CBR Kept the Key Rate Stable at 16% despite Increasing Inflation

Bottom Line: Central Bank of Russia (CBR) announced on June 7 that it decided to keep the policy rate unchanged at 16% for the fourth meeting in a row, but signalled that a rate hike is possible in the near term to tame the stubborn price pressures stemming from high military spending, tight labour market, fiscal policy igniting domestic demand coupled with the recent increase in cost of borrowing. Given inflationary risks and CBR's hawkish forward guidance, we expect the CBR to increase the key rate by 100 bps to 17% at the next policy rate meeting on July 26.

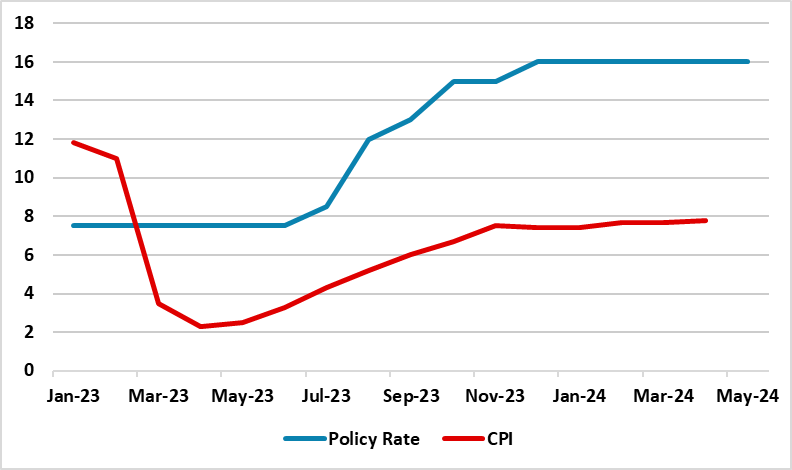

Figure 1: Policy Rate (%) and CPI (YoY, % Change), January 2023 – May 2024

Source: Continuum Economics

On June 7 MPC meeting, CBR decided to halt the policy rate at 16% although inflation remained far above the CBR’s 2024 forecast range and CBR’s medium term target. Despite CBR Governor Elvira Nabiullina said this week that she remains committed to bringing inflation down to the 4% target, we think this is very unlikely to achieve in 2024, particularly due to high military spending, strong fiscal support, strained supply capabilities and tight labor market.

CBR highlighted in its statement on June 7 that "Returning inflation to the target will require a significantly longer period of maintaining tight monetary conditions in the economy," and added it holds open the prospect of increasing the key rate at a future meeting. CBR also emphasized that inflation will return to 4% goal in 2025, and then stabilize close to that level, which looks a tough target to reach under current circumstances.

The labor market remains very tight, as the unemployment rate fell to historically low value of 2.6%. CBR also indicated on June 7 that "Labour shortages come as the key constraint on the expansion of output of goods and services and labor market tightness continues to grow."

We think inflation risks are still tilted to the upside as inflationary pressures and inflation expectations remain high. Inflation has been on the rise recently due to food inflation, and cold weather in May could create further risk for 2024 harvest. Household inflation rose and non-mortgage loans surged in April. The military spending continues to remain high due to larger Russian offensive operations in Ukraine which started as of summer.

We feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s targets particularly in 2024, partly due to base effects, tight labor market and high military spending. Given inflationary risks and CBR's hawkish forward guidance, we expect the CBR to increase the key rate by 100 bps to 17% at the next policy rate meeting on July 26, and CBR will unlikely cut interest rates below 16% until the end of 2024.