As Expected, CBRT Kept Key Rate Unchanged at 50%

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on May 23 despite galloping inflation which edged up to 69.8% in April, up from 68.5% in March. CBRT said in a statement on May 23 that "(...)considering the lagged effects of the monetary tightening, CBRT remains highly attentive to inflation risks", and added that the underlying trend of monthly inflation registered a limited decline in April while recent indicators point to a slowdown in domestic demand compared to the first quarter. We expect a fall in the inflation after June 2024, particularly due to favourable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps. We foresee that the policy rate will be held at 50% in the next MPC meeting, which is scheduled for June 27.

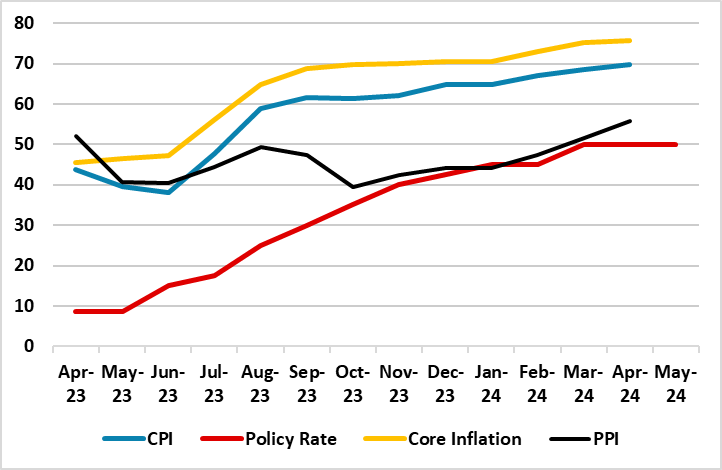

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – May 2024

Source: Continuum Economics

The CBRT decided to hold the key rate stable at 50% on May 23 MPC meeting despite annual inflation hit 69.8% YoY in April due to due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector.

According to the Bank’s assessment on May 23 inflation expectations, geopolitical risks and food prices keep inflationary pressures alive in addition to the high level of and the stickiness in services inflation. MPC report also highlighted that the monetary policy could be tightened further if a significant and persistent deterioration in inflation is anticipated while CBRT expects disinflation to be established in the second half of the year. CBRT also announced that excess liquidity from increased domestic and foreign demand for Turkish lira financial assets will be sterilized through additional measures.

Despite inflation showed a significant uptick in April, there were some good news for Turkish economy. The pace of TRY depreciation slowed down significantly in April as foreign direct investment (FDI) inflows into Turkiye amounted to $1.5 billion in Q1, according to the Turkish International Investors Association (Yased). Total trade deficit decreased in Q1 2024, total exports were 63.6 billion USD with a 3.6% increase, and imports amounted to 83.9 billion USD with a 12.8% decrease compared with Q1 2023.

It is worth mentioning that Treasury and Finance Minister Simsek unveiled a comprehensive savings plan on May 13 within the public sector in order to tackle soaring inflation and enhance efficiency, prioritizing only essential state investment projects in the latest major move to ignite confidence in an economic tightening program, which was then welcomed by CBRT governor Karahan. (Note: We feel that the impacts of mentioned savings plan will be limited over the course of the inflation).

Treasury and Finance Minister Simsek conveyed the expectations that a decrease in inflation would begin in the coming months, and said "Inflation is high but will fall, we have developed a disinflation program for this. We are now in a one-year transition period and the disinflation process has already started."

We also expect a fall in the inflation after June 2024, particularly due to favourable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps. We foresee that the policy rate will be held at 50% in the next MPC meeting, which is scheduled for June 27.