Reserves, Rates, and Reform: BI’s 2025 Strategy to Stabilise the Rupiah

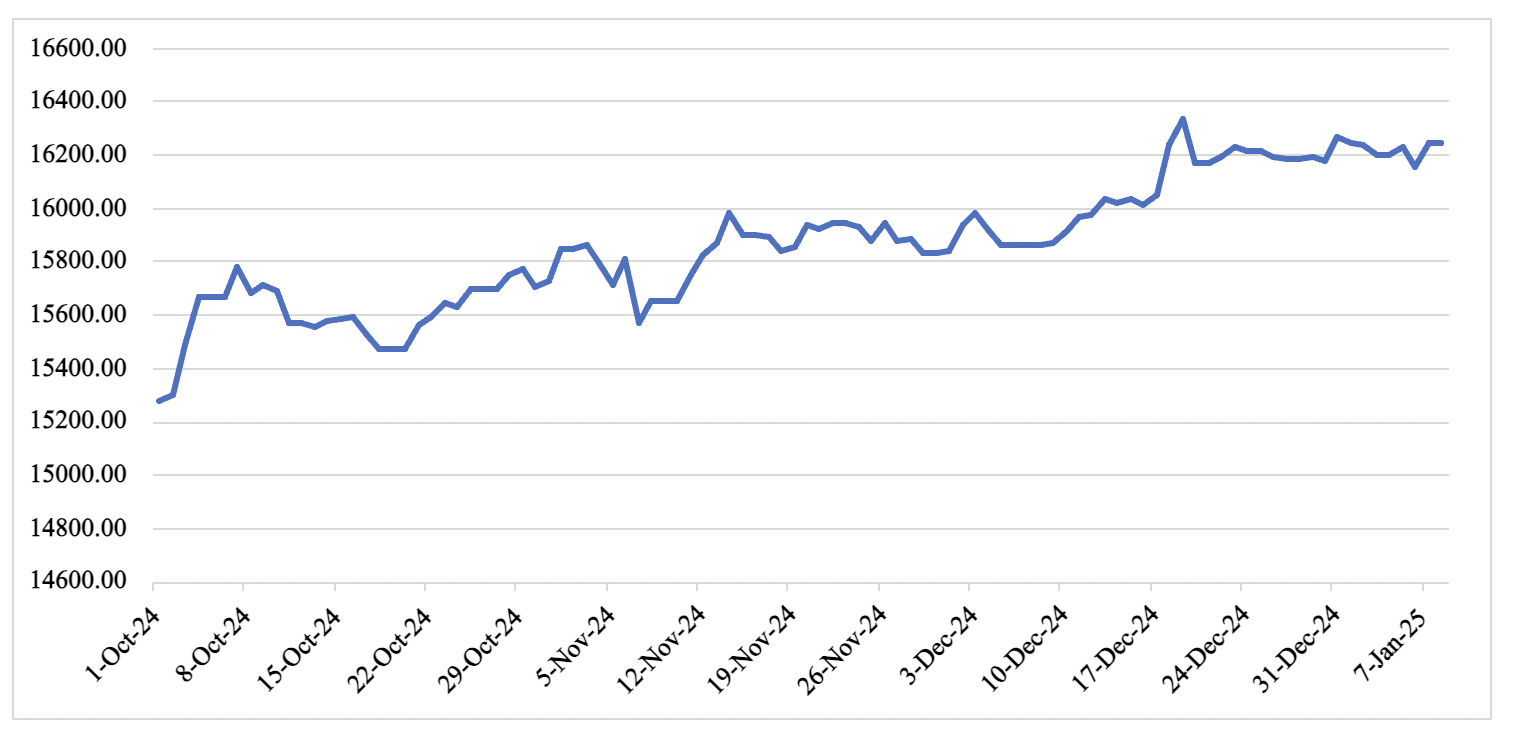

Currency pressures and policy pivots define BI’s entry into 2025, with the rupiah breaching 16,000 per dollar. Strong reserves and strategic moves signal resilience, but sustaining investor confidence in the face of fiscal and structural vulnerabilities remains a tough challenge.

Bank Indonesia (BI) is entering 2025 under intense scrutiny, navigating a volatile mix of global and domestic pressures. A sharp decline in the rupiah, fuelled by a surging US dollar and policy uncertainties at home, has underscored the delicate balancing act required to maintain financial stability while fostering economic growth.

The Indonesian rupiah fell nearly 1% in December 2024, breaching the 16,000 mark against the US dollar, following a surprise decision by President Prabowo Subianto to scale back a planned value-added tax (VAT) hike. The revised policy now limits the tax increase to luxury goods, generating far less revenue than originally anticipated. This has raised concerns about fiscal risks and regulatory uncertainty stemming from these sudden policy shifts, which undermine investor confidence.

Figure 1: USD /IDR Exchange Rate

External factors have further complicated the picture. Geopolitical tensions and the likelihood of fewer rate cuts by the Federal Reserve have bolstered the dollar, leading to significant outflows from emerging markets, including Indonesia. In response, BI has escalated its interventions. In December, the central bank launched a "bold triple intervention," targeting the spot market, non-deliverable forwards and government bonds. This strategy aims to restore market confidence, backed by Indonesia’s record-high foreign reserves of $145bn. Strong reserves enhance BI’s ability to counter external pressures, though interventions alone may not fully offset global financial dynamics.

Given the rupiah’s weakness, BI maintained its benchmark interest rate at 6.0% in December 2024, signalling a commitment to supporting the exchange rate while cautiously supporting growth. The decision followed a surprise rate cut in September, reflecting concerns over Indonesia’s slowing economic momentum. Growth dipped to a one-year low of 4.9% in Q3 2024. Indonesia’s foreign reserves, buoyed by robust trade performance provide a critical buffer. However, the government’s revised VAT policy and slowing growth have highlighted structural vulnerabilities.

Inflation trends provide some leeway. Annual inflation eased to 1.55% in November 2024, its lowest level since mid-2021, bolstered by subdued commodity prices. With inflation well within the central bank’s target range of 2.5% ± 1%, we anticipate further rate cuts in early 2025, potentially lowering the benchmark rate to 5.75% by end-year. However, any monetary easing will be carefully calibrated to avoid exacerbating currency pressures.

Further, to stabilise the rupiah, BI has implemented new regulations requiring commodity exporters to retain a portion of their foreign exchange earnings domestically. These measures aim to bolster foreign reserves and reduce dependency on external capital inflows. Coupled with the issuance of competitive rupiah-denominated securities (SRBI), the policy seeks to enhance market liquidity and support the currency amid heightened volatility. This lends credence to our view that BI will prioritise exchange rate over economic growth.