SA MPC Preview: No Rate Cuts Are Expected on May 29 Due to Uncertainties

Bottom Line: Taking into account that annual inflation increased to 2.8% YoY in April due to higher food prices, we think South African Reserve Bank (SARB) will likely hold the rate constant at 7.5% during the next MPC scheduled on May 29 given plenty of upside risks to inflation including unpredictable outlook for the global economy, return of power cuts (loadshedding), and volatility of ZAR. The decision will still be a close call considering recent withdrawal of the (inflationary) VAT increase and relief in global oil prices. Our end-year key rate prediction remains 7.0% for 2025.

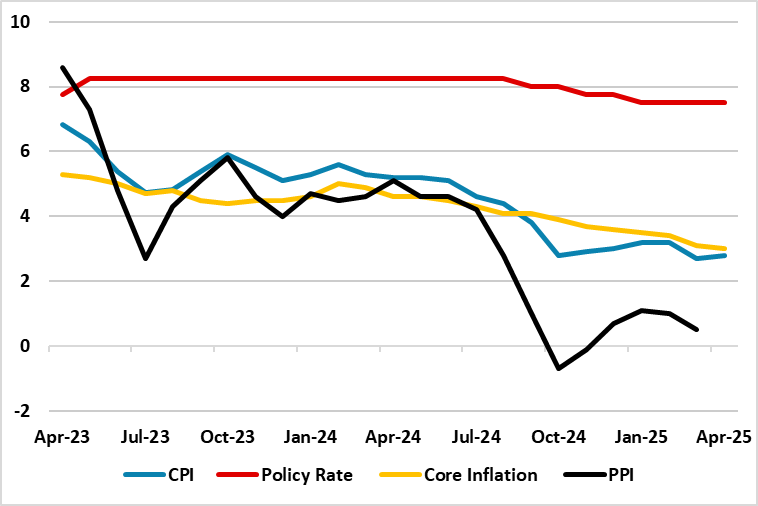

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – April 2025

SARB’s MPC will convene on May 29, and the third key rate decision of 2025 will be announced. We foresee SARB will likely hold the key rate constant at 7.5% despite the decision will be a close call.

First, according to Stats SA’s announcement on May 21, inflation slightly accelerated to 2.8% in April due to higher food prices while it remained below SARB’s midpoint of target band of 3% - 6%. Annual inflation for food and non-alcoholic beverages (NAB) surged to 4.0% in April, the highest annual rate since September 2024. The fall in the annual core inflation was notable as it eased to 3% in April the lowest since July 2021, from 3.1% in March.

Despite inflation remaining moderate, there were some bad news from power cuts (loadshedding), which could ignite inflation in the upcoming months. Eskom announced on May 13 that Stage 2 loadshedding would be implemented following a Stage 2 loadshedding on April 24, which suggested serious issues. Energy experts warn that the recent power cuts reminded that rolling blackouts are still a threat.

Additionally, unexpected global outlook continues to pressurize South Africa linked with increasing global trade risks following the additional tariff decisions by the Trump administration, which could be critical if the U.S. implements tariffs on imports from South Africa following the 90-day pause.

On the other side of the coin, some recent developments back a rate cut decision on May 29 as well. National Treasury issued a press statement on April 24 indicating that the proposed 1%pts increase in VAT over the next two years will not be implemented as the Minister of Finance withdrew Budget 2.0. The recent withdrawal of the (inflationary) VAT increase and relief in global oil prices could encourage SARB to continue easing cycle. Additionally, according to reports, National Treasury and the SARB are looking at reworking the inflation rate target to a narrower band than the current 3% to 6%, which could mean fewer rate cuts in the near term. SARB could be willing to use this window of opportunity at the moment to cut rates while we think risks outweigh the opportunities.

Under current circumstances, we envisage cautious SARB proceeds carefully on interest-rate adjustments, and likely hold the key rate constant on May 29 given plenty of upside risks to inflation. We feel slight CPI hike in April, unpredictable global outlook due to Trump's tariffs and rising concerns about local political instability following disagreement on budget will cause SARB to be careful. Our end year prediction remains 7.0% for 2025.