CBRT Kept Key Rate Unchanged at 50%

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on April 25 despite galloping inflation, and pressure on FX lately. According to the CBRT statement, monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen. Last week, CBRT Governor Karahan also told that the rate-hiking cycle is over and inflation is on track to reach its 36% target by the end of the year. We feel upside risks to inflation outlook remain strong in H1 2024, but we expect a fall in the inflation after June 2024, particularly due to favourable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps. Our projection is that policy rate will be held at 50% in the next MPC meeting, which is scheduled for May 23, as soon as the inflation shows a significant uptick in April and pace of Turkish Lira (TRY) depreciation would reaccelerate.

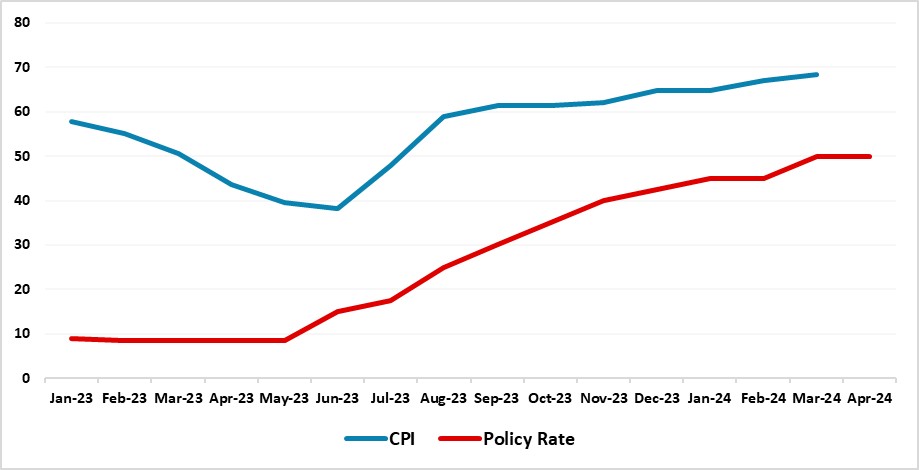

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2023 – April 2024

Source: Continuum Economics

The CBRT decided to hold the key rate stable at 50% on April 25 MPC meeting despite annual inflation swung to a 16-month high (68.5% YoY) in March due to increases in food and education prices, coupled with the lingering impacts of the minimum wage hike on the services sector, as the pressure on FX continues.

According to the Bank’s assessment on April 25 regarding higher-than-expected underlying monthly inflation trend; high level of and the stickiness in services inflation, inflation expectations, geopolitical risks, and food prices remained the key drivers of inflation. The Bank reiterated that monetary policy stance will be tightened in case a significant and persistent deterioration in inflation outlook is foreseen, and the lagged effects of the monetary tightness on financial and economic conditions will be closely monitored in the upcoming period. "While imports of consumption goods and gold contribute to the improvement in the current account balance, other recent indicators imply that domestic demand remains resilient," the MPC statement added.

CBRT also pledged to use extra macro-prudential moves in case of unanticipated developments in credit growth and deposit rates. (Note: To fight against the galloping inflation, CBRT started to implement additional quantitative and macro-prudential tightening steps since the February MPC to strengthen the monetary transmission mechanism but apparently the measures were not fully helpful putting out the inflationary fire, and decelerate TRY depreciation in March).

It appears the fight against the inflation remain one of the top agenda items for the government. Earlier this week, Treasury and Finance Minister Simsek conveyed the expectations that a decrease in inflation would begin in the coming months, and said "We will rapidly observe its decline starting from June." Last week, CBRT Governor Karahan told that the rate-hiking cycle is over and inflation is on track to reach its 36% target by the end of the year. The bank foresees inflation softening to 14% in 2025 and falling to single digits in 2026.

Despite positive remarks by the officials, we still see upside risks to the inflation outlook, especially in the rest of H1 2024. We think hikes in wages, high domestic demand, deterioration in pricing behaviour, weakening currency, strong inflation expectations and surges in public spending during the local elections continue to ignite general level of prices. Our projection is that policy rate will be held at 50% in the next MPC meeting, which is scheduled for May 23, as soon as the inflation shows a significant uptick in April and pace of TRY depreciation would reaccelerate. We continue to foresee a relative slowdown in the inflation trajectory in the second half of 2024, particularly due to favourable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps.