CBR Will Likely Hold Key Rate Constant at 21% on February 14

Bottom Line: After Central Bank of Russia (CBR) held the key rate stable at 21% on December 20 despite expectations were centered around a rate hike, we now foresee that the rate will be kept constant on February 14 taking into account that January will likely bring a little inflation relief supported by the recent RUB strengthening as CBR continues to express confidence with its current monetary policy stance. We think that risks to the inflation outlook remain upside as the fiscal policy is making a big contribution to domestic demand, coupled with elevated military spending, rising wages and surging inflation expectations, while there are no signs of a significant inflation slowdown in the horizon yet.

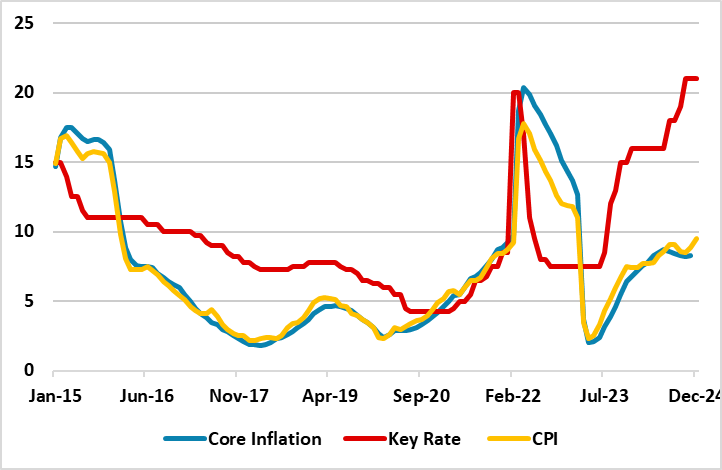

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2024

Source: Continuum Economics

The CBR will hold its first MPC meeting of the year on February 14. Despite the interest rates remain at their highest level in two decades, it appears this has so far failed to slow rising inflation. (Note: CPI stayed elevated at 9.5% YoY in December due to surges in services and food prices). We think CBR will likely keep the policy rate constant at 21% on February 14. (Note: Of course, the CBR could also consider hiking the rate to 22%-23% to fight against inflation, but we deem this unlikely particularly after the decision on December 20.)

First, the bank continues to express confidence with its current monetary policy stance. Secondly, RUB weakening, which accelerated in November and December, got reversed as of January, and this will likely bring a very moderate inflation relief in the first month of the year. (Note: According to the Ministry of Economic Development, annual inflation in Russia from January 28 to February 3 slowed down to 9.92% from 9.95% a week earlier. Inflation rate for January will be announced on February 14).

As noted, we feel the pass-through of the earlier RUB weakening to prices, which increased in December 2024, partly soothed in January. RUB gained about 11.2% of its value against the USD just in January after the negative impacts of U.S. sanctions on Russian banks softened as CBR halted foreign currency purchases in response to the RUB fall.

The CBR emphasized in its bulletin published on February 5 that the high key rate has not helped rising inflation to decelerate yet. The regulator wrote in its report titled “What the Trends Are Saying: Macroeconomics and Markets” that “(…) Consumer demand stayed high despite a slowdown in retail lending and a high saving ratio, while consumer prices continued to go up. To return to a low inflation rate, it is necessary to maintain tight monetary conditions for an extended period. There are still no signs of a transition to a sustainable slowdown in price growth, and more moderate growth of demand is required.”

Remaining concerned about the course of inflation, Putin emphasized on January 22 that "Moderate inflation should be achieved soon. Imbalances in the economy and in the consumer market should be avoided in general, and it is important to monitor the conditions of the demand, its sectoral structure, and lending volumes."

Despite the Ministry of Economic Development expects that in 2025 inflation will stabilize at 4.5%, and in 2026-2027 the figure will reach 4%, we feel restrictive monetary policy partly suppresses prices with lagged impacts and cooling off inflation will take longer than CBR anticipates since demand stays elevated and inflation expectations of households and businesses continue to edge up thus achieving 4.5% target in 2025 will be very tough.

We think that risks to the inflation outlook remain upside as the fiscal policy is making a big contribution to domestic demand, coupled with high military spending, rising wages and surging inflation expectations, while there are no signs of a significant inflation slowdown in the horizon yet.