Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on January 23

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, we believe the rate cuts will continue during the MPC meeting scheduled for January 23. CBRT will likely reduce the policy rate by 250 bps to 45% as the deceleration trend in inflation continued in December, and monthly inflation stood below expectations. Our end year key rate prediction remains at 30.0% for 2025, and we feel Mth/Mth inflation readings in 2025 will be closely followed as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.

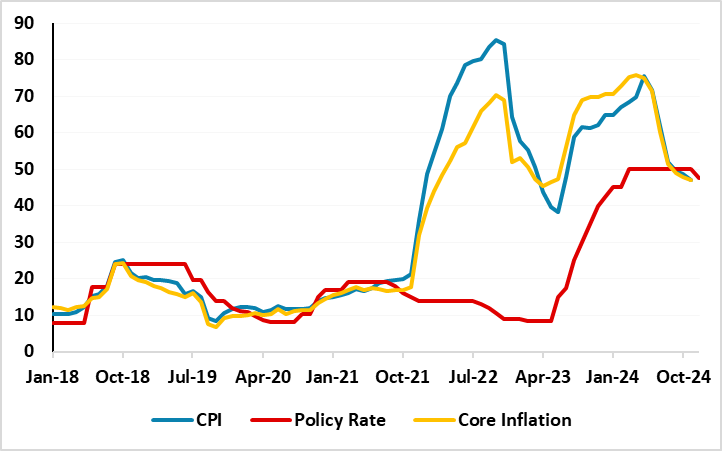

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – December 2024

Source: Continuum Economics

After the deceleration trend in inflation continued in December with 44.4% y/y, supported by moderate slowdown in domestic demand and relative TRY stability; -posting the seventh consecutive decline since June 2024 and almost matching the CBRT’s year-end prediction-, we believe this print has left with some room of choice for the CBRT during the next MPC meeting scheduled for January 23. (Note: CPI cooled off to 44.4% y/y in December from 47.1% in November as inflation figures came out better than expected. More importantly, MoM inflation rose by 1.03% in December as monthly inflation stood below expectations while forecasts in surveys ranged between 1.4% and 1.8%).

Speaking about the CBRT’s prospective rate cuts, president Erdogan said on December 28 that interest rates will fall in 2025 as he reiterated his unconventional belief that lowering interest rates will slow down price increases. "We will definitely start lowering interest rates. 2025 will be the mark year for this. Interest rates will come down so that inflation will also come down. This is a must for us," Erdogan added.

Receiving the green light from Erdogan, the easing cycle already began on December 26 MPC meeting. We now expect CBRT to remain cautious about prospective cuts in 2025 as it would have to monitor inflation closely before interest rate cut decisions, as we envisage upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts could lead average inflation to stand at 31.9% and 20% in 2025 and 2026, respectively. (Note: CBRT governor Karahan recently underscored that YoY inflation will fall to 21% by the end of 2025, though some Turkish businesses and households doubt it will come down that quickly. The government predicts the rate will drop even more in that period, to 17.5%).

Our end year key rate prediction remains at 30.0% for 2025, and we feel Mth/Mth inflation readings will be key in 2025 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization. As noted, we feel CBRT will have to proceed carefully on interest-rate adjustments given domestic inflationary risks and unpredictable outlook for the global economy. We think CBRT will likely set policy prudently on a meeting-by-meeting basis with a focus on responding to any expected significant and persistent deterioration as any upward movement in inflation could lead to a pause in interest rate reductions.