SARB Held the Key Rate Stable at 8.25%

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at a 15-year high of 8.25% on May 30 despite inflation rate fell for a second consecutive month in April due to less severe power cuts (load shedding), a firmer South African rand (ZAR) coupled with lower food and non-alcoholic beverages prices. It appears the decision targeted to anchor inflation expectations around the target midpoint as inflation remained some way off from the 4.5% midpoint of target band of 3% - 6%. Taking into account that SARB governor noted on May 30 that SARB’s fight to quash inflation is not yet done remaining concerned that inflation expectations are elevated, we feel rate cuts could be delayed to Q4 or Q1 2025, which can be further postponed if a coalition with an uncertain fiscal and load shedding policy will be formed, as a coalition seems very likely according to the preliminary results of presidential elections yesterday.

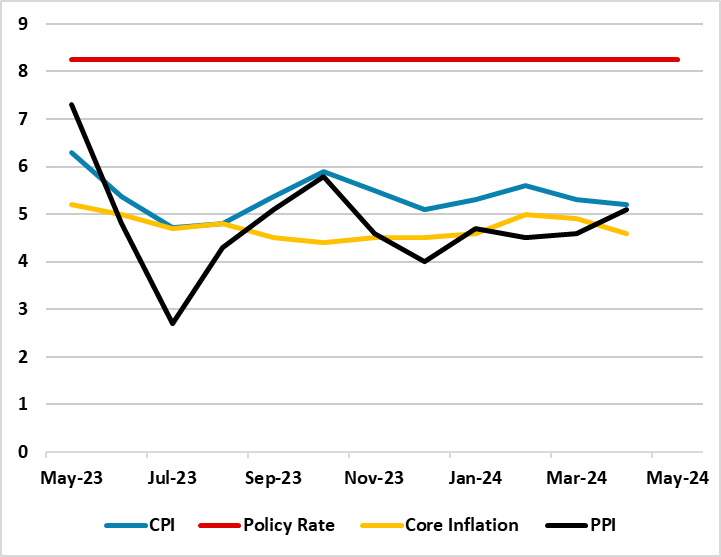

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), May 2023 – May 2024

Source: Continuum Economics

SARB announced its third interest rate decision in 2024 on May 30, and as we expected, the Bank held the policy rate stable at 8.25% at the sixth consecutive MPC meeting.

Despite inflation rate falling for a second consecutive month to 5.2% YoY in April down from 5.3% in March due to less severe power cuts (load shedding), a firmer South African rand (ZAR) coupled with lower food and non-alcoholic beverages prices, it appears SARB remained concerned that inflation expectations are elevated despite inflation within SARB’s target of between 3% and 6%; but still far from the 4.5% midpoint. The inflation in April eased thanks to ZAR strengthening 5.6% over the past month, and load shedding remaining suspended in April reflecting an improvement in Eskom’s generation fleet.

SARB Governor Kganyago said in his presentation on May 30 that "We now see inflation stabilising at our 4.5 percent objective in the second quarter of next year. This is an improvement on our March forecast, which only reached this milestone at the end of 2025. Clearly, the task of achieving our inflation objective is not yet done." Kganyago added that "Fuel price inflation is now expected to be higher, in the near-term, but it improves for 2025. This helps our forecast get to the target midpoint sooner." (Note: We foresee headline inflation will fall to 5.1% and 4.7% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and logistics woes and load shedding will partly ease).

According to the last Monetary Policy Review report released by SARB late April, the risk of higher inflation still remains. The report emphasized that the slower pace of disinflation reflects a range of issues, including normalising services components, housing prices and elevated inflation expectations while administered prices continue to exert substantial upward pressure on headline inflation.

Taking into account that SARB governor repeatedly stressed that SARB will wait for inflation to slow to the midpoint of target range before policy is adjusted, we expect SARB will likely keep the rates unchanged at 8.25% on the next MPC meeting on July 18. We envisage the first rate cut could happen either Q4 or Q1 2025 while SARB will have time to decide on timing once it sees monthly inflation outcomes in Q3 and Q4. We are of the view that rate cuts could be further delayed if a coalition with an uncertain fiscal and load shedding policy will be formed, as a coalition seems very likely according to the preliminary results of presidential elections yesterday.