As Expected, CBRT Continued its Easing Cycle on January 23

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate to 47.5% on December 26, the easing cycle continued on January 23 as CBRT reduced the policy rate by 250 bps to 45% backed by the deceleration trend in inflation continued in December, monthly inflation stood below expectations, TRY remained relatively stable and inflation expectations slightly improved. CBRT cited in its written statement that core goods inflation remained relatively low, and indicators for Q4 suggested that domestic demand stood at disinflationary levels coupled with improving inflation expectations and pricing behavior. Our end year key rate prediction remains at 30.0% for 2025, and we feel Mth/Mth inflation readings will continue to be key as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.

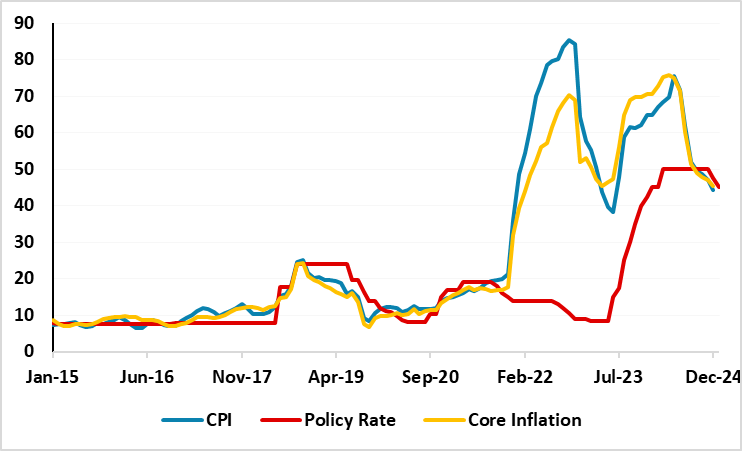

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – January 2025

Source: Continuum Economics

After the deceleration trend in inflation continued in December with 44.4% y/y, supported by moderate slowdown in domestic demand and relative TRY stability, CBRT reduced the policy rate by 250 bps to 45% from 47.5% on January 23, which was the second rate cut in a row.

As noted, CPI cooled off to 44.4% y/y in December from 47.1% in November as inflation figures came out better than expected. More importantly, MoM inflation rose by 1.03% in December as monthly inflation stood below expectations while forecasts in surveys ranged between 1.4% and 1.8%. Additionally, 30% administered rise in the minimum wage for 2025 was lower than workers had requested, which would partly support the inflation relief in the upcoming months.

CBRT cited in its written statement on January 23 that that core goods inflation remained relatively low and indicators for Q4 suggested that domestic demand stood at disinflationary levels coupled with improving inflation expectations and pricing behavior.

CBRT added the tight monetary stance will be maintained until price stability is achieved via a sustained decline in inflation, and MPC will make its decisions prudently on a meeting-by-meeting basis with a focus on the inflation outlook.

Speaking about the rate cuts, president Erdogan said on December 28 that interest rates will fall in 2025 as he reiterated his unconventional belief that lowering interest rates will slow down price increases. "We will definitely start lowering interest rates. 2025 will be the mark year for this. Interest rates will come down so that inflation will also come down. This is a must for us," Erdogan added.

CBRT governor Karahan recently underscored that YoY inflation will fall to 21% by the end of 2025, though some Turkish businesses and households doubt it will come down that quickly. The government predicts the rate will drop even more in that period, to 17.5%. We envisage upside risks emanating from the stickiness of services inflation, inflation expectations, deteriorated pricing behavior, and adverse geopolitical impacts could lead average inflation to stand at 31.9% and 20% in 2025 and 2026, respectively.

Our end year key rate prediction remains at 30.0% for 2025, and we feel Mth/Mth inflation readings will continue to be the key as CBRT will want to avoid reigniting inflation with too aggressive rate normalization. As noted, we feel CBRT will have to proceed carefully on interest-rate adjustments given domestic inflationary risks and unpredictable outlook for the global economy.