No Surprises as CBRT Continued to Hold Key Rate Stable at 50% on September 19

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% for the sixth consecutive month on September 19. CBRT reiterated in a statement that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and added that it remains highly attentive to inflation risks. We foresee that the policy rate will be held unchanged at 50% in the next MPC meeting scheduled for October 17 as inflation continues to stay high, despite the deceleration trend started after June. We don’t expect cautious and hawkish CBRT to start cutting rates in the rest of 2024 until CBRT is confident that there is a sustained decline in the underlying trend of monthly inflation.

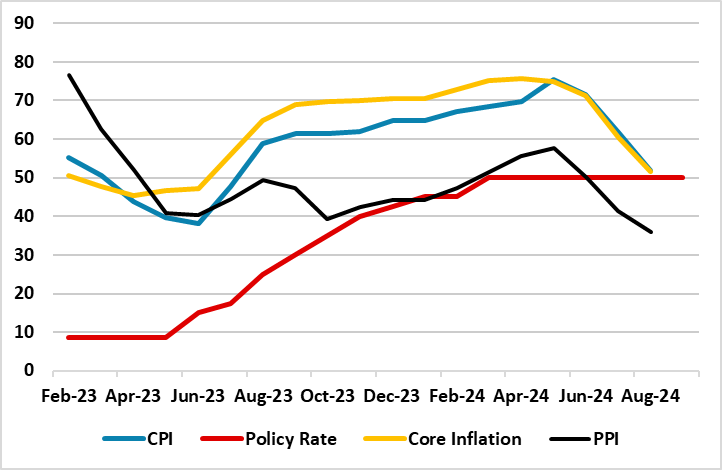

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – September 2024

Source: Continuum Economics

As we expected, the CBRT decided to hold the key rate stable at 50% on September 19 MPC meeting basically to cool off the galloping inflation.

According to the Bank’s assessment on September 19, domestic demand continues to slow down with a diminishing inflationary impact, despite inflation expectations and pricing behavior continue to pose risks to the disinflation process. CBRT slightly shifted its wording, moving from the pledge to tighten further if needed and said: "Monetary policy tools will be used effectively in case a significant and persistent deterioration in inflation is foreseen," while the regulator had said in previous statements that its policy stance would be tightened if such a deterioration in inflation is foreseen.

Concerning the course of inflation, Turkiye’s CPI eased to 52% annually in August down from 61.8% y/y in July backed by the favourable base effects. We foresee that lagged impacts of aggressive tightening coupled with tightened fiscal policies, lower credit growth, and additional macro prudential measure will continue to dominate the inflation outlook and help relieve the CPI in September, but the extent of the decline will be determined by administrative price adjustments and TRY volatility. (Note: TRY lost %5 of its value against the U.S. dollar as relative stability underpinned the inflation relief between June and August).

Speaking about the developments, Treasury and Finance Minister Mehmet Simsek highlighted on September 19 that the inflation forecast for the end of 2024 is 41.5% and said "Our inflation targets are realistic and we believe that we can achieve these targets." (Note: CBRT predicts inflation to fall to 38% and 14% at end-2024 and end-2025, respectively. In the recently updated medium-term program (MTP), the government sees end-year inflation of 41.5%, while our forecast for the annual average inflation stands at 58.8% and 35.3% in 2024 and 2025, respectively).

Taking into account that high inflation will continue to put pressure on CBRT to resume tightening cycle in the upcoming months, we foresee CBRT to hold the key rate constant at 50% through the end of 2024. We don’t expect cautious and hawkish CBRT to start cutting rates the rest of 2024 until there is a sustained decline in the underlying trend of monthly inflation is observed.

Of course, CBRT can also start cutting the policy rate late Q4, which is not our baseline scenario, as this will depend on the pace of the improvement in services inflation and the slowdown of the domestic demand, inflation expectations converging to the projected forecast range and global developments. It is worth noting that the pressure has been growing on the central bank from exporters and industrialists to start lowering its rates to reverse a marked slowdown in the economy, and this will also be a factor of consideration for CBRT in Q4.