EMEA Outlook: Rate Cuts Loading in 2025

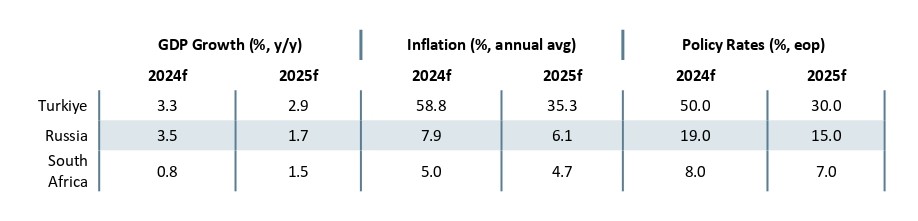

· In Turkiye, we still foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation, and adverse geopolitical impacts leading average inflation to stand at 58.8% and 35.3% in 2024 and 2025, respectively. We think Central Bank of Republic of Turkiye (CBRT) will likely cut the rate by 500bps cuts in every quarter to 30% in 2025. On the growth front, we believe the economy to expand by 3.3% in 2024 and 2.9% in 2025 considering high inflation and tighter fiscal stance will continue to dent GDP growth.

· In South Africa, our end-year policy rate prediction remains at 8.0% for 2024, and 7.0% for 2025. We foresee headline inflation will fall to 5.0% and 4.7% in 2024 and 2025, respectively, considering South African Reserve Bank (SARB) sensitivity to inflation and power cuts are relieved after March. We see growth to stand at 0.8% and 1.5% in 2024 and 2025, respectively, particularly if the new coalition will be able to address the logistical constraints, financing needs, and corruption. Risks to the outlook are broadly balanced, with faster reform implementation under the new government representing an upside risk to growth.

· In Russia, the war in Ukraine coupled with Ukraine’s surprising cross-border incursion in Kursk oblast continue to create an increasing financial burden on Russia due to high military spending, strong fiscal stimulus in addition to aggravation of staff shortages. Our inflation projections for 2024 are now higher at 7.9%. Central Bank of Russia (CBR) increased its policy rate by 100 bps to 19% and we don’t expect any further rate hikes in 2024 as CBR will likely monitor the impacts of tightening in Q4. Our end-year policy rate prediction is 15.0% for 2025 as we foresee CBR to start cutting rates late Q1/Q2 unless inflation picks up and RUB loses value significantly. We envisage growth to hit 3.5% and 1.7% in 2024 and 2025, respectively, backed up by strong military spending, buoyant demand and lending dynamics.

Forecast changes: From our June outlook, we have increased the 2024 inflation forecast for Russia to 7.9% due to continued government spending. We now envisage Russia will start cutting policy rate in Q1/Q2, not in Q4 2024, since inflation stays far from the CBR targets. We also lifted GDP growth forecast for Russia since the economy continues to rebound due to increased public spending in war-related industries and construction while public spending is at unprecedented levels as around 40% of the government budget is spent on the war.

Our Forecasts

Source: Continuum Economics

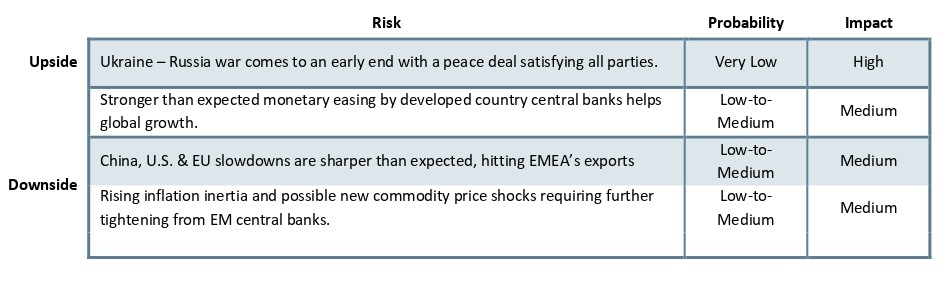

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflations Moderately Ease, 2025 Rate Cuts Are Loading

Country specific factors, geopolitics, China slowdown, global trade worsening, and pace of the rate cuts by the DM economies continue to rule the EMEA outlook in 2024 and into 2025. We think slowdown in DM and China would risk greater uncertainty over the EMEA medium-term prospects.

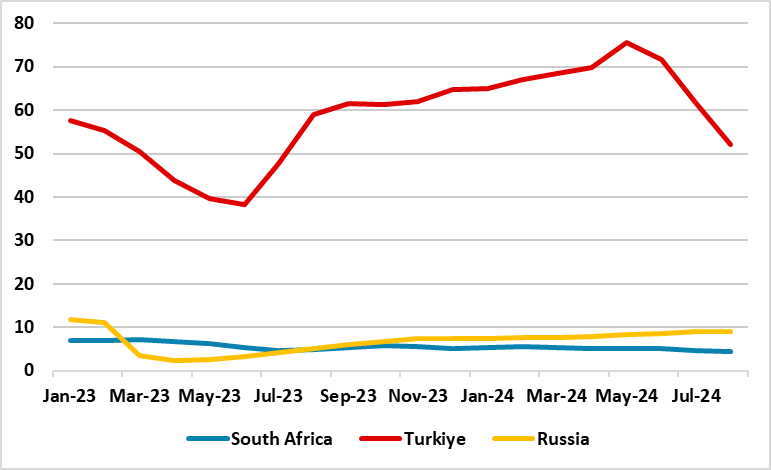

Inflation remains the major concern for EMEA economies since they stay above targets in Russia and Turkey as aggressive monetary tightening cycles are still feeding through. Taking into account that the inflation is now below the midpoint target of 4.5%, South Africa started cutting the policy rate as of September 19 and decreased it from 8.25% to 8.0%, which was the first time since May 2023 that the SARB has changed rates. Russia and Turkiye will be waiting the right time to start cutting rates which would depend on inflationary pressures, likely in 2025.

We continue to forecast that fiscal positions deteriorate during the rest of 2024 and 2025, contributing both to the GDP and inflation prospects. The fiscal deficits in EMEA are projected to remain elevated over the medium term, given rising debt service, and sizeable spending on public wages and transfers, which remain as significant nuisances.

Apart from Russia, the growth trajectories remain unchanged for EMEA countries for 2024. Russian economy is now expected to expand higher-than-expectations since the economy continues to rebound due to increased public spending in war-related industries and construction while public spending is at unprecedented levels coupled with strong fiscal stimulus.

Fed and ECB easing could help EMFX more broadly and allow slower declines or recovery in spot FX rates. We think particularly South Africa can use it as an opportunity to build FX reserves or further policy rate cuts in 2025. TRY and RUB are expected to continue to lose value in 2025 given strong inflation differentials and limited capital inflows.

Figure 1: South Africa, Russia and Turkiye Inflation (%, YoY), January 2023 – August 2024

Source: Continuum Economics, Datastream

South Africa

After the new government of national unity government (GNU) took power early Q3, the ANC-DA led coalition continues to be a relief for the business community and investors though the new education law and the National Health Insurance remain the flash points so far. In the meantime, GNU continues to face significant challenges such as declining real per capita growth, rising level of public debt coupled with high unemployment and poverty rates.

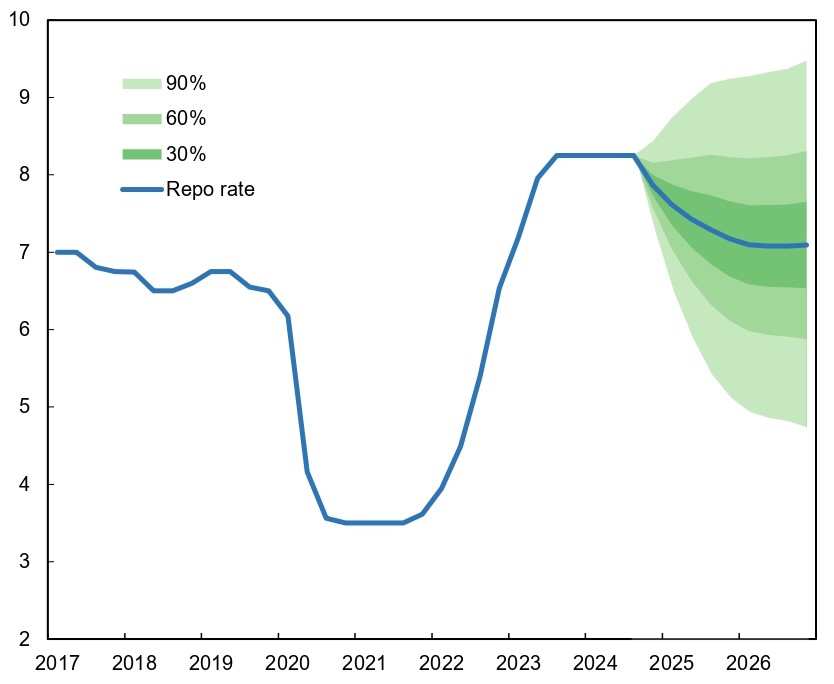

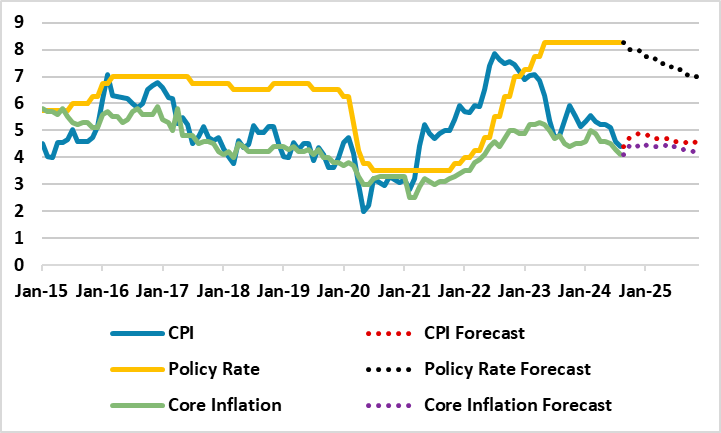

Despite problems, the macroeconomic outlook continues to improve. After inflation decreased to 4.6% YoY in July due to slowdown in costs for food, fuel, housing and transportation, the downward trend continued in August and CPI hit 4.4% YoY, which was below the mid-point of target band of 3% - 6%, and August reading marked the lowest inflation print since April 2021. SARB started the easing cycle by cutting the rates by 25 bps to 8.0% on September 19, which was the first rate cut since they began raising rates in November 2021. We believe the easing cycle will be a relief for the consumers facing high costs of loans, as well as the automotive industry and the property sectors which have been hard hit by the elevated interest rates taking into account that lending rates will come down and help lower the costs of doing business. Our prediction is 8.0% for 2024 end-year policy rate, and 7.0% for 2025 while we foresee 25bps cuts in every quarter in 2025.

Figure 2: SARB Interest Rate Forecast (%), 2017 - 2026

Source: SARB Forecast Report (September 2024)

Our average headline inflation forecast for 2024 remains at 5.0%, before declining to 4.7% and 4.5% in 2025 and 2026, respectively, given lagged impacts of SARB’s previous tightening, suspended loadshedding, a relatively stable ZAR, decrease in inflation expectations coupled with Fed started cutting rates as of September 18. It is worth noting that inflationary risks remain due to the supply-side constraints like crisis at ports and rail network, geopolitical risks, and the U.S. presidential election in November, which shall be closely followed by SARB in Q4 and Q1 2025, before further rate cuts later in 2025. In this regard, SARB governor Kganyago stated on September 19 that inflation could be higher than SARB’s baseline forecast given scenarios such as higher housing costs, larger electricity price increases, wage increases that outrun inflation and productivity growth or higher food inflation could cause uncertainty, demonstrating that SARB will be cautious about risks to the inflation outlook (Figure 3). However, a risk also exists that inflation could be below our baseline forecasts, if the lack of loadshedding causes more inflation control.

Figure 3: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

Another positive development for the economy in Q2 and Q3 was suspended power cuts. After Stages 2 and 3 load shedding was implemented broadly in March, Eskom emphasized on September 20 that load shedding remained suspended for 177 consecutive days, reflecting an ongoing structural improvements in the generation fleet and new investments. In its outlook for the summer period, Eskom announced there will likely be a scenario of load shedding-free summer outlook (September 1, 2024 to 31 March 2025) but we think this will depend on GNU’s determination, continued investments and Eskom’s success in keeping the generation fleet up and running.

Despite GDP growth stood at 0.4% in Q2 2024 driven by weaker manufacturing, mining and construction and depressed in part by widespread power shortages and disruptions at rails and ports, we continue to believe the economy will grow by 0.8% in 2024 on the back of improved investor sentiment and electricity generation, stabilizing at 1.4% in the medium term. The growth figures in 2025 and 2026 will depend on whether the country will remain dedicated to address the electricity shortages, logistical constraints, and financing needs. Downside risks largely relate to the uncertain external environment and an inability of the new government to agree on needed fiscal and structural reforms, as highlighted by IMF’s report on September 4.

On the currency front, we expect the economy will be supported by a trade surplus in 2024 and 2025 coupled with increasing investor’s appetite for South Africa as DM central banks such as Fed and ECB started easing cycles which is expected to soften the pressure on the ZAR. Trade surplus could moderately fall likely due to global slowdown, particularly China. We think particularly Fed easing should help ZAR as South Africa can use it as an opportunity build FX reserves and further rate cuts in 2025.

On the fiscal trajectory front, public finances weakened in 2023 and the country still has need for large domestic and international financing as fiscal positions are weak due to high government debt, rising debt-service costs, and financial sector exposure to sovereign debt. Despite the budget deficit remained in line with the revised budget target thanks to robust revenues and expenditure restraint, debt-to-GDP ratio which stand around 74% is well above the EM average of 58.9%. According to IMF’s country report in September, the fiscal deficit is projected to remain elevated over the medium term, given support to state-owned enterprises, rising debt service, and sizeable spending on public wages and transfers.

The key in 2025 will be carefully timing and coordinating the monetary policy framework to manage expectations and scheduling rate cuts. We expect data-driven and cautious SARB will carefully monitor the inflationary developments given the continued uncertainty about the inflation outlook.

Turkiye

After Turkiye made a shift to traditional economic policies followed by orthodox monetary steps mid-2023, we see a wave of improving economic indicators despite some vulnerabilities remain significant. Turkiye’s removal from the Financial Action Task Force (FATF) Gray list in June 2024 was a remarkable development as well as current account deficit (CAD) shrinking to 2.7% of GDP in Q1 2024, from 4% of GDP in 2023 backed up by increasing exports. International reserves (net of swaps and other liabilities) increased by US$91 billion since April, and international credit agencies upgraded the country’s sovereign risk rating. CDS spreads declined nearly 440 bp since mid-2023.

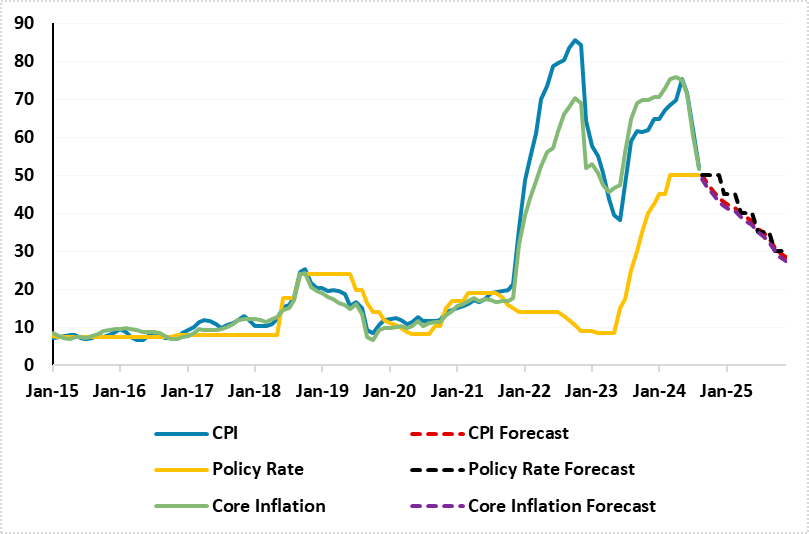

Despite mentioned favorable developments, inflation remain high eroding consumers’ purchasing power. After CPI cooled down to 51.9% y/y in August from 61.8% y/y in July due to favorable base effects, the lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance, we expect the falling trend will continue in Q4 supported by relative slowdown in domestic demand and the decrease in the CAD; but the extent of the decline will be determined by administrative price adjustments and TRY volatility. (Note: TRY lost 5% of its value against the U.S. dollar between June and August).

CBRT predicts inflation to fall to 38% and 14% at end-2024 and end-2025, respectively. In the recently updated medium-term program (MTP), the government sees end 2024inflation of 41.5%, while our forecast for the annual average inflation remain higher than government targets at 58.8%, 35.3% and 21.5% in 2024, 2025 and 2026, respectively. We anticipate strong demand, the stickiness in services inflation, deteriorated pricing behavior, and geopolitical risks will keep inflation pressures alive. We also envisage end-year inflation will likely hit around 43% higher than CBRT’s year-end inflation forecast.

Given forward guidance by the CBRT with disinflation beginning late 2024, macroeconomic stability forecast beginning in 2025, and CBRT governor Karahan repeatedly stressed that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. We expect cautious and hawkish CBRT to delay cutting rates for the rest of 2024 and until there is a sustained decline in the underlying trend of monthly inflation is observed. CBRT remains highly attentive to inflation risks like high inflation expectations and distorted pricing behavior. We feel the first rate cut will happen in Q1 2025 given residual inflationary risks. Our end year key rate prediction is 50.0% for 2024, and 30.0% for 2025 as we foresee 500bps cuts in every quarter in 2025. It is worth noting that the pressure has been growing on CBRT from exporters and industrialists to start lowering its rates to reverse a marked slowdown in the economy, and this will also be an issue to consider for CBRT in Q4 and 2025.

Figure 4: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

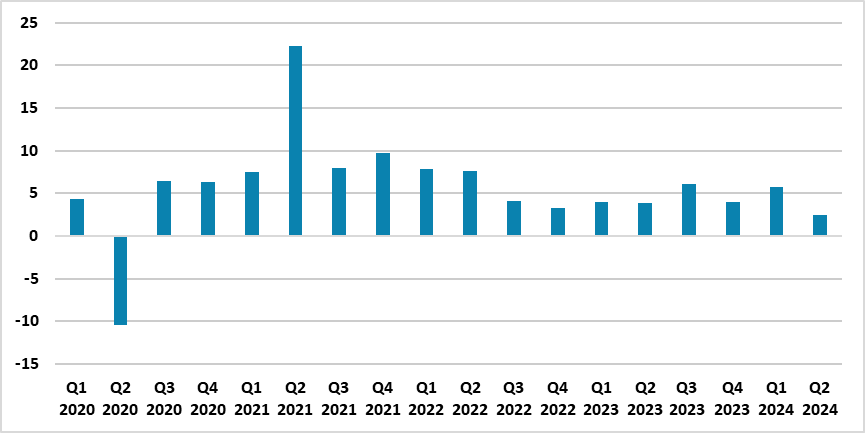

On the growth front, Turkish economy expanded by a strong 5.7% in Q1 backed up by buoyant demand, robust investment, a positive contribution from net exports and government spending, then the growth rate fell sharply to 2.5% in Q2. We now envisage GDP growth will stand at 3.3% in 2024 and 2.9% in 2025 dominated by lagged impacts of aggressive monetary tightening, slowing real wage growth, tighter fiscal actions targeting to slow down demand and lending. (Note: IMF expects growth to moderate to 2.7% in 2025). We feel there is still a downside risk to the growth trajectory considering all the tightening measures in place. We are of the view that household spending will continue to decrease in Q4 2024 and Q1 2025 as the government did not increase minimum wage and pensions in July 2024 to help lower high inflation. In the medium term, we believe a further drop in inflation would boost confidence, and growth would rise back toward potential of 3.5-4%. On the upside, rapidly falling headline inflation in H2 could feed into backward-looking inflation expectations, easing price pressures.

Figure 5: GDP Growth (%), Q1 2020 – Q2 2024

Source: Continuum Economics

On the currency front, the pace of TRY decline partly slowed in Q2 and Q3, which was important in cooling down inflation given FX pass-through from a weak TRY. We continue to see losses for TRY as foreign capital inflow remains weaker-than-expected and inflation differentials dominate, and we see the USD/TRY rate at 34.6 by the end of 2024 and 44 for end 2025. TRY losses are set to accumulate on still wide inflation differentials and domestic vulnerabilities.

2025 will be significant for the Turkish economy from every angle while the key will be aligning fiscal, monetary, and incomes policies, which need to work together during the disinflationary process. Setting prices, wages, and other contracts (such as rents) annually and according to forward-looking inflation will be key to resetting expectations and protecting competitiveness. Maintaining financial stability will require continued vigilance and further reform and macro prudential policies should focus on containing systemic risks, as correctly highlighted by IMF late August.

Russia

The overall environment for doing business in and with Russia remains unfavorable due to the ongoing war in Ukraine. The war continues to create an increasing financial burden on Russia due to high military spending and fiscal support in addition to aggravation of staff shortages.

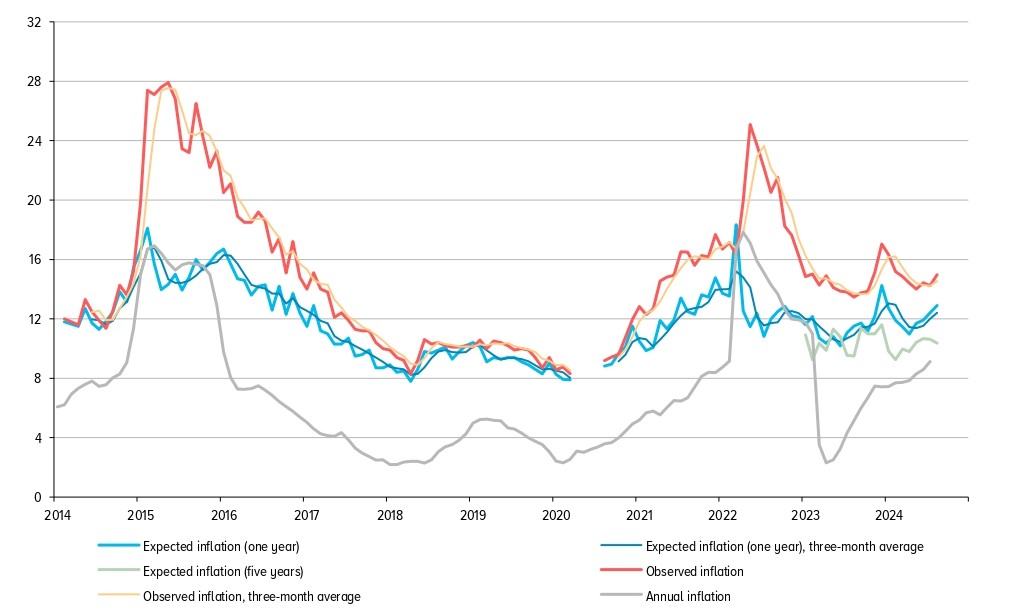

We continue to foresee macroeconomic instability for Russia to remain substantial in 2025 and in 2026, particularly if the Ukraine war would continue, taking into account that inflation is spiking, fiscal deficit is widening and RUB is under pressure. Inflation remains the core macroeconomic problem as CPI has steadily increased from the low of 2.3% in April 2023 to 9.1% in August 2024 as import suppression, labor shortages, supply-chain disruptions and a weaker currency exerted upward pressure on prices, considering inflation remains far above the CBR’s medium term target of 4%. We predict annual average inflation to hit 7.9% and 6.1% in 2024 and 2025, respectively. According to CBR’s survey in September, average annual inflation is expected to stand at 8.0%, 5.9% and 4.4% in 2024, 2025 and 2026, respectively) while we think it will be tough to reach these targets under current circumstances. As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up. We also see the higher market rates had not yet fully affected the lending dynamics as activity in the corporate segment of the credit market remain high.

Figure 6: Inflation Observed and Expected by Households (%), 2014 – 2024

Source: Rosstat and CBR

Additionally, the RUB weakness continues to cause concerns over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023, and lost 7% of its value just in August. We expect RUB would remain weak and volatile in 2025 since the sanctions continue to hurt as the weakness of the currency can still adversely impact inflationary expectations and pressures.

Given acute inflationary risks like strong military spending, lagged feedthrough of the weak RUB, and high inflation expectations, inflationary pressures likely won’t start to soften easily unless Ukraine war comes to a surprising end. Additionally, as CBR noted, growth in domestic demand is still significantly outstripping the capabilities as rising wages and a strong jobs market continue to help shoppers compensate for inflation. The labor market remains very tight as the unemployment hit record-low figure of 2.4% in mid-2024.

As we predicted, CBR hiked the key rate on September 13 to tame the stubborn price pressures. CBR said that the current inflationary pressures remain high, and annual inflation is likely to exceed the forecast range of 6.5–7.0% by the end of 2024. We don’t expect any further rate hikes in 2024 as CBR will likely monitor the impacts of tightening in Q4. We think CBR will likely start considering cutting rates in late Q1/early Q2 if inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. Our end-year key rate forecast is 19.0% for 2024, and 15.0% for 2025.

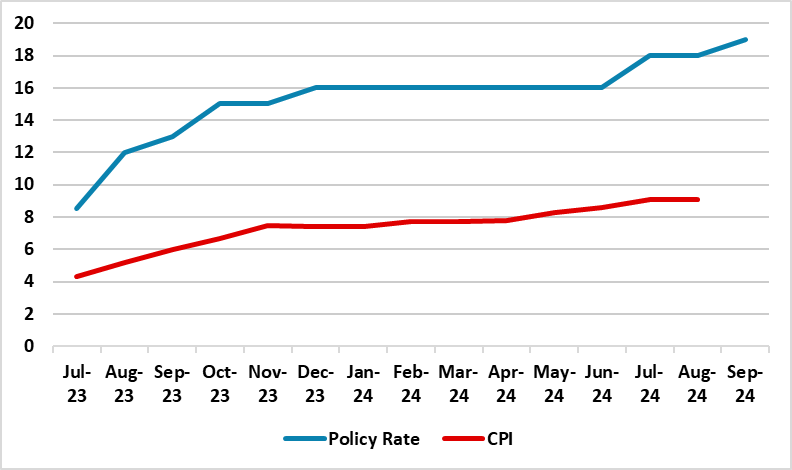

Figure 7: Policy Rate (%) and CPI (YoY, % Change), July 2023 – September 2024

Source: Continuum Economics

On the growth front, the Russian economy expanded by a strong 5.4% and 4.0% in Q1 and Q2, respectively despite the cloudy macro outlook. The main driver for the GDP growth remain the surge in military spending, supported by the improved consumer demand amid greater outlays on social support, higher wages and strong fiscal stimulus. From our June outlook, we have increased our 2024 GDP forecast from 2.5% to 3.5% driven in part by a significant increase in military spending in Donetsk and Kursk oblasts, surges in corporate investment and private consumption. There is an increased public spending in war-related industries and construction in Russia as public spending is at unprecedented levels as around 40% of the government budget is spent on the war. (Note: According to CBR’s survey results in September, GDP is expected to grow by 3.6%, 1.7% and 1.9% in 2024, 2025 and 2026, respectively).

According to CBR’s balance of payments report in August, the current account surplus amounted to $39.7 billion in January-July 2024 compared to $23.5 billion in the corresponding period of 2023. This was mainly driven by the growth of the trade balance surplus by $13.6 billion. The trade balance surplus grew to $76.6 billion, from $63.0 billion in January-July 2023, primarily due to the decline in imports.

On the budget end, we continue to foresee a rise in the budget deficit in 2024. Military analysts assert that Russian spending on defense will rise to around 6% of GDP in 2024 while it was 3.9% of GDP in 2023. We expect the consolidated budget deficit of 1.3% of GDP in 2024, followed by a decline to 1.0% of GDP in 2025, particularly if the Ukraine war will come to end with a peace deal.

On the war end, the offensives particularly in Donetsk and Kharkiv continue to dominate the theatre of war as Russia aims to seize more territory before the U.S. presidential elections in November. Additionally, Ukraine’s surprise cross-border offensive inside Kursk region continues. In response to the incursion, Russian military deployed forces from lower priority sectors of the frontline in Ukraine to Kursk and Russian forces recently regained territory and lost positions. Currently, the pace is slower on Ukrainian side as they are now attempting to dig in and hold areas they seized. We foresee it will likely be hard for Ukraine to sustain the operation whilst Russia continues to bring more artillery and aviation, and it is uncertain whether the operation will be a game changer. The incursion is expected to increase Ukraine’s bargaining position at any negotiations in the future and will likely work as a hedge should Trump be reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal, likely in 2025. A Harris victory in the U.S. would see more support for Ukraine, but eventually a push from the U.S. to reach some peace deal given the deadlock on the war is likely late 2025 or early 2026.