First Cut Since 2023: CBRT Lowered Key Rate to 47.5%

Bottom Line: Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26 which was the first rate cut in around two years, but said it would remain cautious about future cuts. In its press release, CBRT cited a flat underlying trend of inflation in November and suggesting leading indicators pointed to a decline in December, despite inflation remains over CBRT forecasts. Our end year key rate prediction is at 30.0% for 2025, and we think Mth/Mth inflation readings will be key in 2025 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.

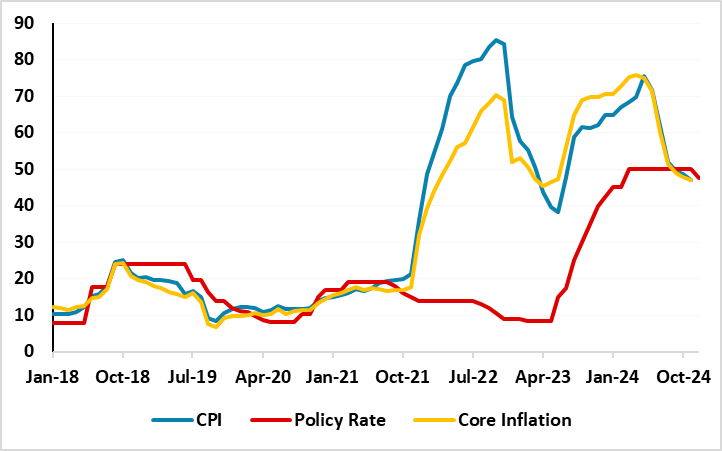

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – December 2024

Source: Continuum Economics

The CBRT decided to lower interest rate by 250 bps to 47.5% on December 26 MPC meeting, which was the first rate cut in around two years. According to the Bank’s assessment on December 26, "The underlying trend of inflation was essentially flat in November. Leading indicators point to a decline in the underlying trend in December and suggest that domestic demand, standing at disinflationary levels, continues to slow down." CBRT added that it would remain cautious about future cuts.

As the easing cycle began, CBRT also emphasized that it will set policy prudently on a meeting-by-meeting basis with a focus on the inflation outlook, and respond to any expected significant and persistent deterioration.

It appears businesses and government officials welcomed CBRT’s cut decision. The president of the Turkish Exporters Assembly (TIM), Mustafa Gultepe, said he hopes for further easing in parallel with the slowdown in inflation.

Taking into account that the inflation deceleration slowed down in Q4 and higher-than-forecast inflation prints blurred the policy outlook, CBRT’s move could be regarded as a partly surprising decision as inflation continues to hover over CBRT’s forecasts and MoM CPI remains elevated. (Note: CPI cooled off to 47.1% y/y in November from 48.6% in October, but slower less-than-expected since food prices and housing costs continued to build. MoM inflation rose by 2.24% in November as monthly inflation stood at slightly above expectations).

The MPC decision came just a day after the announcement of the minimum wage increase for 2025. A lower-than-expected 30% hike in minimum wage brought net monthly pay to 22,104 TRY (USD 627), which will likely exert some upward pressure on prices in coming months.

Additionally, CBRT announced its 2025 road map for “Monetary Policy” on December 25, covering key aspects of its policies and communication strategy for 2025. CBRT highlighted that it plans to end the foreign exchange-protected Turkish lira deposit scheme (KKM) in 2025 as it continues to simplify the macroprudential framework. CBRT also announced that it reduced the number of MPC meetings to eight in 2025 from the current 12, hinting at a higher size of rate cuts per meeting.

As we highlighted in December outlook, we think upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts lead our average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively, despite the CBRT expects inflation to fall to 21% by end-2025. We envisage the inflation outlook in 2025 will be shaped by administrative prices, TRY volatility and tax adjustments.

Our end year key rate prediction is at 30.0% for 2025, and we feel Mth/Mth inflation readings will be key in 2025 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.