CBR Continues to Keep Key Rate Constant at 21% Despite Surging Inflation

Bottom Line: As we predicted, Central Bank of Russia (CBR) held the policy rate stable on April 25 for the fourth consecutive time to combat price pressures. CBR indicated in its written statement that CBR will maintain monetary conditions as tight as necessary to return inflation to the target in 2026, and further decisions on the key rate will be made depending on the speed and sustainability of the decline in inflation and inflation expectations. We continue to foresee a Russia-friendly deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a peace deal will likely take longer-than-expected.

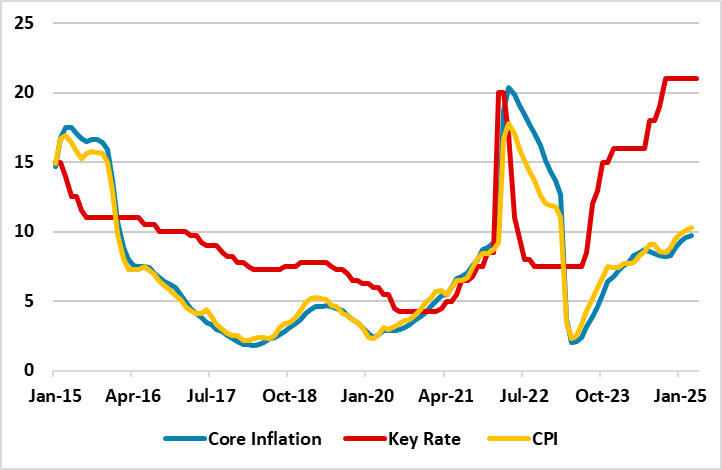

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – April 2025

Source: Continuum Economics

The CBR held its third MPC meeting of the year on April 25 and kept the key rate unchanged at 21%. Despite the interest rates remain at their highest level in two decades, it appears this has so far failed to soften rising inflation since the ongoing war in Ukraine exacerbates economic capacity constraints. We feel any interest rate cuts seem unlikely before H2 2025 under current circumstances since we think there are no signs of a significant inflation slowdown in the horizon yet. (Note: Inflation ticked up to 10.3% YoY in March after hitting 10.1% in February, remaining well above the CBR’s midterm target of 4%, due to surges in services and food prices, huge military spending and elevated inflation expectations).

CBR said in its statement on April 25 that "Current inflationary pressures, including underlying ones, continue to decline, although remaining high." CBR maintained its 2025 inflation forecast at 7.0–8.0%, predicting inflation will return to the target of 4.0% in 2026. The regulator added that it will maintain monetary conditions as tight as necessary to return inflation to the target in 2026, and further decisions on the key rate will be made depending on the speed and sustainability of the decline in inflation and inflation expectations. Speaking about this, CBR governor Nabiullina emphasized following the MPC meeting that “There are still risks related to the labour market and inflation expectations. Despite the slowdown in current price growth, inflation expectations have barely changed since our meeting in March, while a further decrease in inflation expectations is critical to ensure sustainable disinflation.”

It appears CBR considers that balance of inflation risks is still tilted to the upside over the medium-term. CBR noted that the key proinflationary risks are associated with a longer upward deviation of the Russian economy from a balanced growth path and high inflation expectations. A further decrease in the growth rate of the global economy and oil prices in case of escalating trade tensions may have proinflationary effects through the ruble exchange rate dynamics.

We also think the risks to the inflation outlook remain upside as the fiscal policy is making a big contribution to domestic demand, coupled with high military spending. Surging inflation expectations, likely deterioration in the terms of external trade during trade wars and rising wages do not signal a significant inflation slowdown in the horizon yet. (Note: We feel inflation will likely peak at around 10.4%-10.5% YoY in April.)

We continue to foresee a Russia-friendly deal in Ukraine could ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a peace deal will likely take longer-than-expected. CBR could consider reducing the rates afterwards, but this will depend on how peace negotiations will proceed in H2 2025.