CBRT Remains Cautious Holding Key Rate at 50% Despite Recent Fall in Inflation

Bottom Line: Central Bank of Turkiye (CBRT) recently released its summary of the Monetary Policy Committee (MPC) meeting after keeping the policy rate stable at 50% on August 20. CBRT said in its summary that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and reiterated that it remains highly attentive to inflation risks. After consumer price index (CPI) cooled down to 61.8% y/y in July from 71.6% in June due to favourable base effects and lagged impacts of tightening cycle, we foresee the falling trend will continue in August while the policy rate will be held unchanged at 50% in the next MPC meeting scheduled for September 19.

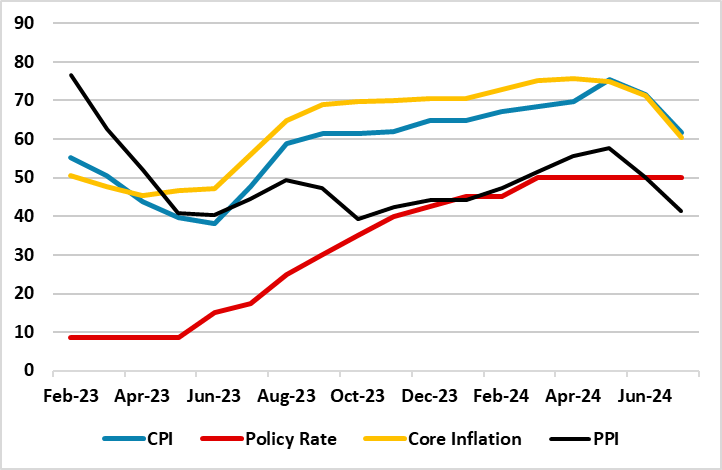

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – July 2024

Source: Continuum Economics

As widely expected, the CBRT decided to hold the key rate stable at 50% on August 20 MPC meeting remaining cautious about inflationary pressures despite relative easing in CPI figures in July.

According to the Bank’s summary of the MPC meeting released on August 27, CBRT decided to keep the policy rate unchanged considering the lagged effects of the monetary tightening, but reiterated that it remains highly attentive to inflation risks. The summary also highlighted that the tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen.

CBRT noted that the despite goods inflation is declining, improvement in services inflation is expected to lag as the high level of and the stickiness in services inflation, inflation expectations, and geopolitical developments keep inflationary risks alive.

Concerning the course of inflation, it appears CBRT remains hopeful that the falling trend will continue in the upcoming months. Monthly inflation is expected to slow down in August compared to the previous month, led by the low course of food prices. CBRT underlined that despite the fall in fuel prices, monthly energy inflation will remain high due to the adjustment in natural gas tariffs for households in July. According to CBRT, leading indicators suggest that price increases will be on the fall thanks to the recent mild course of exchange rates and domestic demand developments.

According to the results of the Survey of Market Participants in August, inflation expectations for the current year-end and the end of the next year edged up by 0.3 and 0.2 ppt to 43.3% and 25.6%, respectively, despite CBRT’s official end-year forecast remained at 38%. We continue to think that it would be very hard to achieve this figure by the end of 2024 as our forecast for the annual average inflation remains at 58.8% and 35.3% in 2024 and 2025, respectively.

As CPI softened in July triggered by favourable base effects and relative TRY stability, we foresee that favourable base effects will continue to dominate the inflation outlook in Q3, but the extent of the decline will be determined by administrative price adjustments. In spite of aggressive monetary tightening, we think buoyant domestic demand, stickiness in services inflation, deterioration in pricing behaviour, and inflation expectations will continue to put pressure on the general level of prices in the rest of Q3 and Q4. Taking this into account, we foresee CBRT to hold the key rate constant at 50% through the end of 2024 unless a major fall recorded in CPI, which is not our baseline scenario.