CBR Hiked Key Rate to 18% as Inflation Soars

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on July 26 that it increased its policy rate by 200 bps to 18% after four consecutive rate holds, and first time in 2024, to tame the stubborn price pressures stemming from high military spending, tight labour market and fiscal policy igniting domestic demand. CBR said in a press release that inflation has accelerated and is developing significantly above April forecast as the growth in domestic demand is still outstripping supply capabilities coupled with continued expansion of retail and corporate lending. The regulator also cited that it will consider the necessity of further key rate increase at its upcoming meetings, which would depend on the inflation readings in the upcoming months.

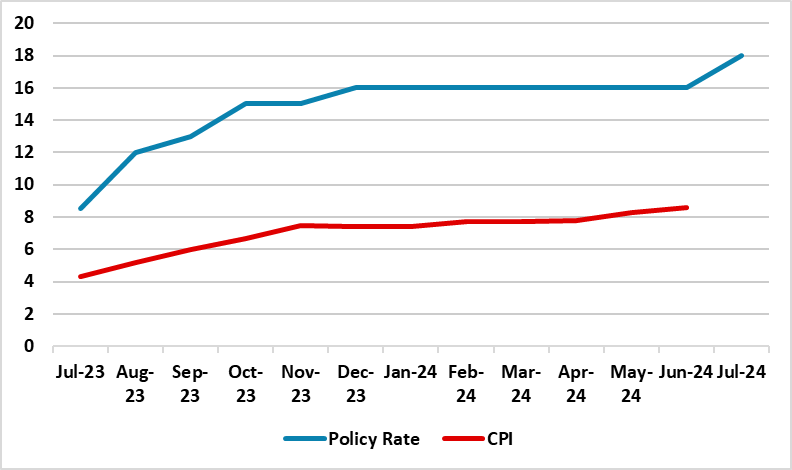

Figure 1: Policy Rate (%) and CPI (YoY, % Change), July 2023 – July 2024

Source: Continuum Economics

On July 26 MPC meeting, CBR decided to lift the policy rate by 200 bps to 18%, bringing the cost of borrowing to its highest in more than two years, as inflation remaining far above the CBR’s forecast range and medium term target. (Note: CPI jumped to 8.6% YoY in June after hitting 8.3% YoY in May, the highest reading since February 2023, driven by the food and services prices which rose by 0.63% and 1.06% MoM, respectively). The last time CBR hiked the key rate was in December 2023, from 15% to 16%.

CBR highlighted in its statement on July 26 that "Inflation has accelerated and is developing significantly above the April forecast. Growth in domestic demand is still outstripping capabilities and expansion of retail and corporate lending continues." CBR added that "(…) Returning inflation to the target requires considerably tighter monetary conditions than presumed earlier. The CBR will consider the necessity of further key rate increase at its upcoming meetings."

In line with this, CBR also raised its inflation forecast for 2024 to 6.5–7.0% while it currently expects CPI to decline to 4.0–4.5% in 2025, which looks a tough target to reach under current circumstances. Taking into account restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation and overheated economy will not be straightforward as we envisage annual average inflation to record 6.9% in 2024 partly due to adverse base effects, strong military spending, high domestic demand, tight labor market, continued expansion of retail and corporate lending, and recent surges in food and services prices.

We foresee the inflation would remain closer to the upper limit of CBR’s revised target in 2024. We expect the CBR to keep the key rate stable at the next policy rate meeting on September 13 taking into account that the CBR said earlier that tight monetary policy is needed for a significantly longer period than was previously foreseen to contain inflation in a more sustainable way.

Of course, it will not be surprising if CBR decides a further rate hike given inflationary risks and its hawkish forward guidance, particularly considering that it strongly signaled it will consider the necessity of further key rate increase at its upcoming meetings while this will depend on the inflation readings in July and August. It is worth noting that the risks to the inflation outlook remain strong as fiscal policy making a big contribution to domestic demand coupled with military spending due to ongoing war in Ukraine. The risk is even higher as a larger Russian offensive operation is now ongoing in Kharkiv and Donetsk which continue to pump up the military expenses.