As Widely Expected, CBRT Kept Key Rate Stable at 50% on June 27

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on June 27 despite galloping inflation edged up to 75.5% in May, up from 69.8% in April. CBRT said in a statement on June 27 that "(…) the tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed." We expect a fall in the inflation after June, particularly due to favourable base effects, lagged impacts of tightening cycle, public savings package, tighter fiscal policies and additional quantitative steps. We foresee that the policy rate will be held unchanged at 50% in the next MPC meeting, which is scheduled for July 23.

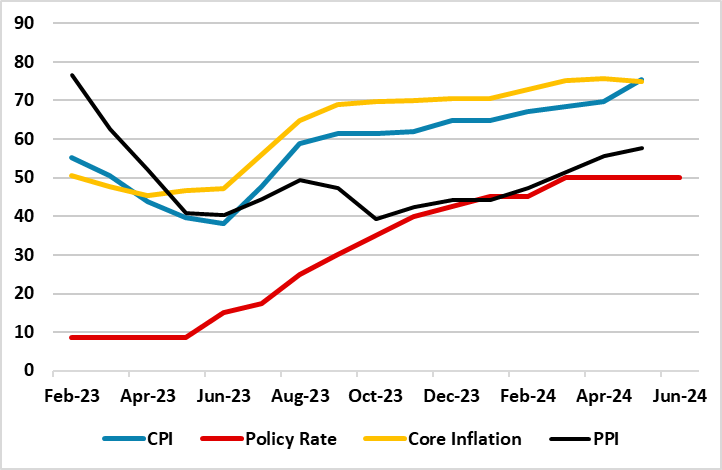

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – June 2024

Source: Continuum Economics

The CBRT decided to hold the key rate stable at 50% on June 27 MPC meeting despite annual inflation hit 75.5% YoY in May due to increases in education, housing, restaurant & hotel prices.

According to the Bank’s assessment on June 27, stickiness in services inflation, inflation expectations, geopolitical risks, and food prices have kept inflationary pressures alive. MPC report highlighted that the domestic demand, albeit still at inflationary levels, continued to slow down. CBRT also announced that monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen, and disinflation will be established in the second half of the year.

CBRT’s governor Karahan repeatedly stressed that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. Central Bank continues to regain credibility as it strongly signals determination in pursuing traditional economic policies until the inflation is under better control, which continue to attract foreign investments, but restoring full-confidence takes time.

On the currency front, Turkish lira (TRY) reached a new historic low against the USD on June 27 trading at over 33.0 liras per dollar, before stabilizing at 32.9 liras in the afternoon, while key rate decision did not have a significant impact on the USD/TRY rate.

One interesting announcement concerning government’s fight against the inflation was the recent statement by the Minister of Labor Vedat Isikhan on June 26, who emphasized that there will not be an interim increase in the monthly minimum wages in July, and new minimum wage will be determined in December. Isikhan also ruled out any adjustments to pensions to protect retirees despite cost-of-living crisis continues to bite Turkish citizens.

Taking government’s efforts to tackle inflation into consideration, we expect a fall in the inflation after June particularly due to favourable base effects, lagged impacts of tightening cycle, public savings package and tighter fiscal policies, coupled with relative TRY stability after April also underpinning the expected inflation relief. Despite inflation readings could put pressure on CBRT to resume tightening cycle in the upcoming months, we foresee CBRT to hold the key rate constant at 50% through the end of 2024.