 6.25%. However, further rate hikes are not expected as the central bank remains wary of hur

April 26, 2024

CBR Kept the Key Rate Stable at 16%

April 26, 2024 1:12 PM UTC

Bottom Line: As widely expected, Central Bank of Russia (CBR) announced on April 26 that it decided to keep the policy rate unchanged at 16% for the third meeting in a row. CBR made critical changes in its key rate and inflation forecasts as it lifted its 2024 inflation forecast to 4.3-4.8% from 4-4

April 25, 2024

CBRT Kept Key Rate Unchanged at 50%

April 25, 2024 3:25 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on April 25 despite galloping inflation, and pressure on FX lately. According to the CBRT statement, monetary policy stance will be tightened in case a significant and persist

April 23, 2024

Indonesia: MPC Preview: Bank Indonesia to Hold Rate Despite Currency Volatility

April 23, 2024 11:12 AM UTC

With inflation within target range and the need to defend the currency amid global uncertainties and US dollar strength, Bank Indonesia (BI) is likely to extend its pause on rate adjustments in the upcoming monetary policy meeting on April 24. BI remains committed to stabilising the Indonesian rupia

April 01, 2024

Indonesia CPI Review: Ramadan Demand Drives Up Inflation

April 1, 2024 1:33 PM UTC

Indonesia's latest Consumer Price Index (CPI) data has revealed a notable acceleration in inflation, surpassing expectations and marking the highest rate since August 2023. The surge, driven primarily by heightened demand during the fasting month of Ramadan, highlights significant price pressures ac

March 27, 2024

Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

March 27, 2024 3:26 PM UTC

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to