CBR Held Key Rate Constant at 21% on February 14

Bottom Line: As we predicted, Central Bank of Russia (CBR) kept the policy rate constant on February 14 for the second consecutive time supported by the recent RUB strengthening while the inflation remains elevated. CBR said in its statement on February 14 that current inflationary pressures remain high, warning that medium-term inflation risks are still tilted to the upside. CBR highlighted that it will assess the need for a key rate increase at its upcoming meeting taking into consideration the speed and sustainability of the inflation slowdown, and hiked its 2025 inflation forecast to between 7% and 8%, from 4.5% to 5%. We now foresee a Russia-friendly deal in Ukraine following immediate talks between the U.S. and Russia could ease some pressure on inflation, alleviate demand-supply imbalances, and be a relief for war-torn Russian economy. CBR could consider reducing the rates afterwards, but this will depend on how peace negotiations will proceed in spring 2025.

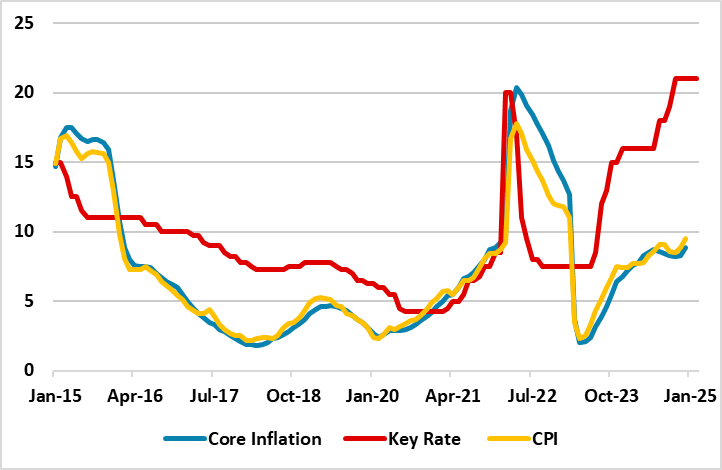

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – February 2025

Source: Continuum Economics

The CBR held its first MPC meeting of the year on February 14 and kept the key rate unchanged at 21%. Despite the interest rates remain at their highest level in two decades, it appears this has so far failed to soften rising inflation since the ongoing war in Ukraine exacerbates economic capacity constraints. We feel any interest rate cuts seem unlikely before H2 2025 under current circumstances since we think there are no signs of a significant inflation slowdown in the horizon yet.

CBR said in its statement on February 14 that current inflationary pressures remain high, warning that medium-term inflation risks are still tilted to the upside. The regulator also hiked its 2025 inflation forecast to between 7% and 8%, from 4.5% to 5%. CBR highlighted that the inflation will hit target of 4% in 2026 staying there further on, and stated that it will assess the need for a key rate increase at its upcoming meeting taking into consideration the speed and sustainability of the inflation slowdown.

Despite inflation remains elevated, we feel the pass-through of the earlier RUB weakening to prices, which increased in December 2024, partly soothed in January. RUB gained about 11.2% of its value against the USD just in January after the negative impacts of U.S. sanctions on Russian banks softened as CBR halted foreign currency purchases in response to the RUB fall.

Despite the Ministry of Economic Development expects the inflation will reach 4% in 2026-2027, and CBR now envisages the inflation will hit 4% in 2026, we feel achieving this will be very tough since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated and inflation expectations of households and businesses continue to edge up.

We think that risks to the inflation outlook remain upside as the fiscal policy is making a big contribution to domestic demand, coupled with high military spending, rising wages and surging inflation expectations, while there are no signs of a significant inflation slowdown in the horizon yet. (Note: We feel inflation will likely peak at around 10.3%-10.5% YoY in April.)

We foresee a Russia-friendly peace deal in Ukraine following immediate talks between the U.S. and Russia could ease some pressure on inflation, alleviate demand-supply imbalances within Russia's economy, and be a relief for war-torn economy. CBR could consider reducing the rates afterwards, but this will depend on how peace negotiations will proceed in spring 2025.