SARB Cuts Key Rate to 7.0% Given Subdued Inflation; Lower CPI Goal Announced

Bottom Line: Despite the uncertainty around United States tariffs and rising domestic food inflation, South African Reserve Bank (SARB) reduced the policy rate by 25 bps to 7.0% during the MPC on July 31 as annual inflation hit 3.0% YoY in June coupled with eased core inflation, and a relatively stable ZAR. The MPC vote was unanimous. SARB governor Kganyago said on July 31 that the inflation target is now dropped to 3%, and will be used as an anchor at future meetings rather than previous midterm target of 4.5%. We think the new inflation target will make SARB more cautious about cutting interest rates aggressively in the future.

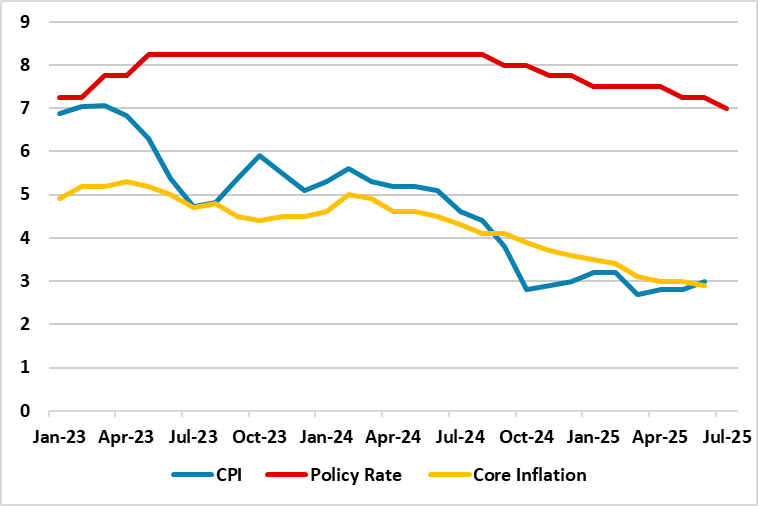

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), April 2023 – July 2025

Source: Continuum Economics

SARB’s MPC convened on July 31 announcing the fourth key rate decision of 2025. SARB continued its easing cycle despite the uncertainty around United States tariffs and rising domestic food inflation. SARB reduced the policy rate from 7.25% to 7.0% considering that annual inflation stood at 3.0% in June coupled with eased core inflation and a relatively stable Rand. The MPC vote was unanimous. (Note: Annual core inflation rate softened to 2.9% in June from 3.0% in two previous months, hitting the lowest reading since April 2021). It is worth noting that inflation expectations also continued to soften in 2025, with all the social groups surveyed expecting it to average less than 4% for the year.

SARB governor Kganyago indicated during the press conference on July 31 that the global economic conditions remain uncertain amid the United States’ tariff push, while local conditions in South Africa remain under pressure.

A significant development on July 31 was seeing SARB basing its recent analysis on a 3% scenario for inflation targeting rather than previous midterm target of 4.5%. Kganyago indicated that the existing 3%-6% target is too high and too wide, and added that core inflation stays roughly where it is currently with a 3% objective. Kganyago highlighted that SARB will use forecasts with a 3% inflation anchor at future meetings mentioning that the expectations settle around a new normal of 3% during 2027, as stakeholders observe lower inflation and learn about the new target. (Note: We think the new inflation target will make SARB more cautious about cutting interest rates aggressively in the future).

Despite positive developments for South African consumers and business people, we think unpredictable outlook for the global economy, rising trade tensions, abrupt shifts in long-standing geopolitical relationships, domestic uncertainties and power cuts (loadshedding) will continue to pressurize prices in H2. (Note: We foresee average inflation will hit 3.4% in 2025). We believe the key for the inflation trajectory will be the global developments and government’s determination to address the electricity shortages, logistical constraints and financing needs.