Surprising Move: CBR Held Key Rate at 21% Despite Surging Inflation

Bottom Line: Despite expectations, Central Bank of Russia (CBR) announced on December 20 that it held the key rate constant at 21%. The CBR emphasized in its statement that monetary conditions tightened more significantly than envisaged by the October key rate decision, and it would continue to evaluate the need for a rate hike, with future decisions based on lending and inflation dynamics. We continue to think that risks to the inflation outlook remain upside as RUB weakens and inflation expectations surge, which could likely compel CBR to continue tightening cycle on February 14, 2025 if inflation will not start cooling off and RUB stabilizes.

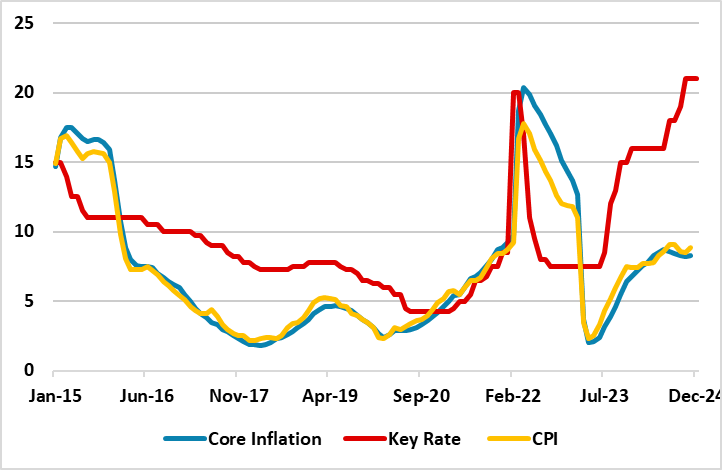

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2024

Source: Continuum Economics

On December 20 MPC meeting, CBR held the policy rate constant at 21% despite inflationary risks, surging inflation expectations and RUB weakening. CBR highlighted in its press statement that the increase in borrowing costs and the cooling of credit activity has created the necessary prerequisites for resuming disinflation processes and returning inflation to the target. While inflation remains elevated, the bank expressed confidence with its current monetary policy stance, and emphasized that annual inflation will decline to 4% in 2026 and stay at the target further on. (Note: CPI continued to stay high at 8.9% YoY in November. MoM price growth fastened to 1.4% in November from 0.8% in October driven by the surging services and food prices).

Despite CBR’s statements; we think domestic demand, boosted by lending, rising wages and increased budget spending continue to outrun production capacity. The RUB weakness remains as a major concern over the inflation trajectory as RUB lost about 15% against the USD just in November due to panic buying of foreign currency in the wake of new U.S. sanctions on Russian banks including Gazprombank. Despite CBR halted foreign currency purchases in response to the RUB fall, the RUB stayed well above the 100 threshold. We expect RUB would remain volatile in 2025, inflationary pressures won’t likely start to soften and macroeconomic instability will remain substantial, though a ceasefire in Ukraine is likely (here) and this could underpin the RUB – a RUB recovery requires a peace deal to lift sanctions, which could take years. It is also worth noting that inflation expectations continue to deteriorate as inflation expectations increased to a one-year high of 13.9% in December 2024, up from 13.4% in the prior month.

CBR also acknowledged on December 20 that inflationary pressures persist with annual inflation rising to 9.5% as of mid-December. Despite this, the regulator indicated that monetary conditions tightened more significantly than envisaged by the October key rate decision, and it would continue to evaluate the need for a rate hike, with future decisions based on lending and inflation dynamics.

As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up, and achieving 4% target in 2026 will be tough for CBR.

We continue to think that risks to the outlook remain upside as the fiscal policy is making a big contribution to domestic demand coupled with continued military spending, RUB weakening and surging inflation expectations, which could likely compel CBR to continue tightening cycle on February 14, 2025 if inflation will not start cooling off and RUB stabilizes in December and January. The war will remain the key issue in 2025 which will affect CBR’s decision making process.