SA MPC Preview: SARB will Likely Cut the Key Rate to 7.5% on January 30

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, we now think it is likely that South African Reserve Bank (SARB) will cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate, power cuts (loadshedding) are suspended for over 9 months, inflation expectations continue to fall, and domestic fiscal outlook is moderately stable. The decision is still a close call considering unpredictable global outlook and global inflation risks could limit SARB’s rate-cutting cycle.

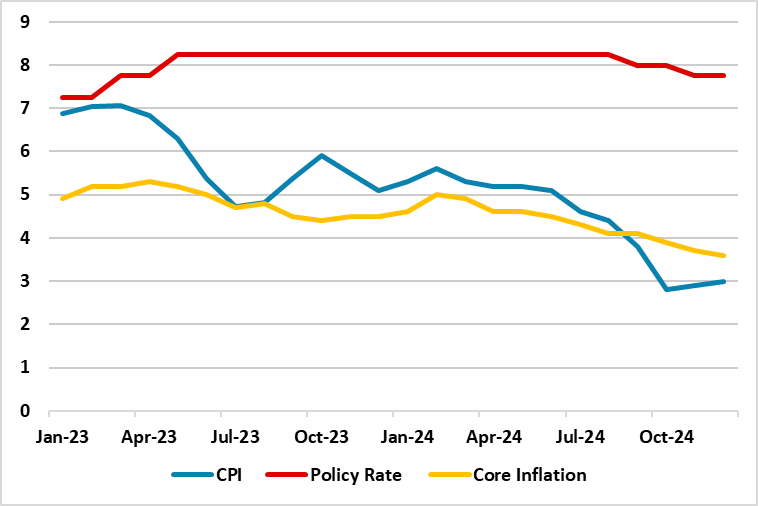

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – December 2024

Source: Continuum Economics

SARB’s MPC will convene on January 30, and the first key rate decision of 2025 will be announced. Another rate cut is likely on muted South African inflation in December, and we now foresee that SARB will reduce the key rate from 7.75% to 7.5%. The decision is still a close call taking into account that unpredictable global outlook and global inflation risks could limit SARB’s rate-cutting cycle.

First, despite South Africa’s inflation slightly increased to 3.0% YoY in December, it remained below SARB’s midpoint of target band of 3% - 6%. The fall in the core inflation was notable as it eased to 3.6% in December to the lowest level since February 2022, compared to 3.7% in November, which backs rate cut bets.

In addition to the smaller-than-expected rise in headline inflation rate in December, the recent recovery in ZAR continues to support the view that SARB will resume its easing cycle. The chance of continuation of the easing cycle is even bigger considering power cuts are still suspended, inflation expectations continue to fall, and the domestic fiscal outlook is moderately stable.

As noted, the inflation readings are supported positively by the suspended power cuts. South Africa’s national electricity utility company, Eskom announced on January 10 that load shedding remained suspended for 289 consecutive days since March 26, 2024 reflecting an improvement in the reliability and stability of the power generations coupled with new investments.

Speaking on inflationary pressures, SARB governor Kganyago said this week that policies being enacted by U.S. president Trump may be inflationary and threaten to derail future rate cuts. “To the extent that the measures taken are inflationary, it could slow down the disinflation process that central banks had so steadfastly worked on since the great inflation of 2022,” governor indicated. “There is a risk that the reduction in the restrictiveness of monetary policy that we had seen over the past year could then be brought to an abrupt halt”, Kganyago added.

Under current circumstances, we envisage cautious SARB will proceed carefully on interest-rate adjustment in the upcoming months, and SARB will focus on anchoring inflation expectations near the midpoint of its target range which will remain critical for monetary policy decisions.