Softening inflation will provide BI room to hold rate

Bank Indonesia in a pro-stability move decided to maintain the key policy rate at 6.25%. The move comes at a time when the weakness in the Indonesia Rupiah has increased in recent weeks. A rate cut is therefore not on the horizon.

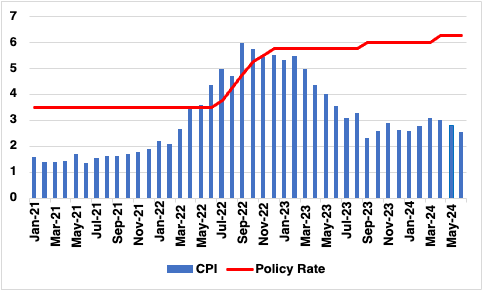

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics

Indonesia's CPI Inflation Slows, Driven by Falling Food Prices

Indonesia’s consumer price index (CPI) inflation rate slowed to 2.51% yr/yr in June, down from 2.84% in May, according to the latest data from the Central Statistics Agency (BPS). This marks the slowest inflation rate since September 2023, largely driven by a deceleration in food prices. Food price growth, a significant component of the CPI, eased to 4.95% yr/yr in June from 6.18% in May. This reduction in food prices contributed a substantial 0.35 percentage points (pps) to the decline in the headline inflation rate. Additionally, prices for restaurants and utilities also applied downward pressure on inflation. Conversely, minor inflationary pressures arose from increases in transport, household equipment, and personal care prices during June.

Over the past year, food prices have been the primary driver of inflation in Indonesia, accounting for approximately 1.40 pps of the overall CPI inflation rate. Personal care, restaurant, and transport prices followed, contributing about 0.20-0.30 pps each. Other sectors showed relatively subdued inflation dynamics. With CPI inflation now edging towards the midpoint of Bank Indonesia's target band of 2.5% ± 1%, the central bank's primary concern appears to have shifted to the depreciation of the Indonesian rupiah (IDR). Core inflation, which excludes volatile food and energy prices, also eased to 1.9% yr/yr in June, after a period of moderate increases in the preceding months. In our view, Bank Indonesia will remain focussed on supporting the IDR. A rate cut at this point is unlikely, especially as the Federal Reserve has deferred its rate cut. Meanwhile, BI's foreign exchange reserves have diminished considerably in recent months, which could reduce the room the central bank has to support its currency. Consequently, another rate hike cannot be ruled out. The chances of this though remain very low. We anticipate a rate cut in end-2024 of 25bps for now. Economic growth remains healthy and so BI has sufficient headroom to hold rates.