EMEA Outlook: Stubborn Inflation Dominates

· In Turkiye, we expect Central Bank of Republic of Turkiye (CBRT) will likely halt the key rate at 50% until the end of 2024, which is our baseline scenario. We expect a fall in inflation likely after July due to favorable base effects, additional macro prudential measures, public savings package and tighter fiscal policies. We still foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation would cause 2024 average inflation to stand at 58.8% as monetary tightening is still feeding through. On the growth front, we expect the economy to expand by 3.3% in 2024 and 3.2% in 2025, as galloping inflation and tighter fiscal stance continue to dent GDP growth.

· In South Africa, the recent elections have created a coalition government (ANC-DA-IFP-PA-GOOD) for the first time in country’s history, which will likely be weaker than a one-party government for some time. This coalition will likely be less able to undertake necessary fiscal reform policies abruptly and deal with power cuts (load shedding). We foresee headline inflation will fall to 5.1% and 4.7% in 2024 and 2025, respectively, thanks to South Africa Reserve Bank’s (SARB) sensitivity to inflation and as power cuts (load shedding) are relieved, particularly between April and June. We feel SARB will likely start cutting interest rates in Q4, though a risk exists that it could be further delayed to Q1 2025 due to sticky inflation. We see better growth of 0.9% and 1.4% in 2024 and 2025, respectively, particularly if the new coalition can address the logistical constraints, financing needs, and corruption.

· In Russia, the war in Ukraine continues to create an increasing financial burden on Russia due to high military spending in addition to aggravation of staff shortages. Russian forces started their larger summer offensive operation in Ukraine aiming to seize more territory before the U.S. presidential elections in November, as Putin hopes that Donald Trump is elected U.S. president and threatens to curtail Ukraine funding thus forcing and end to the war. Our inflation projections stay high as May’s 8.3% YoY inflation remained far above the CBR’s 2024 forecast range of 4% - 4.5%. We foresee Central Bank of Russia (CBR) will likely hike the rate in Q3 to 17% due to surge in inflation, increase in cost of borrowing and new set of sanctions on June 13. We envisage annual average inflation to record 6.9% in 2024.

Forecast changes: From our March outlook, we have increased the 2024 GDP forecast for Russia due to continued strong military spending, and invigorated consumer demand. We also foresee South Africa will start cutting policy rate in Q4, not in Q3, since inflation stays far from the 4.5% mid target point.

Our Forecasts

Source: Continuum Economics

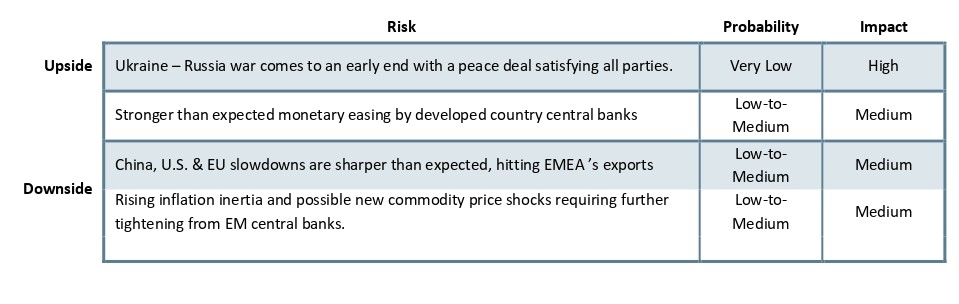

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflation Still High, Fiscal Problems Continue

EMEA economies continue to be squeezed by macroeconomic problems such as stubborn inflation and financial pressures. We think country specific factors, geopolitics, China slowdown, global trade worsening, and pace of the rate cuts by the DM economies will rule the EMEA outlook in H2 2024.

Inflation remains the major concern for EMEA as they stay above the targets in all major EMEA countries despite restrictive monetary tightening cycles still feeding through. EMEA countries halted the tightening cycles, and are waiting the right time to start cutting rates which would depend on inflationary pressures. Turkiye lifted the policy rate to 50% in March, and we think the policy rate will be kept stable until the end of 2024, if inflation would not necessitate further rate hikes.

In the meantime, we think slowdown in the U.S. and China, slow European recovery and different signals concerning DM rate cuts continue to risk greater uncertainty over the EMEA medium-term prospects. We continue to forecast that fiscal positions deteriorate during the rest of 2024, contributing both to the GDP and inflation prospects.

EM FX outlook projections are dominated by domestic fundamentals. ECB easing in June and Fed’s likely easing in September could help EMFX more broadly and allow slower declines or recovery in spot rates. We think particularly South Africa can use it as an opportunity to cut rates or build FX reserves. Turkish lira (TRY) has been the best-performing carry trade in emerging markets over the in H1 and investors buy TRY forwards as higher summer tourism revenues, positive current account seasonality and tight monetary conditions will likely boost the country’s finances. TRY is expected to lose value in H2 given strong inflation differentials.

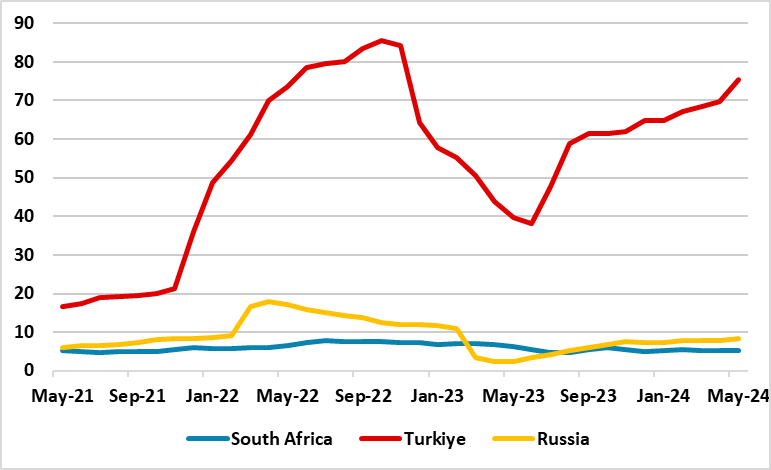

Figure 1: South Africa, Russia and Turkiye Inflation (%, YoY), May 2021 – May 2024

Source: Continuum Economics, Datastream

South Africa

The most significant development for South Africa in Q2 was the elections on May 29. After African National Congress (ANC) lost the majority at the National Congress for first time on 40% of the vote, and formed a coalition government with the main opposition Democratic Alliance (DA) called the government of national unity (GNU) with the ANC-lead on June 14, along with three smaller opposition parties, Inkatha Freedom Party (IFP), Patriotic Alliance (PA) and GOOD. Lawmakers voted to put former president Ramaphosa back in office for his second term. (Note: Ramaphosa vowed on June 19 as the new president and is expected to appoint a cabinet soon). ANC-DA coalition is a relief for the business community and investors, though foreign policy, land reform, ANC’s black empowerment program, and the National Health Insurance could become clashing points to threaten the coalition’s stability.

According to draft coalition deal, rapid, inclusive and sustainable economic growth was listed as a top priority while other priorities include land reform, job creation, infrastructure development, structural reforms, transformational change, and fiscal sustainability. The coalition is expected to follow a more liberal framework, with a strong focus on private sector based on labour market to create jobs, inspire entrepreneurship, get tough on crime. We foresee the coalition government backed by DA would likely push for some fiscal tightening in the budget for the current 2024/5 year in July given limited fiscal space. We envisage the coalition will be weaker at least for some time, and less able to undertake necessary fiscal reform policies abruptly and deal with power cuts (load shedding) in the near future, since the focus will be on shaping the new cabinet and finalizing power sharing.

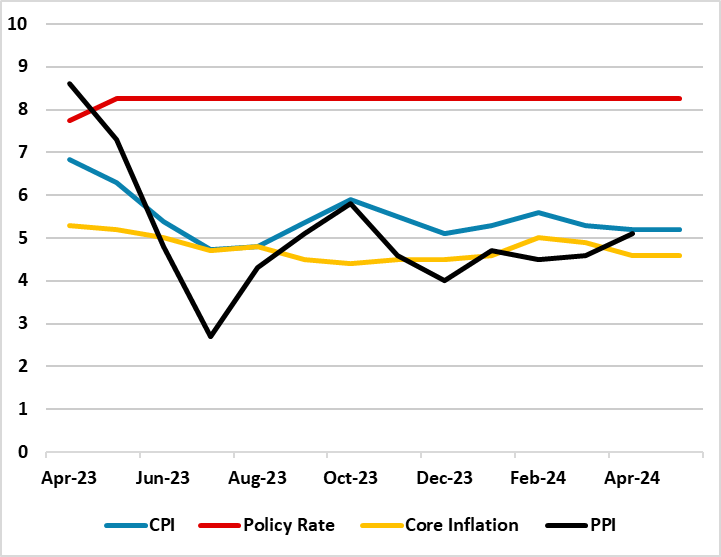

Our headline inflation forecast for 2024 is at 5.1%, before declining to 4.7% in 2025 due to the lagged impacts of SARB’s previous tightening, and partly relieved power cuts (load shedding). Despite these, risks to the inflation outlook are still assessed to the upside as acceleration in fuel and electricity prices continue to present inflationary risks, along with logistical constraints and political uncertainties.

There was some good news from the load shedding front in April and May supporting the inflation softening process. After Stages 2 and 3 load shedding was implemented broadly in March, Eskom announced on June 14 that that load shedding remained suspended for 79 consecutive days, reflecting an improvement in the reliability and stability of the generation coal fleet. (Note: This period of stability is the longest since the stretch from July 23, 2021, to October 6, 2021). As indicated in the March outlook, the country had targeted lifting the share of renewable energy in its power generation mix from 11% currently to 41% by 2030, and we think both private and government investments may accelerate in 2024 and 2025, despite major reforms having to wait the coalition government’s determination in dealing with load shedding.

SARB continues to keep the key rate constant at a 15-year high of 8.25% as of 2024 and strong tightening in 2023 is still feeding through with lagged impacts. We think the recent increase in the inflation figures, particularly inflation jumping from 5.2% in April 2024 to 5.4% YoY in May 2024 due to higher housing & utilities, food and transport prices will likely cause SARB to act cautiously. SARB will be wary of potential risks to the outlook as inflation remaining within SARB’s target of between 3% and 6%; but still far from the 4.5% midpoint. Taking into account that SARB governor Kganyago indicated on May 30 that SARB’s fight to quash inflation is not yet done remaining concerned that inflation expectations are elevated, we feel rate cuts could be delayed to Q4 or Q1 2025. Our end year prediction is 8.0% for 2024 end-year policy rate (i.e one 25bps cut in Q4), and 7.0% for 2025.

On the growth end, we assess the economy will grow by 0.9% in 2024, -lower than our previous prediction of 1.2% in March outlook- due to negative Q1 GDP growth, which was down 0.1%, as weaker manufacturing, mining and construction drove much of the downward momentum on the economy. The growth figures will depend on how the coalition will work in H2 2024 and if the country will be able address the electricity shortages, logistical constraints, and financing needs. We also think there are downside risks to growth; as households continue struggling with finding spare funds in an environment of high interest rates, and businesses facing a tough domestic environment including high lending rates and high costs of doing business. This situation could be reversed somewhat after SARB starts cutting the policy rate, and lending rates would likely be coming down.

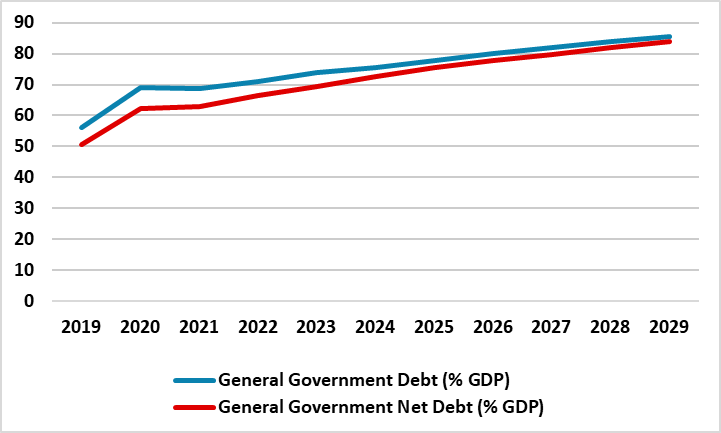

On the fiscal trajectory front, public finances weakened in 2023 and the country still has need for large domestic and international financing as fiscal positions are weak due to high government debt, rising debt-service costs, and financial sector exposure to sovereign debt. Compared to a year ago, the budget deficit for 2023/24 in South Africa is estimated to worsen from 4% to 4.9% of GDP.

SARB’s Financial Stability Report (FSR), which was published on June 3, demonstrated that South Africa’s debt-to-GDP ratio of 73.7% is well above the EM average of 58.9% (Figure 3). In addition, SARB noted risks to the fiscal outlook, underscoring that the fiscal position has steadily deteriorated over the last decade, with growth in debt-service costs and the stock of sovereign debt accelerating following the pandemic and inflation shocks. We think the government fiscal balance and debt trajectory remain cloudy as fiscal room remains limited to fund structural reforms, productive investments, social spending needs and renewable energy efforts. The coalition’s determination will be key to fight against fiscal problems.

Figure 2: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – May 2024

Source: Continuum Economics, Datastream

Figure 3: General Government (Net) Debt (% of GDP), 2019-2029

Source: IMF’s Fiscal Monitor (April 2024)

Turkiye

To start with the political front, local elections were held on March 31. Despite Justice and Development Party’s (AKP) main target was to win back the major cities such as Istanbul, Ankara and Izmir, all major cities would remain administered by Republican People’s Party (CHP) mayors. CHP became the first party in the elections and won more local municipalities than any other parties in Turkiye while AKP lost an election for the first time in the last 22 years. The increase in the total votes to New Welfare Party (YRP), and Peoples’ Equality and Democracy Party (DEM) were remarkable since the growing support to YRP likely dented support to AKP.

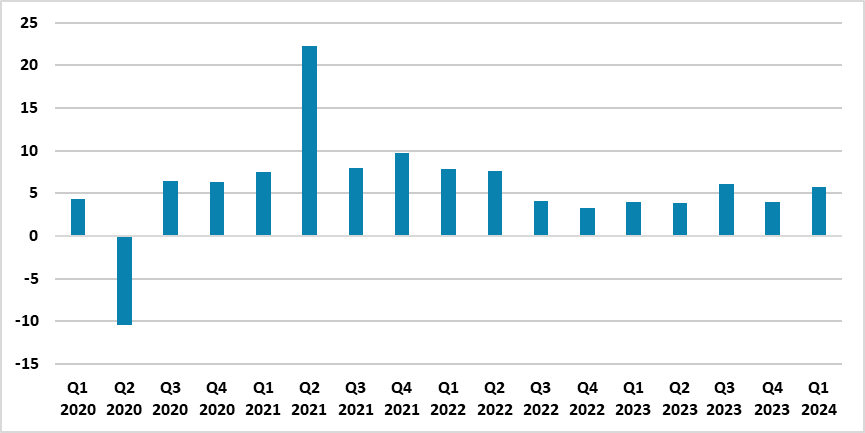

On the growth front, Turkish economy expanded by a strong 5.7% in Q1 backed up by buoyant demand, robust investment, a positive contribution from net exports and government spending before the local elections (Figure 5) One reason why household consumption surged substantially in Q1 was the government took measures such as increasing the minimum wage by 50% to counterbalance the expensive cost of living, and households decided to bring purchases forward consumption in expectation of higher inflation.

Despite strong growth in Q1, we envisage GDP growth will stand at 3.3% in 2024 and 3.2% in 2025 since we feel the pace of the GDP growth will decelerate in H2 2024 due to the lagged effects of CBRT’s tightening, slowing real wage growth, tighter fiscal actions targeting to slow down demand and lending, coupled with likely reduction in government spending thanks to public savings package. There is still a downside risk that growth can be lower than expected, particularly considering all tightening measures in place. Turkiye government unveiled a public savings package on May 13 to support the disinflation process by promoting savings and exercising expenditure control in the entire public sector, which is based on three main pillars. Savings in the public sector, disciplined spending in the budget, and enhanced efficiency in public investments, suspending new vehicle purchases, personnel recruitment and rentals for three years. We are of the view that household spending will likely decrease in H2 of 2024 if the government will not increase minimum wage and pensions in July, as it was previously announced, while possible hikes in the minimum wage and premium payments to retirees could complicate inflation outlook.

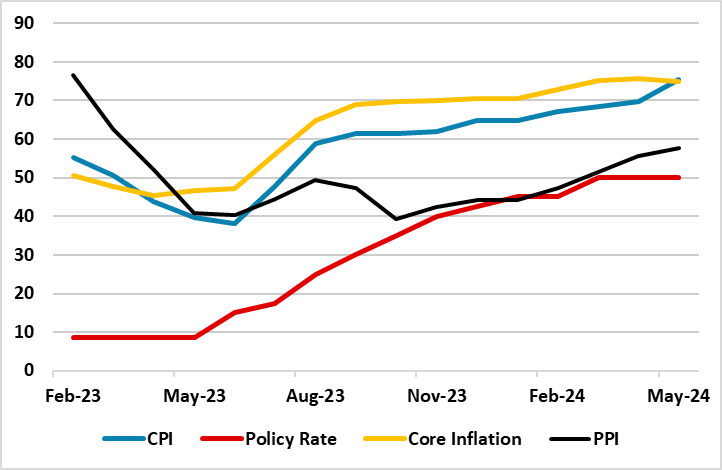

Inflation remains the core economic problem. Our forecast for the annual average inflation is 58.8% and 35.3% in 2024 and 2025, respectively. Firstly, we think CPI will start declining after June partly due to favorable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps, and tighter fiscal stance. The disinflationary process can be supported by promoting savings and exercising expenditure control in the public sector, as mentioned above. CPI will likely remain considerably high than 30% until the end of 2025 as the measures to contain inflation have lagged impacts. (Note: CBRT released the second quarterly inflation report of the year on May 9, and lifted end-year inflation prediction from 36% to 38%). We anticipate strong demand, the stickiness in services inflation, deteriorated pricing behavior, and geopolitical risks keep inflation pressures alive in H2 2024. (Note: Turkish CPI surged to 69.8% annually and 3.2% monthly in May due to increases in hotel, education and food prices. See Figure 4).

Given forward guidance by the CBRT with disinflation beginning in H2 2024, and macroeconomic stability forecast beginning in 2025, we are of the view that CBRT has shown determination by hiking the rate from 8.5% to 50% as of Q1. CBRT governor Karahan repeatedly stressed that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. The most important part of the story is the Central Bank continues to regain credibility as it strongly signals determination in pursuing traditional economic policies until the inflation is under better control, which continue to attract foreign investments, but restoring full-confidence will take time. Despite inflation readings could put further pressure on CBRT to resume tightening cycle in the upcoming months, we foresee CBRT to hold the key rate constant at 50% through the end of 2024.

Despite increasing geopolitical risks and volatile global energy prices may limit the slowdown in imports which could put further pressure on Turkish current account deficit (CAD) in H2, we think slowing domestic demand thanks to aggressive monetary tightening, coupled with strong services trade balance and tourism revenues likely heal CAD in H2 2024, and help Turkiye’s balance of payments account. We predict continued inflows from abroad as long as high inflation expectations delay interest rate cuts, stop and then a slow to moderate autumn decline in the TRY (to avoid excessive real appreciation). We anticipate the USD/TRY rate at 35.5 by the end of 2024.

On the capital account, recent data showed a slow paced re-acceleration of inflows due to the increasing appetite for Turkish assets from foreign investors thanks to CBRT’s signals on the continuation of tight monetary and fiscal policies.

Figure 4: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – May 2024

Source: Continuum Economics

Figure 5: GDP Growth (%), Q1 2020 – Q1 2024

Source: Continuum Economics

Russia

The Ukraine war continues to create an increasing financial burden on Russia due to high military spending in addition to aggravation of staff shortages. The offensives at the front lines started to pick up steam after April/May as the Russian forces started their larger summer 2024 offensive operation, particularly in Donetsk and Kharkiv, aiming to seize more territory before the U.S. presidential elections in November. Despite U.S. approving a $61 billion wartime aid package for Ukraine late April, military analysts consider that it would probably be summer at best, and year’s end at worst, before Ukraine can stabilize its front lines with the infusion of aid.

We still think the fate of the war will be determined by the U.S. presidential election as Putin continues to hope that Trump is reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal with current territories, likely in 2025. Europe would likely step up military support if a president Trump curtails support, but it would likely be modest given disagreements within the EU. If Biden is elected U.S. president, the war will likely remain a stalemate for a longer time without a peace deal. We continue to foresee macroeconomic instability for Russia to remain substantial in 2024 and in 2025, particularly if the Ukraine war would continue, as the inflation is spiking, fiscal deficit is widening and ruble (RUB) is under pressure.

On the growth front, the Russian economy expanded by a strong 3.6% YoY in 2023, and 5.4% in Q1 despite the cloudy macro outlook. The main driver for the GDP growth remain the surge in military spending, supported by the improved consumer demand amid greater outlays on social support, higher wages and strong fiscal stimulus. Despite Q1 growth reading, we anticipate a partial slowdown in GDP growth in the rest of 2024 (+2.5% YoY) and in 2025 (+1.2% YoY). From our March outlook, we have increased our 2024 GDP forecast from 1.9% to 2.5% driven in part by a significant increase in military spending due to likely intensified Russian offensive operations in Ukraine this summer, oil export volumes holding steady and surges in corporate investment and private consumption. (Note: CBR also upgraded its outlook on GDP growth for 2024 to 2.5-3.5%, when compared to previous predictions of 1-2%).

As emphasized, demand and lending continue to remain buoyant despite restrictive monetary tightening. According to CBR’s Monetary Conditions and Monetary Policy Transmission Mechanism report published in May, corporate lending remained strong in April as the annual growth in the portfolio of corporate loans was 20.4% in April. High consumer activity, positive consumer sentiment, and subsidized lending programs were still factors supporting great consumer demand for loans. The growth rate of the portfolio of unsecured consumer and car loans remained high and volumes of new subsidized mortgage loans were still large.

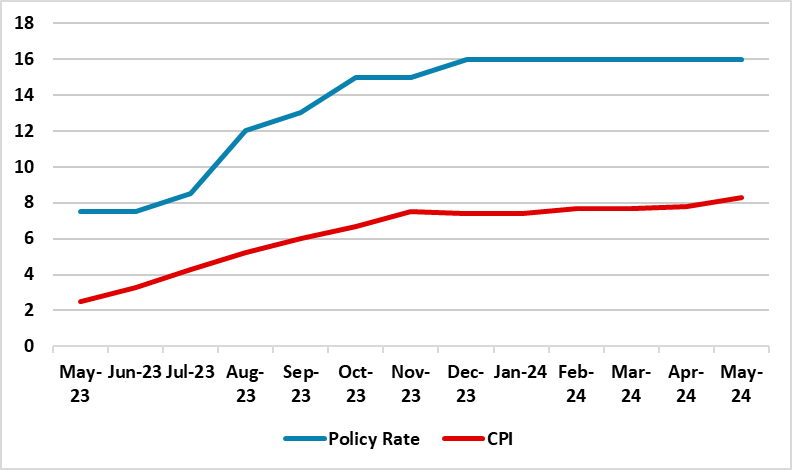

Inflation, which started to surge particularly after June last year, continues to stay higher than the government’s projections. Inflation is far above the CBR’s 2024 forecast range of 4%-4.5%, and CBR’s medium term target of 4%, as May inflation stood at 8.3% YoY. We think the inflationary risks remain acute basically due to high military spending, strong fiscal policy, lagged feedthrough of the weak RUB and tight labor market. We predict annual average inflation to stand at 6.9% in 2024.

Given the risks, CBR Governor Elvira Nabiullina stated in early June that there is a possibility of a significant rate hike in July if inflationary pressures don’t start to ease. We foresee CBR will likely hike the rate in Q3 to 17% due to surge in inflation, increase in cost of borrowing, new set of sanctions, and buoyant domestic demand. (Note: There is a continuing increase in OFZ yields (federal government bonds) as well. Ministry of Finance was placing its 10 year bonds at 13.8% at the first auction after May holidays, but cancelled due to low demand and on May 22, Ministry of Finance placed the 10 year OFZ with 14.3% yields). We think CBR will likely start considering cutting rates in Q4 if inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. However, this will not be very straightforward given Ukraine war continues to dominate Russia economic outlook. Our end-year key rate forecast is 16% and 10% end 2025.

In addition to the war in Ukraine overheating the economy, the new set of sanctions by the U.S. Treasury Department targeting the country’s financial system on June 13, has prompted the Moscow exchange to halt trading of dollars and euros, which would likely ignite the cost of doing business and further stoke inflation. (Note: According to Russian newspaper Kommersant, some Russian banks and exchange offices raised rates as high as 200 rubles to the dollar while the rate set on the Moscow Exchange was just under 90 rubles to the dollar on June 12). The CBR said it would set daily dollar and euro exchange rates based on aggregated data from commercial bank purchases and sales, and fixed official rate at 84 rubles to the dollar on June 19.

We continue to foresee a rise in the budget deficit in 2024. Military analysts assert that Russian spending on defense will rise to around 6% of GDP in 2024 while it was 3.9% of GDP in 2023. (Note: According to official information, Russia spends 29% of all public expenditures on defense, while the NATO average is only 4.3%). We think this figure would be probably larger when considering the reconstruction expenditures in occupied parts of Ukraine, coupled with larger offensive operation ongoing in Ukraine.

Figure 6: Annual Growth Corporate and Retail Loans (%), 2018 - 2024

Source: CBR

Figure 7: Policy Rate (%) and CPI (YoY, % Change), May 2023 – May 2024

Source: Continuum Economics, Datastream