CBRT Continued to Hold Key Rate Stable at 50% for Seventh Consecutive Meeting

Bottom Line: Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% for the seventh consecutive month on October 17. CBRT’s press release remained almost unchanged, as the regulator highlighted that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and added that it remains highly attentive to inflation risks. We continue to foresee that the policy rate will be held unchanged at 50% in the rest of 2024 as slowing trend in CPI decelerated in September. We expect cautious and hawkish CBRT to start cutting rates in Q1 2025, if inflation trajectory allows in Q4.

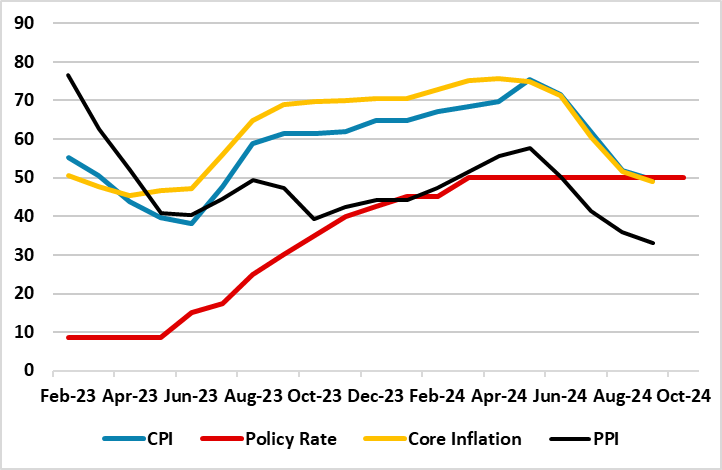

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – October 2024

Source: Continuum Economics

As we anticipated, the CBRT decided to hold the key rate stable at 50% on October 17 MPC meeting basically to cool off the elevated inflation. According to the Bank’s assessment, inflation expectations and pricing behavior continue to pose risks to the disinflation process.

After the inflation deceleration partly slowed down in September, CBRT noted that the underlying inflation trend has slightly increased despite core goods inflation remained low. (Note: CPI cooled off to 49.4% y/y in September from 51.9% y/y in August). "The tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and inflation expectations converge to the projected forecast range," the bank stated.

After CPI softened in Q3 ignited by favourable base effects, lagged impacts of aggressive tightening and relative TRY stability underpinning the inflation relief, we envisage that inflation will continue decelerate in Q4, but the extent of the decline will be determined by administrative price adjustments, TRY volatility and tax adjustments late 2024. (Note: TRY lost almost 1% of its value against U.S. Dollar in September). Despite CBRT predicts inflation will to fall to 38% and 14% at end-2024 and end-2025, respectively, and the government sees end 2024 inflation of 41.5% in the updated medium-term program (MTP), we foresee end-year inflation will likely hit around 43-44% backed by moderate slowdown in domestic demand. We think high inflation expectations, stickiness in services inflation, deteriorated pricing behavior, and geopolitical risks will keep inflation pressures alive.

Speaking about the developments, CBRT deputy governor Cevdet Akcay said in a recent statement for The Economist that “We will stay tight until the underlying trend of monthly inflation comes down on a sustainable basis.” Taking into account that elevated inflation will continue to put pressure on CBRT to resume tightening cycle in the upcoming months, we continue to foresee CBRT to hold the key rate constant at 50% through the end of 2024.

We expect cautious and hawkish CBRT to start cutting rates in Q1 2025 if inflation trajectory allows in Q4. It is worth noting that the pressure has been growing on the central bank from exporters and industrialists to start lowering its rates to reverse a marked slowdown in the economy, and this will also be a factor of consideration for CBRT in the upcoming months.