Indonesia: MPC Review: Bank Indonesia Surprises With A Rate Hike

In a pre-emptive move to both curb inflationary pressures and safeguard the Indonesia Rupiah (IDR) against furhter depreciation, Bank Indonesia, in a surprise move, increased its main policy rate by 25 bps to 6.25%. However, further rate hikes are not expected as the central bank remains wary of hurting economic growth.

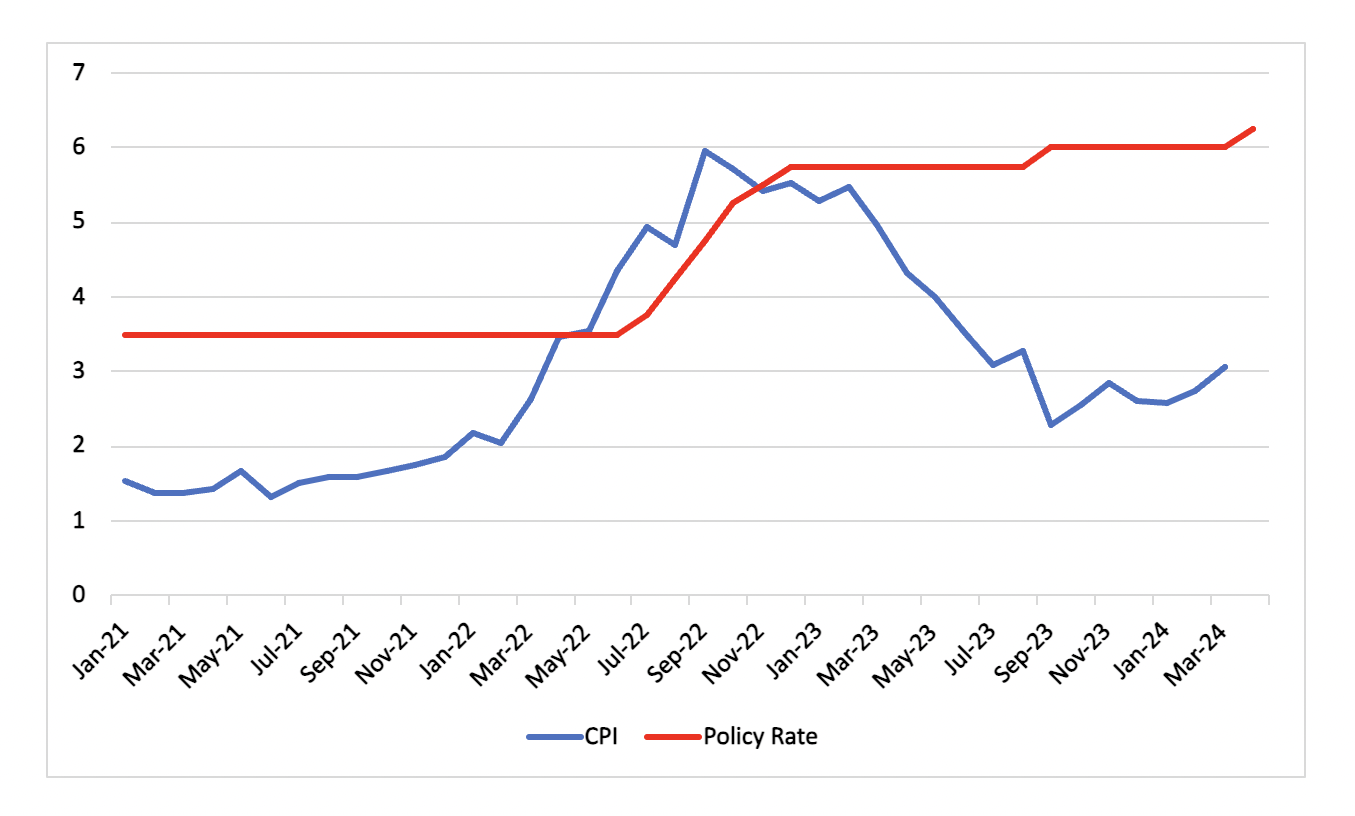

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (% y/y)

Source: Continuum Economics

In surprise rate hike, Bank Indonesia increased its key 7-day reverse repo rate by 25 basis points to 6.25%. It is worth noting though that recent weeks have seen growing indications of a potential rate hike, especially with the significant pressure faced by the rupiah. Alongside this adjustment, the central bank has also raised the deposit facility rate to 5.50% and the lending facility rate to 7.00%, both by 25 basis points.

The decision to raise rates is justified by Bank Indonesia as a measure to bolster the rupiah, which has been under strain along with other emerging market currencies due to tensions in the Middle East. The central bank has committed to continued interventions in the foreign exchange market, primarily through spot and domestic non-deliverable forward transactions. Last week, the Indonesian central bank intervened in the foreign exchange markets to provide support for the rupiah, as the currency surpassed the 16,000 mark against the dollar. Additionally, the government urged state-owned companies to refrain from making large-scale purchases of the dollar. Meanwhile, in addition to heightened geopolitical tensions and other global factors, the rupiah's decline has also been influenced by concerns regarding the potential impact of president-elect Prabowo Subianto's populist policies on Indonesia's fiscal deficit targets. Prabowo has pledged to implement a program offering free meals and milk to schoolchildren, anticipated to incur costs of Rp460 trillion ($28.5bn). Looking at the the fiscal figures, in Q1, the state budget surplus experienced a significant decline of 93.7% yr/yr, totalling IDR 8.1trn. This deterioration in performance was driven by a reduction in revenues alongside increased expenditure, partially attributed to pre-election spending. Despite these challenges, the budget managed to maintain a modest surplus as it entered Q2. According to Bank Indonesia governor Perry Warjiyo, the increase in interest rate is a proactive measure to ensure inflation remains within the central bank’s target range of 1.5 - 3.5%. Indonesia's inflation rate climbed to 3.05% yr/yr in March.

Additionally, changes in expectations regarding the Federal Reserve's monetary policy easing have also contributed to the pressure on the rupiah, as the Fed is now anticipated to implement fewer rate cuts than previously expected and delay the beginning of its rate cutting cycle. The rupiah has depreciated by 5.1% against the USD year-to-date, although Bank Indonesia notes that it has fared comparatively better than other emerging market currencies such as the Korean won and the Thai baht.

Bank Indonesia has maintained its GDP growth forecast for Indonesia at 4.7-5.5% and pledges to enhance policy coordination with the government. This aligns with the stance of Finance Minister Sri Mulyani Indrawati, who recently stated that the government is formulating strategies to reinforce the rupiah. On a positive note, CPI inflation remains within the central bank's target band of 2.5% +/- 1%, alleviating immediate concerns as attention shifts towards stabilising the rupiah. While the rate cut reinforces Bank Indonesia's committment to ensuring exchange rate stability, it is in no way a signal of a rate tightening cycle. We do not expect any further rate cuts in 2024. With inflation within the target range, and economic growth showing signs of easing, the central bank will be wary of further rate hikes.