Easing Cycle Restarts: CBRT Reduced the Key Rate to 43% on July 24

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 300 bps to 43% during the MPC meeting on July 24 taking the deceleration trend in inflation and relative TRY stability in June into account. CBRT highlighted in its written statement that the underlying trend of inflation remained flat in June, and the disinflationary impact of demand conditions has strengthened. Our end year key rate prediction remains at 34.0% for the-end of 2025.

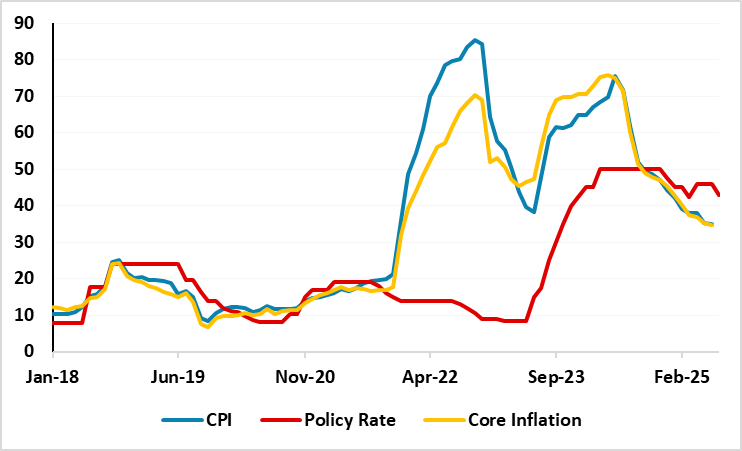

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – July 2025

Source: Continuum Economics

The deceleration trend in inflation, which continued in June with 35.1% y/y supported by lagged impacts of previous monetary tightening and tighter fiscal measures, left with some room of choice for the CBRT on July 24, and CBRT used this opportunity to cut the rates by 300 bps to 43% taking the moderate fall in MoM inflation and relative TRY stability in June into consideration. (Note: CPI cooled off to 35.1% y/y June from 35.4% in May with education and housing prices leading the rise in the index. MoM inflation rose by 1.4% in June, lower than 1.5% MoM inflation the previous month). This is first rate cut since March 2025, during when the arrest of Istanbul mayor Imamoglu caused a market turbulence and sent TRY to tumbling.

In its written statement on July 24, CBRT emphasized that the underlying trend of inflation remained flat in June, and the disinflationary impact of demand conditions has strengthened. (Note: The regulator added that the leading indicators suggesting a temporary rise in monthly inflation in July due to month-specific factors).

Although CBRT reduced the key rate more-than-expected, it appears the CBRT’s accompanying communications maintained a hawkish tone, suggesting a more cautious approach to monetary easing going forward. CBRT highlighted that the tight monetary policy stance, which will be maintained until price stability is achieved, will support the disinflation process through moderation in domestic demand, real appreciation in TRY, and improvement in inflation expectations.

It appears business people and exporters were also expecting this move. Speaking about the CBRT’s rate cuts, Burhan Ozdemir, the head of the Independent Industrialists and Businessmen Association (MUSIAD) recently said that the value of the TRY is not at the level exporters would want it to be, noting that the current real interest rate has been too high relative to the exchange rate.

It is worth noting that key concern for the CBRT remains service sector inflation, particularly in housing rentals, and education prices. We believe deteriorated pricing behaviour, inflation expectations, adverse geopolitical developments coupled with hike in natural gas prices as of July 1 will likely lead to average headline inflation to stand at 34.5% in 2025, despite the CBRT predicts inflation will soften to 24% at the end of 2025.

We continue to think that CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. Our end year key rate prediction remains at 34.0% for the-end of 2025, and we feel Mth/Mth inflation readings will continue to be key in H2 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.