SARB in 2025: Rate Cuts Will Continue

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased it from 8.25% to 8.0% given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we now foresee the rate cuts will continue in 2025 after a pause on the MPC scheduled at November 21. Our end-year policy rate prediction remains at 8.0% for 2024, and 7.0% for 2025. The key for SARB in 2025 will be carefully timing and coordinating the monetary policy framework to manage expectations and scheduling rate cuts given the continued uncertainty about the inflation outlook.

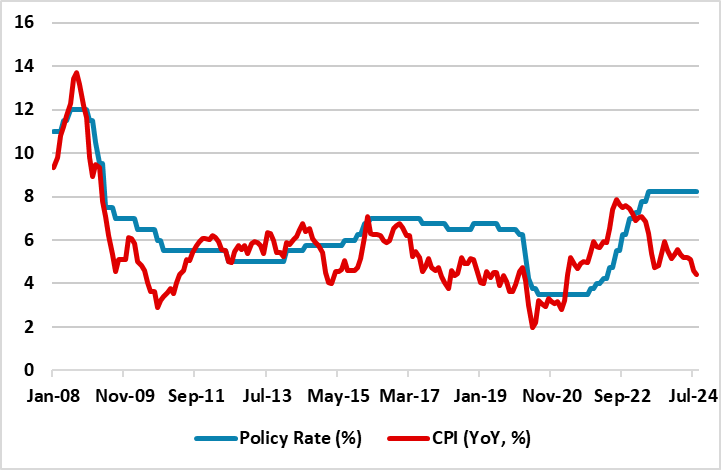

Figure 1: Policy Rate (%), CPI (YoY, % Change), January 2008 – August 2024

Source: Continuum Economics

After SARB announced its interest-rate decision on September 19 and cut the policy rate by 25 bps from 8.25% to 8.0% for the first time since its Covid-19 response over four years ago, the focus is now on SARB’s key rate decisions in Q4 2024 and 2025.

First, we expect SARB will hold the key rate stable at 8% during the last MPC meeting of the year scheduled at November 21, as the regulator will likely monitor the first impacts of the rate cut decision on September 19 and would like to view the September inflation on October 18 and October inflation late November before taking its decision.

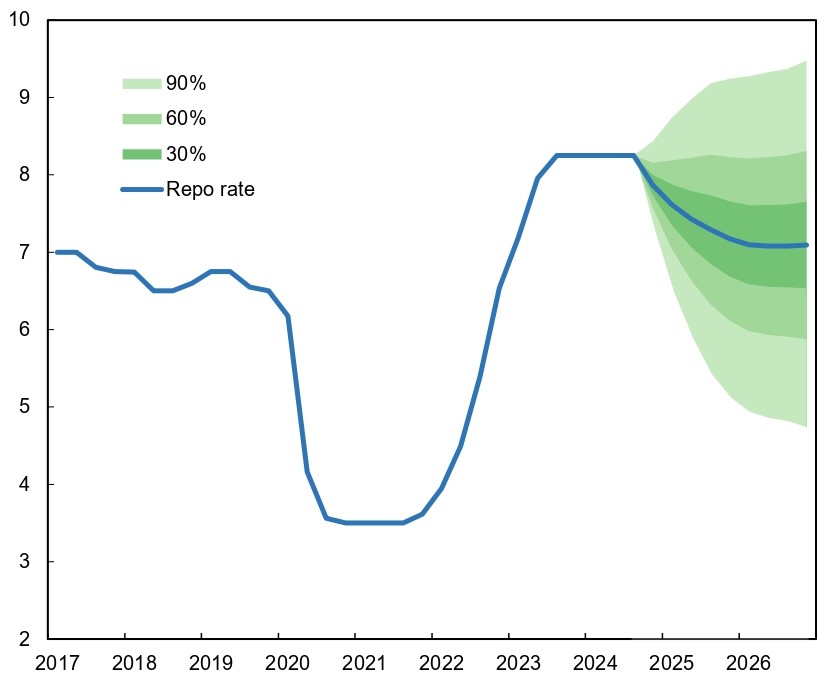

Given the recent fall in inflation, which now cruises below SARB’s midpoint of target band of 3% - 6%, i.e 4.5%, coupled with suspended power cuts and deceleration in inflation expectation, we foresee the rate cuts will likely continue in 2025. Our prediction is 8.0% for 2024 end-year policy rate, and 7.0% for 2025 as we foresee 25bps cuts in every quarter in 2025.

Figure 2: SARB Interest Rate Forecast (%), 2017 - 2026

Source: SARB Forecast Report (September 2024)

The indicator to be closely watched by SARB will definitely be the inflation data given the continued uncertainty about the inflation outlook. Despite the recent fall in CPI, we feel there is still an upside inflationary risk emanating from volatile food and fuel prices, supply-side constraints like crisis at ports and rail network, geopolitical risks, and the U.S. presidential election in November. The future of loadshedding remains imponderous and energy analysts remain cautious despite load shedding is suspended for 191 consecutive days as of October 4, reflecting structural generation improvements and new investments, thus contributing to lower inflation figures.

It is worth noting that SARB governor Kganyago stated on September 19 that inflation could be higher than SARB’s baseline forecast given scenarios such as higher housing costs, larger electricity price increases, wage increases that outrun inflation and productivity growth or higher food inflation could cause uncertainty, demonstrating that SARB will be cautious about risks to the inflation outlook. However, a risk also exists that inflation could be below our baseline forecasts, if the lack of loadshedding causes more inflation control. (Note: We foresee average headline inflation will stand at 5.0% and 4.7% in 2024 and 2025, respectively.)

We think SARB will closely follow rate decisions by Fed and ECB, which are expected to continue their cutting cycles, loosen global financial conditions and potentially easing pressure on the ZAR, and giving room for SARB to continue cutting rates in 2025.

The key for SARB in 2025 will be carefully timing and coordinating the monetary policy framework to manage expectations and scheduling rate cuts. We expect data-driven and cautious SARB will carefully monitor the inflationary developments given the continued uncertainty about the inflation outlook. As SARB frequently reiterated that they pay attention to inflationary pressures are under control backed up by data and expectations, we think unexpected inflation hikes can jeopardize the anticipated rate cuts in 2025, which is not our baseline scenario.