CBR Hiked Key Rate to Historic 21% Level

Bottom Line: Central Bank of Russia (CBR) announced on October 25 that it increased its policy rate by 200 bps to 21% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press release that “Over the medium-term horizon, the balance of inflation risks is still significantly tilted to the upside,” and the regulator revised its inflation and key rate predictions significantly for 2024 and 2025. CBR now sees inflation returning to its goal in 2026 rather than 2025.

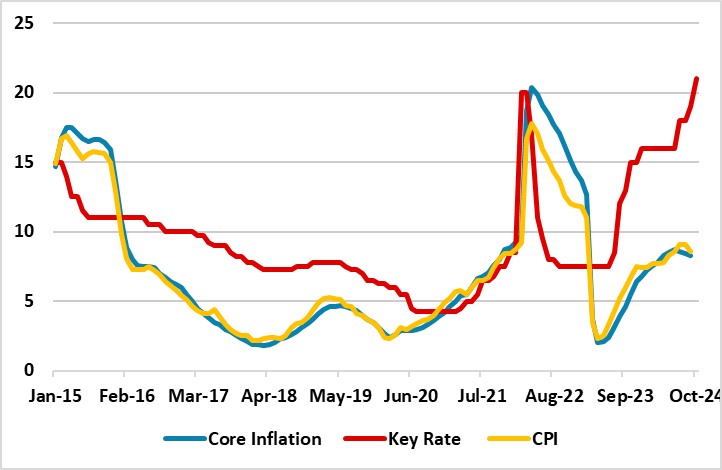

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2024

Source: Continuum Economics

On October 25 MPC meeting, CBR decided to lift the policy rate by 200 bps to 21% given inflationary risks and its hawkish forward guidance, bringing the cost of borrowing even higher than the emergency rate initially introduced after Ukraine-Russia war started. The new interest rate is the highest in Russia since the breakup of the Soviet Union in 1991.

CBR highlighted in its press statement that the growth in domestic demand is still significantly outstripping the capabilities to expand the supply of goods and services and inflation expectations continue to increase as CPI is running considerably above the Bank of Russia’s July forecast. (Note: CPI continued to stay high at 8.6% YoY in September. MoM price growth fastened to 0.5% in September from 0.2% in August driven by the food and services prices, which surged by 9.2% and 11.6% in annual terms, respectively). We think domestic demand, boosted by lending, rising wages and increased budget spending, continue to outrun production capacity. Sources emphasize that factories are largely running at full speed, in many cases to produce items that the military can use such as vehicles and clothing.

CBR revised its annual inflation predictions significantly for 2024 and 2025 as well. According to the announcement, CBR lifted its 2024 inflation forecast range from 6.5%–7.0% to 8%-8.5%, and hiked the range from 4%-4.5% to 4.5%-5% for 2025. Additionally, average key rate prediction for 2024 is now 17.5%, slightly higher than previous range of 16.9%-17.4%. 2025 average policy rate prediction has been raised from 14%-16% to 17%-20%. Raising its projections, CBR warned that “a return of inflation to the target will require a much higher medium-term key rate path than forecast in July.” The regulator now sees inflation returning to its goal in 2026 rather than 2025.

On another note, the RUB weakness remains as a major concern over the inflation trajectory as RUB weakened by around 20% against the dollar in 2023, and lost 4.6% of its value just in September. (Note: RUB further weakened on October 10, remaining at its lowest against the USD since October 2023 at 97.4 and hovering around 96.5 as of October 25). We expect RUB would remain weak and volatile the rest of 2024 since the sanctions hurt, and the weakness of the currency will likely continue to adversely impact inflationary expectations and pressures.

It is also worth noting that inflation expectations continue to deteriorate, reaching 13.4% in October from 12.5% in the previous month, showing concerns over the inflationary trend.

As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up. We also see the higher market rates had not yet fully affected the lending dynamics as activity in the corporate segment of the credit market remain high. The labor market remains tight as the unemployment hit record-low figure of 2.4% in mid-2024. We feel the risks to the outlook remain upside as the fiscal policy is making a big contribution to domestic demand coupled with continued military spending due to ongoing war in Ukraine, and costly operations in Kursk oblast against Ukraine’s surprising cross border incursion.

CBR will likely have hard times in Q4 2024 and H1 2025 until inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. Given inflationary risks and CBR’s hawkish forward guidance, we think it will not be surprising if CBR will decide to hike the key rate to 22%-23% during the MPC scheduled on December 20 due to elevated inflation, weakening RUB and worsening expectations.