Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to quash inflation is not yet done. We feel SARB will likely start cutting interest rates in Q3 2024, but the pace will vary depending on how soon inflation will approach to target levels.

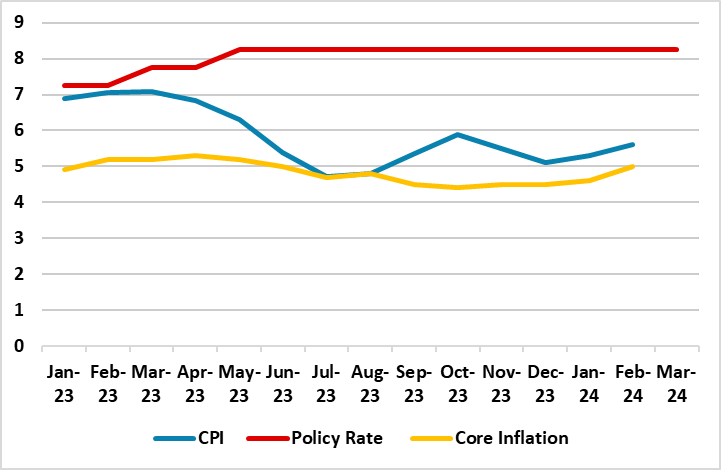

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – March 2024

Source: Continuum Economics

SARB announced its second interest rate decision in 2024 on March 27, and as we expected, the Bank held the policy rate stable at 8.25% at the fifth consecutive MPC meeting. The decision was unanimous, with the MPC currently made up of 5 members, which will expand to six when Mampho Modise takes over as Deputy Governor next week.

We think the recent increase in the inflation figures, particularly inflation jumping from 5.1% in December 2023 to 5.6% YoY in February 2024 due to higher housing & utilities, food and transport prices has caused SARB to act cautiously, and be wary of potential risks to the outlook as the inflation remaining within SARB’s target of between 3% and 6%; but still far from the 4.5% midpoint. Additionally, according to the data released on March 19, average inflation expectations for 2024 and 2025 also remained well above that midpoints ignited some SARB concern.

SARB Governor Kganyago said in his presentation on March 27 that "We still see headline inflation heading back to 4.5%, but very slowly. However, given extra inflation pressure, headline now reaches the target midpoint only at the end of 2025, later than previously expected."

Kganyago added that "We expect the load shedding burden will ease somewhat, which could relieve inflationary pressures ignited by steep fuel price hikes." (Note: We also foresee headline inflation will fall to 5.1% and 4.7% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and logistics woes and load shedding will partly ease).

One key risk for the inflation trajectory is the current dry and hot weather conditions caused by the El Nino leading to concerns that food price inflation may increase. We saw core inflation hitting 5% in February, pushed higher by services inflation, particularly medical aid costs, and this is also worrisome considering core inflation recorded 4.6% in January. According to analysts, wages, education and rental costs could be sources of further inflationary pressures in the coming months.

Under current macroeconomic circumstances, we think stronger-than-expected inflation figures could cause SARB to delay the rate cuts to Q3 and after the May 29 elections, if the CPI trajectory allows in the upcoming moths. We think Fed easing in H2 2024 should help ZAR as South Africa can use it as an opportunity to cut rates or build FX reserves. This will be also related with the presidential elections outcome as a coalition with an uncertain fiscal and load shedding policy could delay easing further. We expect the first rate cut could happen either on the MPC meeting scheduled on July 18 or on September 19 while SARB will have time to decide on timing once it sees monthly inflation outcomes in Q2 2024.