Time Has Come: SARB will Likely Decrease the Key Rate to 8.0% on September 19

Bottom line: South African Reserve Bank (SARB) will likely start cutting the key rate at the upcoming MPC meeting on September 19 and decrease the rate from 8.25% to 8.0% given recent fall in inflation, suspended power cuts (loadshedding) after March, deceleration in inflation expectations and a relatively stable Rand (ZAR). Our end-year policy rate prediction is 8.0% for 2024, and 7.0% for 2025.

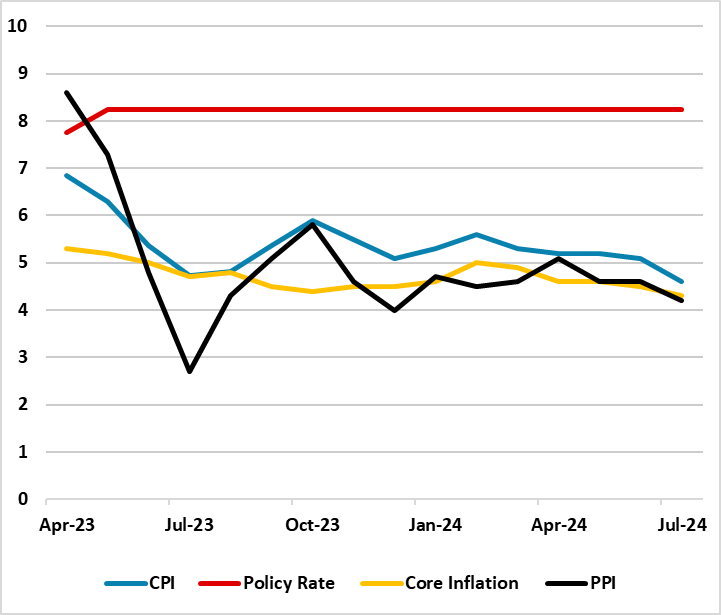

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – July 2024

Source: Continuum Economics

SARB will announce its next interest-rate decision on September 19, and we expect the regulator to cut the policy rate by 25 bps from 8.25% to 8.0%, for the first time since its Covid-19 response over four years ago.

First, on the inflation front, CPI decreased to 4.6% in July 2024 driven by lower annual rates in several categories, notably food and non-alcoholic beverages, fuel, transport, and housing and utilities. July inflation was very close to the midpoint of SARB’s target range of 3% and 6%. August inflation figures will be announced on September 18, and we believe the CPI will remain close to 4.5%. (Note: Our headline inflation forecast for 2024 remains at 5.1% due to the lagged impacts of SARB’s previous tightening, lower food prices and relieved load shedding).

On the power cuts end, after Stages 2 and 3 load shedding was implemented broadly in March, South Africa’s national electricity utility company, Eskom announced on September 6 that load shedding remained suspended for 163 consecutive days, reflecting structural generation improvements and new investments. This is a significant development for South African economy as the suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures. (Note: Inflation outlook was also supported by a relatively stable ZAR, which hovered around 17.8-18.2 against the USD in August).

In addition to inflation readings, positive news is coming from the inflation expectations, as well. According to BER survey released on September 12, the average inflation forecast for 2024 fell to 5.1% in Q3 from 5.3% in Q2. This a key data point for the central bank at its monetary policy meetings – are likely to reinforce expectations that the bank will cut its key rate next week, particularly taking into account that SARB is data-dependent and SARB Governor Lesetja Kganyago repeatedly said the regulator is paying full attention to the inflation expectations. Remaining expectant about the inflation outlook, Kganyago also underscored that “We anticipate further progress as inflation slows, helping to re-anchor expectations firmly at 4.5%.”

As SARB intermittingly signalled that it plans to start cutting interest rates after the inflationary pressures are under control backed up by data and expectations, we foresee an end to SARB tightening. Of course, SARB could also decide to hold the key rate stable at 8.25%, but this is not our baseline scenario due to reasons mentioned above.

It is worth noting that inflationary risks remain due to the supply-side constraints like crisis at ports and rail network, subdued consumer demand continuing to pressure retail, geopolitical risks, the U.S. presidential election in November, which could lead SARB to remain cautious this time and wait for the next MPC meeting scheduled on November 21 to start rate cuts.