As we Expected, CBR Hiked Key Rate to 19% as Inflation Continues to Soar

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on September 13 that it increased its policy rate by 100 bps to 19% to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press release that the current inflationary pressures remain high, and annual inflation is likely to exceed the July forecast range of 6.5–7.0% by the end of 2024. The regulator emphasized that growth in domestic demand is still significantly outstripping the capabilities to expand the supply of goods and services. We now don’t expect any further rate hikes in 2024 as CBR will likely view the impacts of tightening in Q4, unless inflation further roars and RUB loses value significantly.

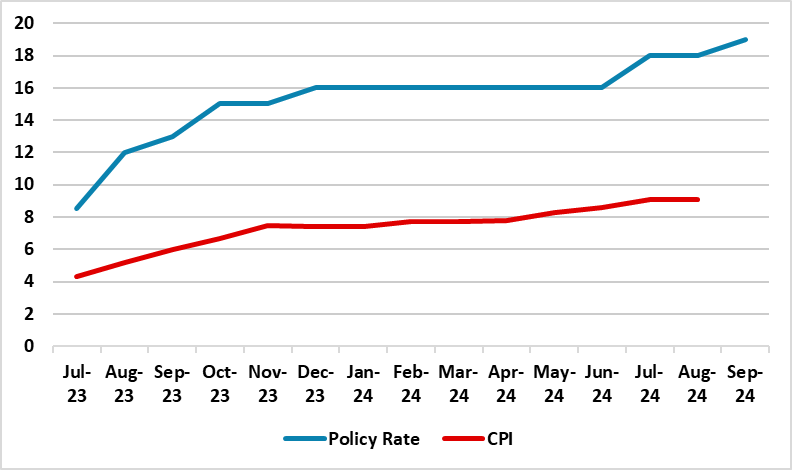

Figure 1: CPI (YoY, % Change) and Policy Rate (%), July 2023 – September 2024

Source: Continuum Economics

On September 13 MPC meeting, CBR decided to lift the policy rate by 100 bps to 19% given inflationary risks and CBR’s hawkish forward guidance, bringing the cost of borrowing to its highest in more than two years as inflation remaining far above the CBR’s forecast range and medium term target (Note: CPI stayed at 9.1% YoY in August after July. MoM price growth was 0.2% in August driven by the food and services prices, which rose by 9.7% and 11.7% in annual terms, respectively). Today’s rate rise marks the seventh in over a year while the last time CBR hiked rates was in July, by 200bps.

CBR highlighted in its press statement that further tightening of monetary policy was required since the current inflationary pressures remain high, and annual inflation is likely to exceed the July forecast range of 6.5–7.0% by the end of 2024, partly due to strong domestic demand. CBR added that "(…) Rising wages and a strong jobs market have helped shoppers compensate for inflation, and as a result consumer activity remain high."

Speaking about the inflationary pressures, CBR governor Nabiullina said she was committed to achieving a lasting lowering of inflation, and added that "We are prepared to maintain strict monetary conditions for as long as necessary considering the current level of inflation is unacceptable.”

Taking into account CBR’s inflation forecasts for 2024 and 2025, it seems it will be very tough to reach these targets under current circumstances. As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation and overheated economy will take longer than CBR hopes as we envisage annual average inflation to record 7.9% in 2024 partly due to adverse base effects, strong military spending, high domestic demand, tight labor market, continued expansion of retail and corporate lending, and recent surges in food and services prices.

As CBR noted, growth in domestic demand is still significantly outstripping the capabilities as rising wages and a strong jobs market continue to help shoppers compensate for inflation. The labor market remains tight as the unemployment hit record-low figure of 2.4% in mid-2024. We feel the risks to the outlook remain upside as the fiscal policy is making a big contribution to domestic demand coupled with continued military spending due to ongoing war in Ukraine, and costly operations in Kursk oblast against Ukraine’s surprising cross border incursion. CBR will likely have hard times in Q4 until inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. We now don’t expect any further rate hikes in 2024 as CBR will likely view the impacts of tightening in Q4, unless inflation further roars and RUB loses value significantly.