Surprising Move: CBR Reduced Key Rate to 20% from 21%

Bottom Line: Despite predictions were centered around no change, Central Bank of Russia (CBR) cut policy rate on June 6 for the first time after September 2022 citing easing in inflationary pressures, including core inflation. CBR indicated in its written statement that CBR will maintain monetary conditions as tight as necessary to return inflation to the target (4%) in 2026, and monetary policy will remain tight for a long period.

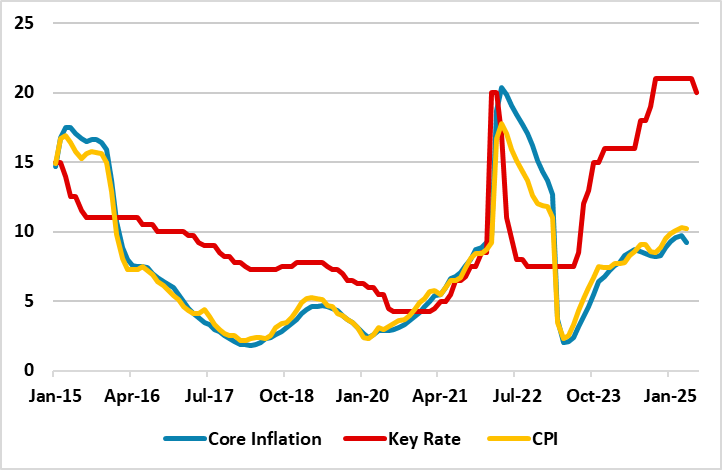

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – June 2025

Source: Continuum Economics

The CBR held its fourth MPC meeting of the year on June 6 and reduced the key rate by 100 bps to 20% from its highest level in two decades, despite ongoing war in Ukraine exacerbates economic capacity constraints and ignites military spending. CBR cited that signs of economic cooling and easing price pressures emerged. (Note: The annual inflation rate in Russia eased to 10.2% in April from the two-year high of 10.3%, halting five consecutive increases while remaining well above the CBR’s midterm target of 4%, due to surges in services and food prices. Annual core inflation decreased to 9.2% from 9.7% in April).

CBR said in its statement on June 6 that "While domestic demand growth is still outstripping the capabilities to expand the supply of goods and services, the Russian economy is gradually returning to a balanced growth path. The monetary policy would remain tight for a long period in order to return inflation to its 4% target."

Speaking about the course of inflation, CBR governor Nabiullina recently stated that the importance of maintaining low inflation for the overall economy and added that “What we are saying is that it will be necessary to maintain tight monetary conditions for an extended period of time."

It is worth noting that Russia's economy minister Reshetnikov had urged the central bank to cut rates earlier in the week, as concerns mount about falling output in various sectors. (Note: Russia’s GDP grew by 1.4% in Q1 2025, according to Rosstat, a drop from 4% in the previous two years).

Despite the move, we think balance of inflation risks is still tilted to the upside over the medium-term as the fiscal policy is making a big contribution to domestic demand. High military spending, likely deterioration in the terms of external trade during ongoing trade wars and rising wages do not signal a significant permanent inflation slowdown in the horizon yet.

We continue to foresee a peace deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a peace deal will likely take longer-than-expected. Under current circumstances, we predict reaching 4% target will be very tough despite what CBR envisaged, even in 2026.