SARB to Continue Rate Cuts in 2025, but the Pace Will Depend on Inflation Trajectory and Global Developments

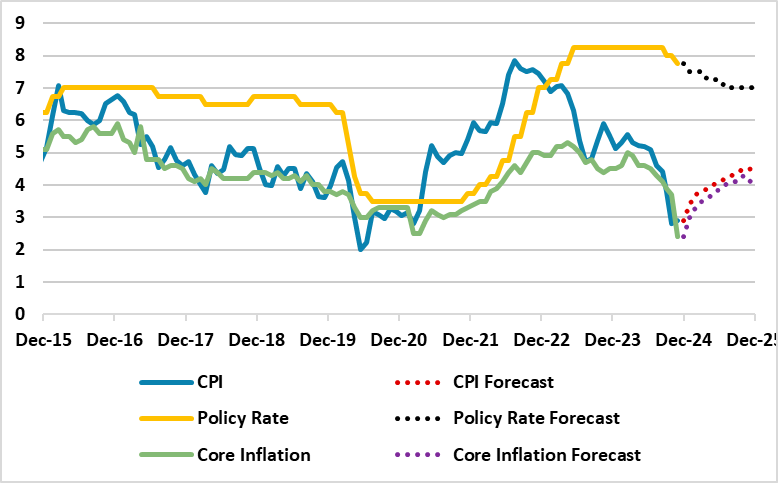

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased the rate from 8.25% to 7.75% in 2024 given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we foresee the rate cuts will continue in 2025 but the pace will depend on inflation prints, and global developments. Our end-year policy rate prediction remains at 7.0% for 2025 while we foresee average headline inflation will hit 4.2% in 2025.

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

After SARB decreased the rate from 8.25% to 7.75% in 2024 given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, the focus is now on SARB’s key rate decisions in 2025.

As inflation remains well below 4.5% midpoint, we feel this continues to allow more space for rate cuts; as we foresee 25 bps cuts in the first three quarters of 2025. Cautious SARB will likely halt Q4 2025, particularly if the impacts of trade tariffs over the global economies will be harsher than expected. (Note: SARB governor Kganyago signaled late December that officials will proceed carefully on interest-rate adjustments, given the unpredictable outlook for the global economy).

The major indicator to be closely watched by SARB during the easing cycle will be the inflation data given the continued uncertainty about the inflation outlook. (Note: Inflation decreased to 2.9% YoY in November due to slowdown in costs for food, fuel, and housing, slightly up from a four-year low of 2.8% in October). We foresee average headline inflation will hit 4.2% in 2025 given suspended loadshedding, lagged impacts of SARB’s previous tightening, and a relatively stable ZAR as Fed and ECB continue cutting cycles.

The key for the inflation trajectory will be the coalition’s determination to address the electricity shortages, logistical constraints, and financing needs. Despite the recent fall in CPI, we feel there is still an upside inflationary risk emanating from volatile food and fuel prices, supply-side constraints, and geopolitical risks. Additionally, it is worth mentioning that that Eskom is planning to apply tariff hikes over the next two years 2025/2026: 36.15% and 2026/2027: 11.81%, which could also lift CPI over expectations. The future of loadshedding remains imponderous and energy analysts remain cautious despite load shedding is suspended for more than nine months now.

We think SARB will closely follow rate decisions by Fed and ECB, which are expected to continue their cutting cycles, loosen global financial conditions and potentially easing pressure on the ZAR, and giving room for SARB to continue cutting rates in 2025. We feel it will be important for South Africa to monitor fuel prices, trade tariffs, and global oil price movements, as they could significantly impact inflation forecast.

As noted in the December outlook, the key for SARB in 2025 will be carefully timing and coordinating the monetary policy framework to manage expectations and scheduling rate cuts given the continued uncertainty about the inflation outlook. We expect data-driven and cautious SARB will carefully monitor the inflationary developments as SARB frequently reiterated that they pay attention to inflationary pressures are under control backed up by data and expectations. We feel any unexpected inflation hikes can jeopardize the anticipated rate cuts in 2025, which is not our baseline scenario.