Rupiah Gains Ground: BI Stays Cautious on Rate Cuts

Bank Indonesia held its key interest rate at 6.25% to stabilise the rupiah and attract FX inflows, while maintaining interventions in the FX and bond markets. Inflation remains within target, and GDP growth forecasts are steady. Future rate cuts depend on US Federal Reserve actions. A 25bps cut is expected in end-2024.

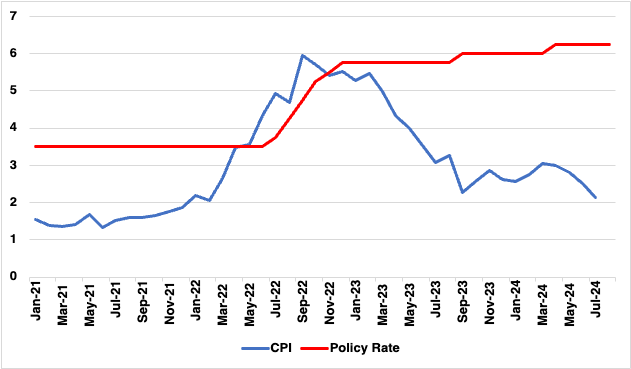

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics

Bank Indonesia (BI) has opted to maintain its key interest rate at 6.25%, in a decision anticipated by us and aligned with the central bank's ongoing strategy to stabilise the rupiah and manage inflationary pressures. The announcement followed the Monetary Policy Committee (MPC) meeting held on August 20-21, where the central bank also chose to keep the deposit facility rate at 5.50% and the lending facility rate at 7.00%.

This move comes as the rupiah continues its upward trajectory, appreciating 5.34% against the US dollar throughout August, solidifying its position as the region’s top-performing currency. The currency's rally has been underpinned by BI's active intervention in the bond market, with significant sales of both government bonds (SRBI) and foreign currency bonds (SVBI and SUVBI) bolstering foreign exchange inflows and reducing depreciation pressures.

The decision to hold rates reflects Bank Indonesia's cautious stance as it navigates a complex global economic landscape. The central bank is prioritising currency stability and inflation control within the target range of 2.5% ±1%, particularly in light of evolving expectations regarding US monetary policy. With the Federal Reserve potentially moving towards an earlier-than-expected rate cut due to slowing economic growth, Bank Indonesia is poised to follow suit, albeit not preemptively. Indeed, Bank Indonesia’s policy approach appears anchored in the broader context of the US Federal Reserve's decisions. The central bank's current strategy suggests a wait-and-see approach, with any potential easing likely contingent upon further moves by the Fed. This cautious stance underscores BI's commitment to maintaining economic stability amid external uncertainties.

In terms of economic outlook, BI has retained its GDP growth forecast at 4.7%-5.5% for the year, with public spending expected to support growth above the 5% threshold. The current account deficit is projected to remain manageable, within a range of 0.1%-0.9% of GDP. This optimistic outlook is underpinned by the rupiah's recent performance, which has not only stabilised but also outperformed regional peers.

Looking ahead, should the rupiah's strength persist, the central bank may face increasing calls to consider a rate cut sooner rather than later. However, for now, Bank Indonesia appears content to maintain its current course, with a focus on sustaining the momentum in the currency market and ensuring inflation remains under control. A 25bps rate cut is expected in Q4 2024.