Bank Indonesia Holds Firm on Rates: A Steady Hand for Currency Stability

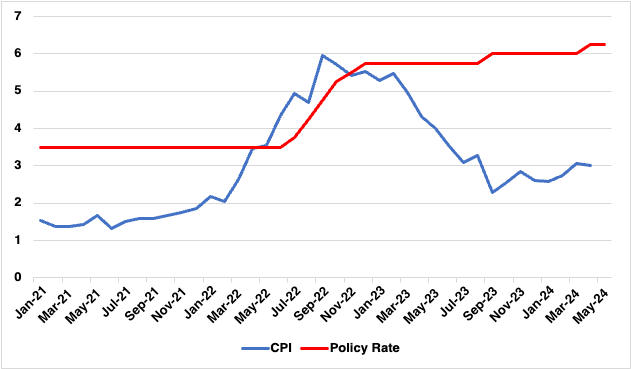

Bank Indonesia in a pro-stability move decided to maintain the key policy rate at 6.25% today. The move comes at a time when the wakness in the Indonesia Rupiah has abated and headline inflation has edged down. Despite improving stability, a rate cut is not in sight in the near term.

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics

Indonesia's central bank, Bank Indonesia (BI), has decided to maintain its benchmark interest rate at 6.25% in its latest review earlier today, in line with our expectations. The decision aligns with BI's pro-stability monetary policy, aimed at keeping inflation in check and simultaneously maintaining the stability of the Indonesia Rupiah (IDR). BI left the overnight deposit facility rate unchanged at 5.50% and the lending facility rate steady at 7.00%.

BI's latest status quo move comes after a surprise interest rate hike last month, intended to anchor inflationary expectations, attract foreign portfolio investors to buy Indonesian assets and strengthen the rupiah. The IDR had fallen to four-year lows against the U.S. dollar in April. Although it has recovered some of the losses, the currency remains susceptible to global risk sentiment fluctuations related to U.S. monetary policy and international conflicts. BI Governor Perry Warjiyo emphasized that the decision to maintain the current rates is consistent with the central bank's pro-stability approach, ensuring that inflation stays within the target range of 2.5±1% for 2024 and 2025, while also maintaining the stability of the rupiah and managing capital inflows. Warjiyo expressed confidence that the rupiah would stabilize and potentially strengthen, as Indonesian assets continue to offer attractive returns to investors.

Indonesia's economic growth has shown positive signs, with data earlier this month revealing a real GDP growth of 5.11% yr/yr in Q1 2024. The annual inflation rate also eased slightly to 3% yr/yr in April, remaining within BI's target range of 1.5% to 3.5%. BI has kept its growth outlook for 2024 in the range of 4.7% to 5.5%, compared to last year's 5.05%.

Looking ahead to H2-2024, BI's outlook remains cautiously optimistic. The central bank's primary goal is to keep inflation within its target range through a balanced mix of monetary, macro-prudential, and payment system policies. Although there were earlier expectations for a potential rate cut this year, the likelihood of such a move has decreased. We now expect BI to maintain its current rate to ensure rupiah stability, especially given the anticipated actions of the U.S. Federal Reserve. Given that BI now anticipates a Fed rate cut only in December 2024, it is unlikely to cut rates in the coming months. Meanwhile, there remains a slim probability of another rate hike should geopolitical tensions and supply disruptions push up inflation or the IDR come under extensive pressure. For now, we expect BI to hold the 6.25% interest rate till end 2024; a rate cut is likely in early 2025.