CBR Kept the Key Rate Stable at 16%

Bottom Line: As widely expected, Central Bank of Russia (CBR) announced on April 26 that it decided to keep the policy rate unchanged at 16% for the third meeting in a row. CBR made critical changes in its key rate and inflation forecasts as it lifted its 2024 inflation forecast to 4.3-4.8% from 4-4.5% previously, and increased its key rate prediction from 13.5-15.5% to 15-16% for 2024. We continue to think stubborn price pressures remain strong due to high military spending, currency weakening, tight labour market, fiscal policy igniting domestic demand coupled with high lending activities. Despite inflationary risks, we expect the CBR to hold the key rate stable at 16% at the next policy rate meeting on June 7.

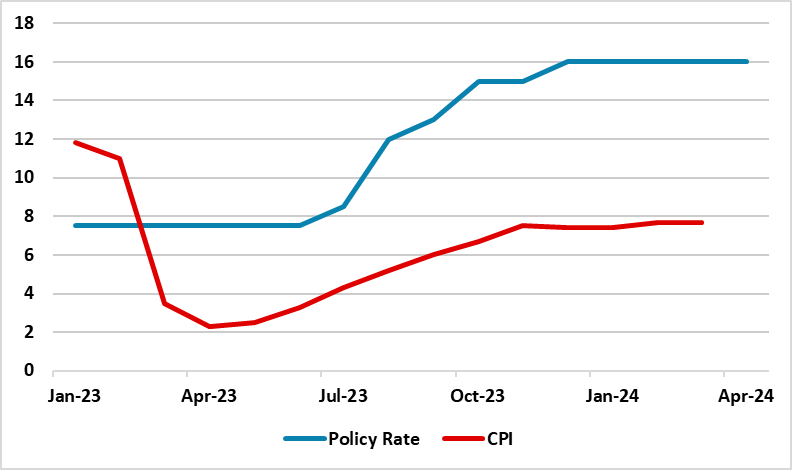

Figure 1: Policy Rate (%) and CPI (YoY, % Change), January 2023 – April 2024

Source: Continuum Economics

On April 26 MPC meeting, CBR decided to halt the policy rate at 16% although March’s 7.7% YoY inflation remained far above the CBR’s 2024 forecast range and CBR’s medium term target. CBR acknowledged that inflation would return to its 4% target more slowly than previously forecasted, and it may struggle to reach its 4% target this year mainly due to elevated domestic demand and strained supply capabilities.

CBR also highlighted in its statement on April 26 that current inflationary pressures are gradually easing, but remain high. Consumer activity is still high amid a significant increase in households’ incomes and positive consumer sentiment while labour shortages come as the key constraint on the expansion of output of goods and services leading to increasing labour market tightness. CBR added that the main proinflationary risks are associated with changes in terms of trade (including as a result of geopolitical tensions), persistently high inflation expectations, higher upward deviation of the Russian economy from a balanced growth path, as well as with a fiscal policy normalization path.

As CBR highlighted, we think inflation risks is still tilted to the upside as inflationary pressures and inflation expectations remain high. The domestic demand continues to be stronger than the production of goods and services coupled with labor deficit. The military spending remains high due to ongoing war in Ukraine. Fiscal policy continues to ignite domestic demand coupled with high lending activities. Additionally, the Ruble’s (RUB) weakness continues to cause concerns over the inflation trajectory as RUB weakened by around 1% of its value in March.

It is worth mentioning that CBR made to critical changes in its key rate and inflation forecasts. The bank lifted its 2024 inflation forecast to 4.3-4.8% from 4-4.5% previously, and envisaged that annual inflation will soften to 4% in 2025. CBR also raised its forecast for the average key rate in 2024 and 2025 to 15.0–16.0% and 10.0–12.0%, respectively. (Note: CBR’s previous key rate prediction for 2024 was 13.5-15.5%).

We continue to foresee demand and imports will be partly squeezed particularly in 2H of 2024, but only gradually with lagged effects. We feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations particularly in 1H of 2024, partly due to base effects, weakening RUB, tight labor market and high military spending. The risks to the outlook are even stronger as military analysts foresee Russian offensive operations in Ukraine will likely intensify in the upcoming months, probably late May or June.

In this framework, we do not expect any rate cuts in Q2, and we predict that CBR will likely consider cutting rates in late Q3/Q4, if the inflation trajectory allows. This is in line with CBR’s predictions, which explicitly mentioned in its statement that “tight monetary conditions will be maintained in the economy for a longer period than previously forecast”.