Turkiye Inflation Report: CBRT Keeps Its End-Year Inflation Forecast at 24%

Bottom Line: Central Bank of Turkiye (CBRT) released its second quarterly inflation report of the year on May 22, and kept its inflation forecast constant for 2025 at 24%. CBRT governor Karahan signalled to maintain a tight stance until a permanent decline in inflation is sustained and price stability is achieved. We think deteriorated pricing behaviour, food and commodity prices volatility, the stickiness of services inflation, and adverse geopolitical developments will likely lead average headline inflation to stand at 31.9% in 2025. We foresee the road to bringing inflation back down to single-digit levels will be very bumpy since the inflation remains sticky, and the inflation falling down to 8% in 2027 is very unlikely under current circumstances.

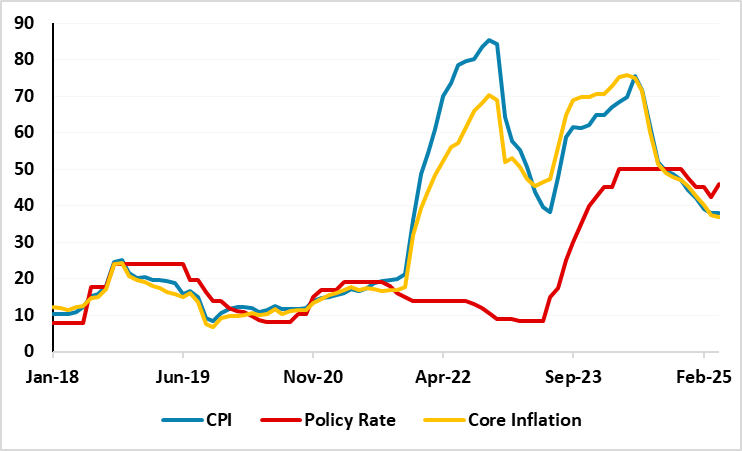

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – April 2025

Source: Continuum Economics

CBRT released the second quarterly inflation report of the year on May 22, and maintained its end year-end inflation forecast at 24%. Inflation forecast was set at 12% for 2026, 8% for 2027, and the inflation report mapped out a gradual path toward its medium-term objective of 5% inflation. CBRT governor Karahan highlighted that CBRT maintained its forecast range for this year between 19% and 29%, citing the recent rise in uncertainties. The governor also signalled to keep a tight stance until a permanent decline in inflation is sustained and price stability is achieved, reaffirming CBRT will adjust interest rates on a meeting-by-meeting basis on data-driven decisions.

According to second quarterly inflation report, the disinflation process has continued since June 2024 despite several risks, including global uncertainties and a potential uptick in food prices. (Note: The inflation softened to 37.9% y/y in April from 38.1% y/y in March.) Taking into account that the key concern remains service sector inflation, particularly in housing rentals, and food prices, Karahan emphasized that "Despite the recent moderation, uncertainties surrounding global trade and economic policies remain elevated. While these uncertainties increase downside risks to global growth, potential inflationary effects vary across countries." It appears CBRT doesn't expect to see persistent inflation rigidity, and seasonal factors are expected to bring the seasonally adjusted monthly inflation rate down to slightly above 1% by the end of the year (currently above 2.5%). Having said that, risks remain tilted to the upside.

We continue to feel deteriorated pricing behaviour, the stickiness of services inflation, food and commodity price volatility, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025.

We think the road to bringing inflation back down to single-digit levels will be very bumpy since the inflation remains sticky, and the inflation falling down to 8% in 2027 is very unlikely under current circumstances, as opposed to what CBRT indicated in its quarterly inflation report.