CBR Reduced its Key Rate to 18% as Inflation Softens

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June from 13.4% the prior month. CBR stated in its written statement that current inflationary pressures, including underlying ones, are declining faster than previously forecast, and signaled that monetary policy would remain tight for a long period in order to bring inflation back to target by 2026. We believe reaching 4% target will be tough in 2026, and CBR needs to be cautious since cooling off inflation will take likely longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong.

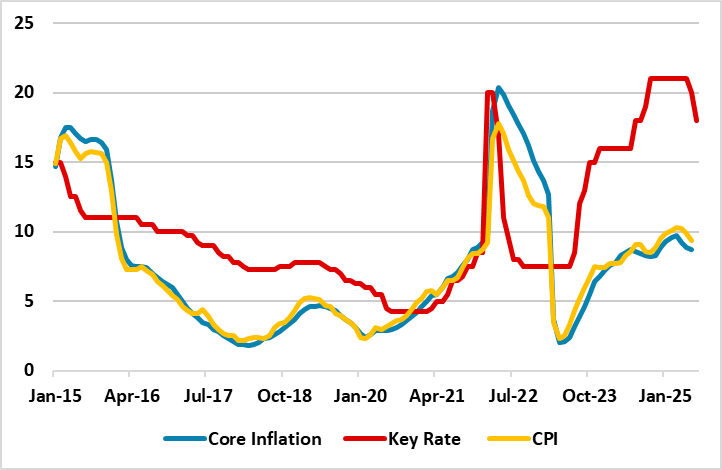

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – July 2025

Source: Continuum Economics

During its MPC meeting on July 25, CBR reduced the policy rate by 200 bps to 18% due to easing in inflationary pressures, including core and MoM inflation, and softening inflation expectations. (Note: Inflation slowed to 9.4% in June from 9.9% in May partly due to favorable base impacts, recent RUB stability and falling oil prices. MoM price growth fastened to 0.2% in June over the previous month, marking the lowest hike after August 2024). The rate cut was widely expected by Russian business people and exporters, who pressurized CBR to cut rates since businesses were hit hard by high rates.

In addition to decelerating trend in inflation, we think there are some signs of moderate economic cooling. The inflation expectations declined in June to 13% from 13.4% the prior month. We also feel the pass-through of the earlier RUB weakening to prices, which increased in Q1, partly soothed after May. RUB gained about 5.7% of its value against the USD between May 1 and July 15.

CBR highlighted in its written statement on July 25 that it will maintain a level of monetary policy tightness necessary to bring inflation back to target by 2026. (Note: Under CBR’s baseline scenario, an average key interest rate of 18.8–19.6% per annum in 2025 and 12.0–13.0% per annum in 2026 is required to return to inflation targets).

Concerning the inflation targets, CBR emphasized that it expects the inflation to stand at 6.0% - 7.0% in 2025 and hit the target of 4% in 2026 while monetary policy would need to remain tight for a long period in order to return inflation targets. (Note: According to CBR’s communications, CBR lowered its 2025 inflation forecast to between 6% and 7% from between 7% and 8%. The regulator held its GDP forecasts stable at between 1% and 2%). We believe reaching 4% target will be tough in 2026, since cooling off inflation will take longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong.

We continue to think a peace deal in Ukraine is the real key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is unlikely in 2025. CBR needs to be cautious since the pace of state spending could turn pro-inflationary if Ukraine war continues in 2026.