2025 will be Key for CBRT

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, which was the first rate cut in around two years, we believe the rate cuts will continue in 2025 following inflation fighting drive in 2024 while our end year key rate prediction remains at 30.0% for 2025. We feel CBRT will have to proceed carefully on interest-rate adjustments in 2025, given domestic inflationary risks and unpredictable outlook for the global economy, particularly considering CBRT held its inflation target constant at 5% in its road map monetary policy report on December 25. We think 5% inflation target will be hard to achieve before 2028 under current circumstances as we foresee upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts could lead average inflation to stand at 31.9% and 20% in 2025 and 2026, respectively.

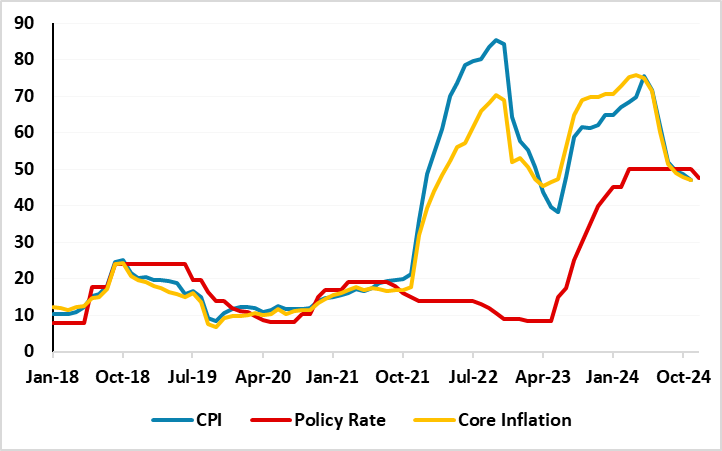

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – December 2024

Source: Continuum Economics

2025 will be decisive for the Turkish economy from every angle while the key will be aligning fiscal, monetary, and incomes policies, which need to work together during the disinflationary process while the burden on CBRT will be huge. We feel CBRT will have to proceed carefully on interest-rate adjustments in 2025, given domestic inflationary risks and unpredictable outlook for the global economy.

Preparing for 2025, CBRT published a significant road map for monetary policy on December 25, covering key aspects of its policies and communication strategy for 2025. According to the monetary policy framework report, the CBRT’s inflation target remained at 5%. The report highlighted that "The monetary policy will be conducted in a way to ensure the monetary and financial conditions to bring inflation to this target in the medium-term."

CBRT highlighted that it plans to end the foreign exchange-protected TRY deposit scheme (KKM – Kur korumali mevduat) in 2025 as it continues to simplify the macroprudential framework. According to the announcement, the share of TRY deposits within total deposits rose to 58.6%, while the share of KKM accounts fell to 6.2% as of December 20, demonstrating the shift reflecting the growing demand for TRY assets. CBRT also announced that it reduced the number of MPC meetings to eight in 2025 from the current 12, hinting at a higher size of rate cuts per meeting.

Taking into account that the CBRT decided to lower interest rate by 250 bps to 47.5% on December 26 MPC meeting, which was the first rate cut in around two years, we believe the rate cuts will continue in 2025 following inflation fighting drive in 2024. As the easing cycle began, CBRT will likely set policy prudently on a meeting-by-meeting basis with a focus on the inflation outlook, and respond to any expected significant and persistent deterioration. We expect CBRT to remain cautious about future cuts in 2025 and 2026 as it would have to monitor inflation closely before interest rate cut decisions. Our end year key rate prediction is at 30.0% for 2025, and we feel Mth/Mth inflation readings will be key in 2025 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.

We think CBRT’s 5% inflation target will be hard to achieve before 2028 under current circumstances as we foresee upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts lead our average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively, despite the CBRT expects inflation to fall to 21% by end-2025. We envisage the inflation outlook in 2025 will be shaped by administrative prices, TRY volatility and tax adjustments.