As Expected, SARB Cut the Key Rate to 7.5% on January 30

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, South African Reserve Bank (SARB) decided to cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate, power cuts (loadshedding) are suspended for over 9 months, inflation expectations continue to fall, and domestic fiscal outlook is moderately stable. We feel SARB will likely halt the easing cycle during the next MPC scheduled on March 20 due to unpredictable global outlook and inflation risks. We think domestic inflation can gradually increase in the upcoming months as base effects attenuate and fuel prices likely recovering from their 2024 levels.

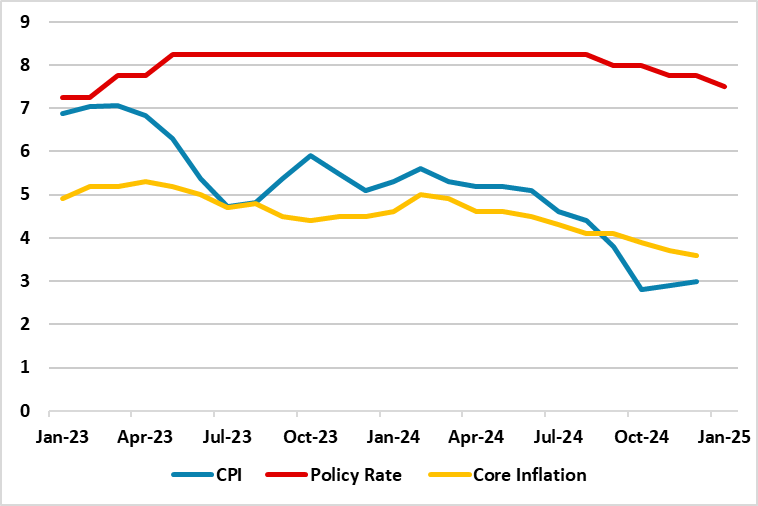

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – January 2025

Source: Continuum Economics

On January 30, SARB decided to reduce the key rate by 250bps to 7.5% on muted inflation in December (3%, YoY), which stayed below the midpoint target of 4.5%. The MPC decision was a close call taking into account that unpredictable global outlook and global inflation risks which pressurize SARB’s rate-cutting cycle. Four MPC members voted for the cut, while two voted for rates to remain unchanged.

In addition to the smaller-than-expected rise in headline inflation rate in December, it appears the recent recovery in ZAR, suspended power cuts, falling inflation expectations, and moderately stable domestic fiscal outlook favored SARB resumes its easing cycle.

As noted, the inflation readings have been positively affected by the suspended power cuts. South Africa’s national electricity utility company, Eskom announced on January 24 that load shedding remained suspended for 303 consecutive days since March 26, 2024 reflecting an improvement in the reliability and stability of the power generations coupled with new investments.

Speaking on prospective interest rate decisions, SARB governor Kganyago said on January 30 that "The MPC would like to emphasize that its decisions will be made on a meeting-by-meeting basis, with no forward guidance and no pre-commitment to any specific rate path. Such decisions will continue to be outlook dependent, responsive to data developments, and sensitive to the balance of risks to the forecast." Kganyago added that inflation is still an issue.

Under current circumstances, we envisage cautious SARB will proceed carefully on interest-rate adjustment in the upcoming months, and SARB will focus on anchoring inflation expectations near the midpoint of its target range which will remain critical for monetary policy decisions. We feel SARB will likely halt the easing cycle during the next MPC scheduled on March 20 due to unpredictable global outlook and inflation risks. We think domestic inflation can gradually increase in the upcoming months as base effects attenuate and fuel prices likely recovering from their 2024 levels.