Hawkish Stance Maintained: CBRT Held the Key Rate Stable at 46% Despite Softening Inflation

Bottom Line: Central Bank of Turkiye (CBRT) held the policy rate unchanged at 46% during the MPC on June 19 despite inflation continues to ease. CBRT highlighted in its written statement that the tight monetary stance will be maintained until price stability is achieved via a sustained decline in inflation, signalling CBRT wants inflation to be under control before any rate cut decisions. We think the regulator shifted its tone to prepare markets for the beginning of a rate-cutting cycle during the next MPC on July 24, if domestic inflation will continue to soften and global tensions will partly ease.

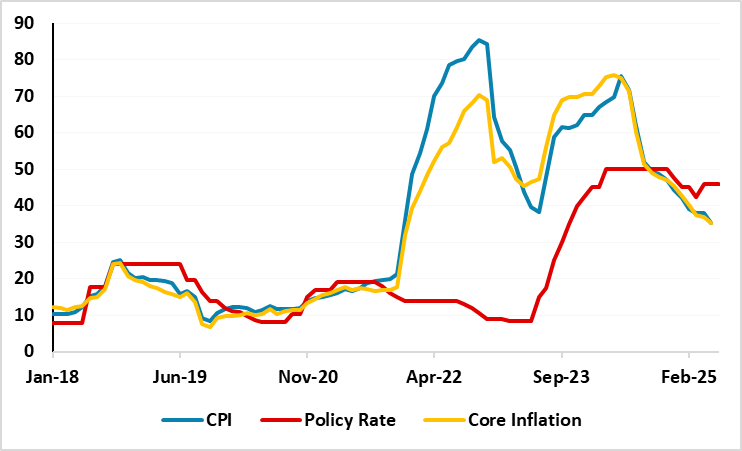

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – June 2025

Source: Continuum Economics

Despite the deceleration trend in inflation continued in May with 35.4% y/y supported by lagged impacts of monetary tightening, fiscal measures and suppressed wages, CBRT decided to hold the key rate constant at 46% on June 19. (Note: MoM inflation rose by 1.5% in May, lower than 3.0% MoM inflation the previous month). CBRT also kept the upper band of its rate corridor at 49% despite predictions it would be lowered.

CBRT highlighted in its written statement on June 19 that the underlying trend of inflation declined in May while leading indicators suggest that this decline continues in June and data for the Q2 pointing to a slowdown in domestic demand. CBRT emphasized that tight monetary stance will be maintained until price stability is achieved via a sustained decline in inflation, signalling CBRT wants inflation to be under control before any rate cut decisions.

According to CBRT’s second quarterly inflation report of the year published on May 22, year-end inflation forecast was kept at 24%. Inflation forecast was set at 12% for 2026, 8% for 2027, and the report mapped out a gradual path toward its medium-term objective of 5% inflation. CBRT governor Karahan highlighted that CBRT maintained its forecast range for this year between 19% and 29%, citing the recent rise in uncertainties.

We continue to envisage upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts will likely lead average inflation to stand at 34.5% in 2025. We anticipate domestic and geopolitical risks will keep inflation pressures alive for a longer period, and it will be unlikely to reach single digit inflation target by 2027 due to risks. Thus, it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time.

We expect cautious CBRT will continue its cutting cycle during the next MPC on July 24 as it shifted its tone to prepare markets for the beginning of a rate-cutting cycle, if domestic inflation will continue to soften and global tensions will partly ease. Our end year key rate prediction for 2025 and 2026 are at 34% and 21%.